Top 5 Vendors in the Pharmerging Market from 2017 to 2021: Technavio

Print

01 February 2017

Yahoo Finance

LONDON--(BUSINESS WIRE)-- Technavio has announced the top five leading vendors in their recent global pharmerging market report. This research report also lists 40 other prominent vendors that are expected to impact the market during the forecast period.

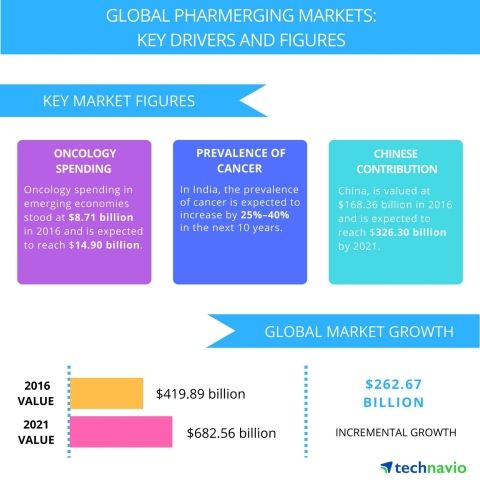

The pharmaceutical industry worldwide witnesses a dramatic regional shift to the pharmerging market, owing to the opportunities available. Considering the on-going trend of shift in global medicine dosage consumption to developing countries, about 55-60% of the global consumption should come from pharmerging markets by 2021. This will eventually lead to an incremental growth of around 25% from 2016 level.

Competitive vendor landscape

As most of the pharmaceutical companies lose ground in the matured markets of the Americas and Europe, pharmerging markets have been increasingly perceived as high growth potential markets by the top pharmaceutical companies. The markets are highly fragmented with the presence of a large number of local and international vendors distributed across the verticals.

“As the emerging markets move toward consolidation through acquisition and alliances, the competitive environment is expected to settle down at product innovation and launch level. The vendors that show customized business model, suit the local requirements with a strong supply chain management and are expected to grow during the forecast period,” says Sapna Jha, a lead cardiovascular and metabolic disorders research analyst from Technavio.

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five pharmerging market vendors

AstraZeneca

AstraZeneca engages in the R&D, manufacturing, and distribution of drugs for the treatment of respiratory diseases, inflammation, and autoimmunity disorders and infections; oncology diseases; cardiovascular and metabolic diseases; neurological diseases, and gastrointestinal diseases. In FY2015, the company reported sales of USD 23.64 billion and spent USD 5.99 billion on its R&D.

Key highlights: In February 2016, AstraZeneca entered a licensing agreement with China Medical System Holdings for the global rights of calcium channel blocker, Plendil (felodipine), in China.

GlaxoSmithKline

GlaxoSmithKline undertakes the manufacture and marketing of pharmaceutical products which include OTC products, vaccines, and health-related consumer products across the world. It generated revenue of USD 36.57 billion and recorded R&D expenses of USD 5.44 billion during the FY2015.

Key highlights: In July 2016, GSK received the China Food and Drug Administration (CFDA) approval for its human papillomavirus, Cervarix, for the treatment of cervical cancer.

Pfizer

Pfizer is a research-based biopharmaceutical company that produces, manufactures, and develops a wide range of pharmaceutical products for various therapy areas including arthritis, cardiovascular, metabolic disorders, infectious, and respiratory. For the FY2015, the company reported net sales of USD 48.85 billion and spent USD 7.69 billion on R&D activities.

Key highlights: In July 2016, Pfizer and NovaMedica signed a strategic partnership in Russia to invest in a new pharmaceutical manufacturing plant in the Vorsino industrial park, Kaluga Region, Russia.

Sanofi

Sanofi engages in research, development, and marketing of various therapeutic solutions and healthcare products. The revenue and R&D expenses of the company amounted to USD 41.10 billion and USD 5.83 billion respectively in FY2015.

Key highlights: In July 2016, Sanofi launched two drugs, Lyxumia (lixisenatide) and Zemiglo for the treatment of type 2 diabetes in India.

Novartis

Novartis undertakes the research, manufacture, and marketing a range of healthcare products worldwide. In FY2015, the company generated net sales of USD 49.41 billion and spent USD 8.93 billion on R&D activities.

Key highlights: In August 2016, Novartis completed clinical trials for Entresto (a heart failure drug), in China, and is expected to launch in 2017.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.