Allergan Buys Liver Drug Maker Tobira for Up to $1.7 Billion

Print

20 September 2016

Doni Bloomfield / Bloomberg

- Premium of at least 498 percent over Tobira’s Monday close

- Other liver drug stocks soar: Intercept, Galectin, Conatus

Allergan Plc agreed to buy Tobira Therapeutics Inc. for as much as $1.7 billion to gain a late-stage experimental drug to treat liver diseases, one of the most anticipated categories in biotechnology.

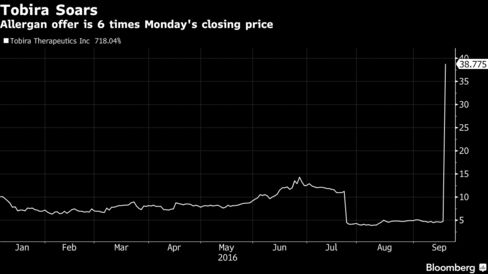

Allergan will pay $28.35 a share in cash upfront and up to $49.84 a share if Tobira hits certain sales and regulatory goals, according to a statement Tuesday. The lower price values Tobira about $533 million based on the number of shares outstanding, and even if the liver drug maker doesn’t hit the goals, the offer is six times Tobira’s $4.74 closing price on Monday -- a 498 percent premium.

Tobira, based in San Francisco, is developing several treatments for non-alcoholic steatohepatitis -- known as NASH, a severe type of fatty liver disease. The hefty premium shows how important therapies for the disease have become for biotech companies, with Gilead Sciences Inc. and Intercept Pharmaceuticals Inc. both working on experimental therapies to treat it.

Tobira’s shares jumped more than eight-fold to $40.25 at 10:33 a.m. in New York, while Allergan dropped 2.1 percent to $240.20.

The deal sent shares of NASH-focused drugmakers soaring. Intercept rose 6.7 percent, Galectin Therapeutics Inc. jumped 14 percent and Conatus Pharmaceuticals Inc. rose 22 percent. Bigger biotech firms also got a boost from Allergan’s purchase, with Gilead up 2.6 percent.

Allergan is making its second acquisition in a week after agreeing to buy Vitae Pharmaceuticals Inc., a maker of dermatology medicines, for $639 million last Wednesday. Last month, Allergan Chief Executive Officer Brent Saunders said the company doesn’t need to do any “big M&A,” confirming a change of approach to dealmaking following the collapse of its its planned $160 billion merger with Pfizer Inc. in April in the face of regulatory hurdles.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.