Where the money is, Part Two: The top cities and regions for biotech VC investments

Print

20 January 2017

John Carroll / Endpoints News

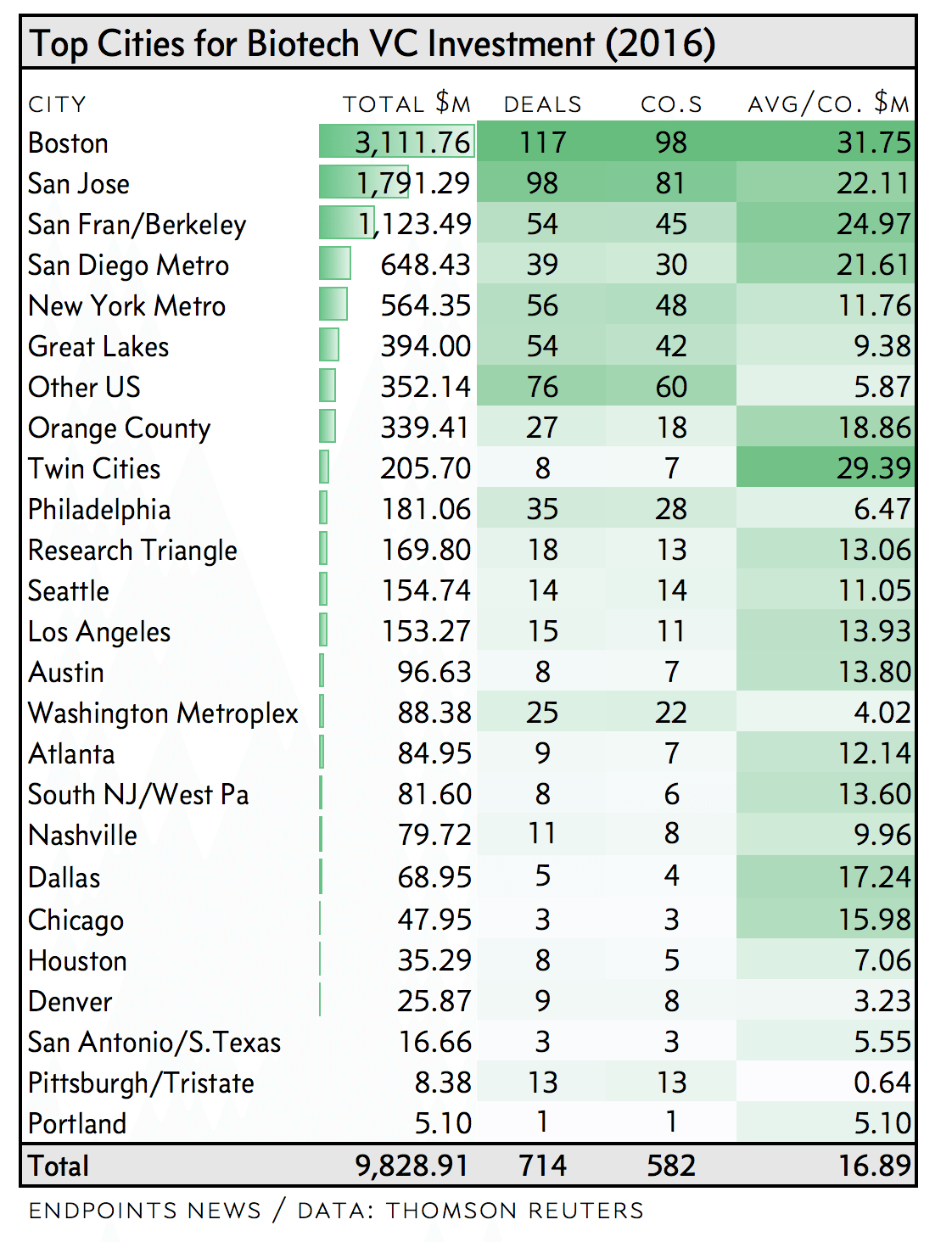

Make no mistake about it. Despite another big showing for the Bay Area in the roster of VC deals that delivered in 2016, Cambridge/Boston was the clear leader in the US last year, according to the latest tally of 2016 numbers by Thomson Reuters.

