Pharmaceutical Promotional Spending: Global Trends

Print

18 January 2013

Christopher Wooden/ Cegedim Strategic Data

Overall Trends

|

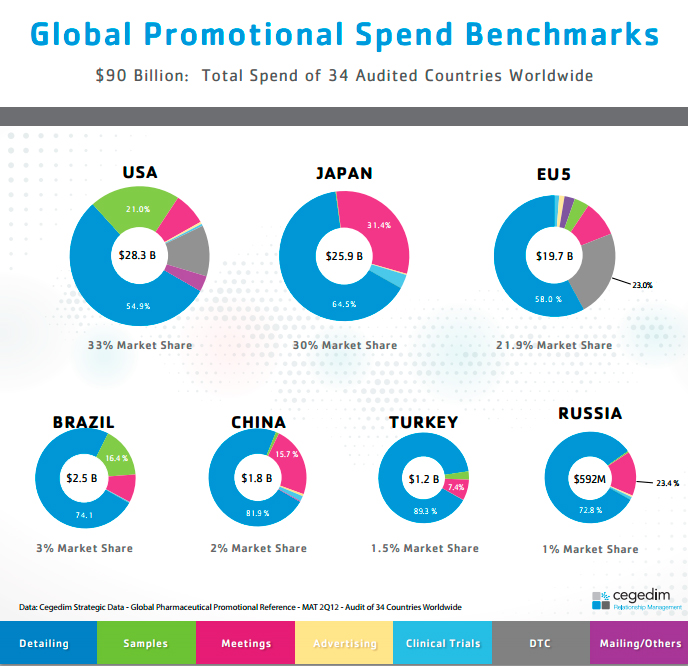

In the twelve-month period to June 2012, industry spending on audited channels came to $90 billion in constant US Dollars with spending in the United States accounting for 32% of the worldwide total. |

||

|

|

|

On the previous Moving Annual Total (MAT) period, worldwide spending was practically flat - showing a slight drop of just 1%. |

|

|

|

Significant increases in emerging markets ( Brazil +22%, Russia +42% , China +30%) were in marked contrast to cuts in more established markets (USA -6%, EU5 -3.6%). Spending in Japan was flat. |

Channel Mix

The channel mix used has evolved dramatically over the past 10 years. Historically, pharmaceuticals promotion has been primarily face-to-face, sales rep driven – even in established western markets. Lead by the USA, pharmaceutical companies have increasingly leveraged a variety of traditional promotional channels to build brand and disease awareness among HCPs and the public. The major European markets followed, albeit without the freedom to advertise direct to consumer (DTC). Today, the results show a rich marketing mix with the industry in the US and Europe using every available (and allowable) channel to get the message out. Despite “official” guidelines and periodic government “crack downs,” industry marketing practice remains largely self-regulated to a greater or lesser degree depending on the country in question.

Recently, as the industry in the west has faced the patent cliff along with anaemic product pipelines, there has been much discussion of replacing face-to-face sales reps with e-detailing and other digital channels. To be sure, sales forces have been cut, and companies are seeking to augment reduced sales force levels with new channels. Multi-channel marketing comprising face-to-face, phone and digital seems to be the flavour of the moment. It is also common sense. Studies have repeatedly shown that quality, face-to-face interaction with reps remains the essential element in any company’s success.

New Media / Digital Channels

However, to ignore the potential in so-called “new media” or digital channels would be short-sighted. The industry appears to be taking this seriously with digital spending up over 20% in Brazil, 30% in the US and EU5, and over 80% in China. In Russia, digital promotion was almost non-existent two years ago, whereas in 2013, CSD measured over $1.5 million in industry spend on this channel.

Meanwhile, the most traditional of channels, such as direct (paper) mailing and print advertising in professional medical journals have indeed seen precipitous drops since the 90s when they were state of the art and represented a relatively significant portion of the industries marketing budget. Nevertheless, these channels will not likely disappear soon. Nor should they – no more so than paper advertisements for food delivery or car service should disappear from consumer mail boxes. When well designed and deployed, they remain an effective means of putting the brand in front of HCPs. Their reduced use is not necessarily a reflection of a lack of effectiveness, it is only that marketers have more choice of channels than ever before, and spending has been diverted away from these seemingly old fashioned channels.

Exploiting Location

The most compelling aspect of this new generation of mobile solutions, however, is the ability to exploit location-based services to improve the timeliness and relevance of HCP interaction. Combining mobile CRM with location awareness ensures the latest information updates on an organization or HCP are made available prior to the interaction, to support the most meaningful conversation.

And if an HCP is unavailable, rather than waste time trying to manually determine a new visiting schedule, representatives can use location-aware tools that provide a graphical view of individuals a field user could meet in proximity of their current location based on their call goals—optimizing productivity.

Emerging Markets

Sales potential and real growth in emerging markets – especially BRIC – have seen dramatic increases in the build-up of sales force levels, and until a few years ago, promotion in these markets was exclusively rep driven. However, within the last few years, the channel mix used, especially in China, has widened. For example, growth in spending on meetings has been impressive as a means of reaching a wide audience at a single event. In both China and Brazil event spending is up over 25%, while spending on meetings in Russia has more than doubled.

As for the use of digital promotion in these markets, it has been observed that the emerging markets have leap-frogged some of the more conservative, established markets such as Spain and France. Physician use of the internet, mobile phones and even social media in emerging markets appears to be out-pacing use in Western markets. While the relative level of spending on these channels does not appear to be significant alongside the cost of traditional channels, they will certainly continue to be developed, in large part because of their low cost. Their long term success will depend ultimately on what emerges as best practice. However, unlike established best practice with traditional channels, digital channels will evolve and change rapidly as the underlying technology improves.

Clearly, companies that succeed in adapting to this dynamic environment will have a strong advantage over those that don’t.

Methodology

Cegedim Strategic Data, the market research unit of the Cegedim Group, maintains a worldwide daily diary audit of over 30,000 HCPs. The audit, covering over 30 countries including the Americas, Europe, Japan, BRIC and other emerging markets measures HCP exposure to Pharmaceutical industry sales force activity and other marketing channels. Validated average costs are applied per channel and projected to the audited population of HCPs in each country. The results provide a measure for benchmarking overall promotional spending by channel in each market. CSD does not claim to track all promotional channels and specialty groups. Therefore, the absolute figures should be used as a guide only, providing relative indicators of the level of marketing investment.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.