Solid technology, smart decisions at the heart of Regeneron's remarkable R&D productivity

Print

16 July 2014

Michael Flanagan, FirstWord Lists

Regeneron Pharmaceuticals has emerged as one of the most prolific wellsprings of new antibody drugs in the biopharma universe thanks to its success in combining innovative technologies with intelligent target selection.

With three drugs on the market and a landmark partnership with Sanofi providing up to $160 million in annual research funding through at least 2017, Regeneron appears to have laid the foundation to potentially vie for a place among the biggest biotechs in the world. The company's pipeline was once again in the spotlight last week when positive data were presented for dupilumab for moderate-to-severe atopic dermatitis.

The company's drugs generated almost $2 billion in total worldwide sales last year, the lion's share of which came from ophthalmic drug Eylea (aflibercept). Partner Bayer markets Eylea outside the US.

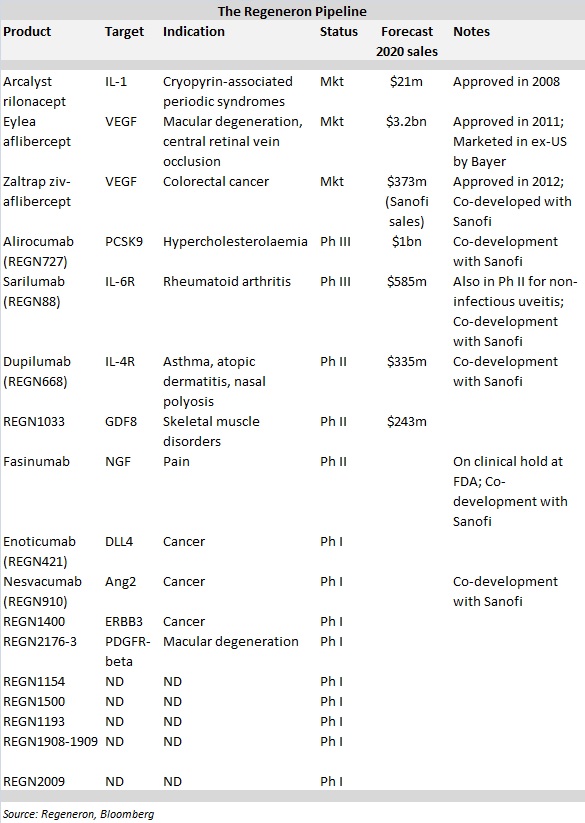

What's more, Regeneron's clinical pipeline is chock full, with two products in Phase III testing, three in Phase II and another nine in Phase I trials. According to Bloomberg, analysts expect the company's sales to almost triple by 2020 to $5.8 billion.

David Grainger, a venture partner at Index Ventures and author of the DrugBaron blog, says the secret to Regeneron's success is simple: shrewd target selection. "The single critical thing Regeneron did right was realise earlier than anyone else that the value in the monoclonal antibody space was in the target rather than in the delivery technology platform," Grainger told FirstWord.

There are many companies out there using their own particular flavour of antibody technology to discover mAbs for themselves and/or others, he noted. What has set Regeneron apart is that "instead of focusing on the 'nuts and bolts' of antibodies, they focused on the biology and on collecting the most promising targets" a decade ago.

Grainger pointed to Cambridge Antibody Technology (CAT) – a contemporary of Regeneron's in the antibody technology space bought by AstraZeneca in 2006 – as a counter example. CAT was a pioneer yet "the value they generated lies almost entirely in Humira. Their technology platform languishes as part of MedImmune (itself part of AstraZeneca) – nothing special in a world with a zillion antibody platforms," Grainger said.

Rheumatoid arthritis therapy Humira, which is sold by AbbVie, was the biggest selling drug in the world last year, pulling in $10.7 billion.

Indeed, this "analysis also explains why there aren't more Regeneron's," Grainger said, adding "target selection and validation is a bespoke affair – target by target. You can't capture it as a 'platform' like you can technical advances in making antibodies."

Renowned R&D commentator Bernard Munos is more succinct in his praise of the company, telling FirstWord "Regeneron is everything that a pharmaceutical company should be: led by bold scientists, and translating great science. It is the living proof that the success formula that made the industry great -- focus on great science and do it well, and everything else will follow -- still works today."

Needless to say, Regeneron's future did not always look so bright. In fact, the company initially spent a decade developing growth factors. But with little to show for the work, it switched gears and turned to a Trap technology capable of creating fusion proteins that bind to signalling molecules to block their harmful effects. Trap compounds use the Fc region of an antibody as a scaffold upon which decoy receptor domains are built.

This effort produced all three of the company's marketed products. More recently, Regeneron's attention has been primarily on the discovery and development of fully-human mAbs using its VelociSuite technologies, which has generated an impressive stream of clinical candidates.

A key ingredient to the company's success in exploiting the potential of the technologies has been its long-standing collaboration with Sanofi that began in 2007 and was expanded in 2009. Under the deal, which Sanofi has an option to extend for up to three years beyond 2017, the pharma has rights to co-develop and lead commercialisation efforts for Regeneron's fully-human mAbs.

On July 9, Regeneron unveiled plans to move dupilumab into Phase III testing later this year after the mAb against IL-4 and IL-13 met the primary endpoint in a Phase IIb trial to treat atopic dermatitis. Dupilumab will be Regeneron's third internally discovered mAb in Phase III testing, joining alirocumab and sarilumab, with two more in Phase II and nine additional programmes in Phase I trials.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.