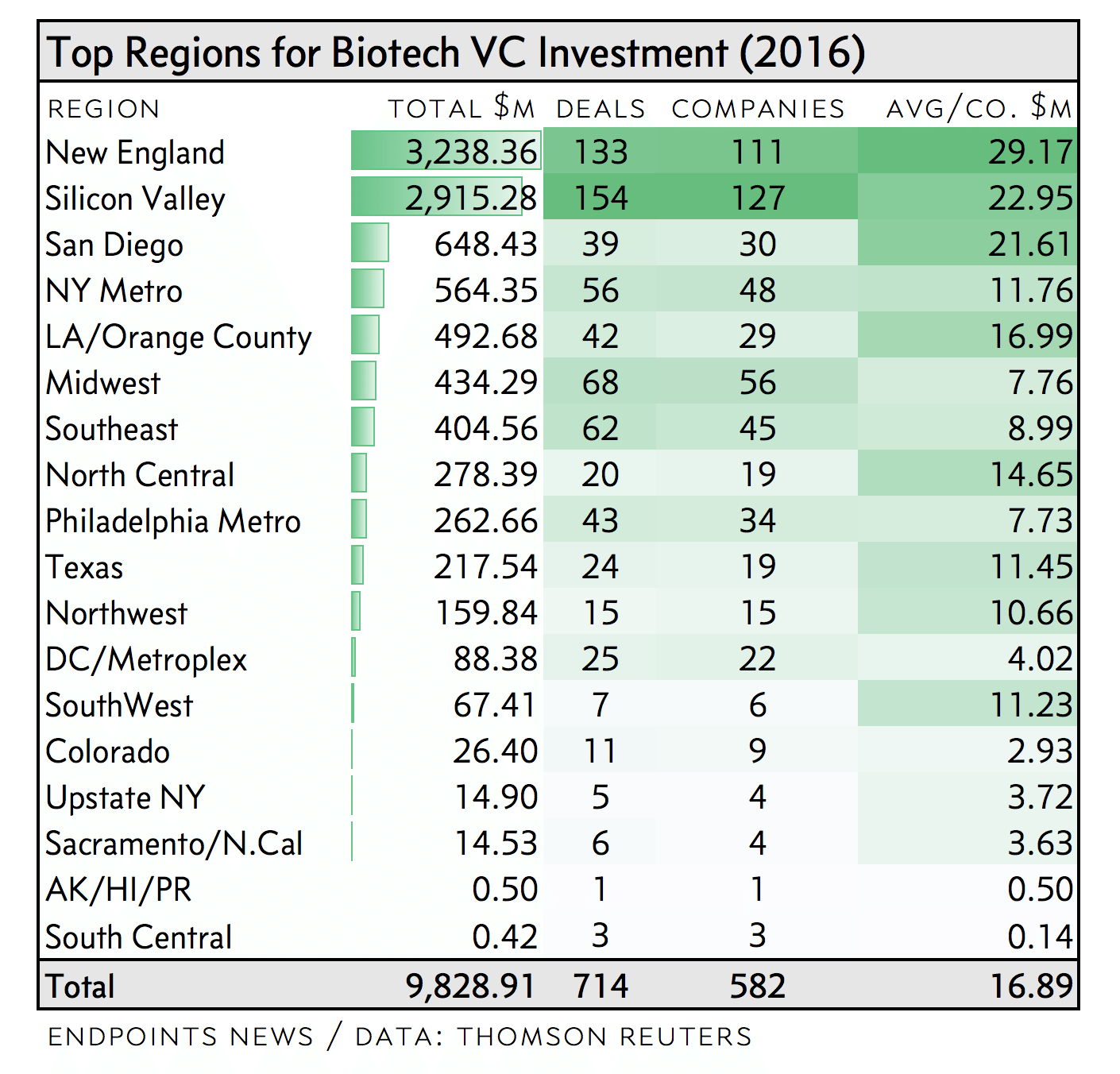

There’s long been a rivalry between the two coasts when it comes to investing in the life sciences. And if you include the three key hub cities in California, adding number 3 player San Diego, the West Coast continues to dominate the field. But the confluence of academia, VC cash, big pharma migrations and big science has made Cambridge the epicenter of new biotech investments globally.

And signs look good for the trends on display in the charts below to continue to play out in 2017. While the IPO window has partially closed, VCs continue to land record new funds for added investing.

As we saw reflected in yesterday’s list of the top 100 VCs, the rest of the US tends to pale in comparison when you look outside of California and Massachusetts while examining the flow of billions of dollars into the industry. But we can’t ignore one big change: New York City now comes in right behind San Diego. And with new city and state initiatives aimed at smoothing off some of the Big Apple’s rough edges, New York may be poised to compete with San Diego for the number 4 spot among the cities.

It’s already number 4 among the key regions tracked by Thomson Reuters, up from the 7th spot in 2015, with a big increase in cash and deals. If that trends hold true, New York may have a long way to go in catching up to either Boston or the Bay Area, but there’s no mistaking its rise into the middleweight category. And that has some big implications for investment patterns in the biotech world to come.

Sou

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.