Digital Health Funding Tops $4.1B: 2014 Year in Review

Print

06 January 2015

Teresa Wang, Rock Health

2014 was an incredible year for the digital health ecosystem, particularly for the 258 companies that had their coffers filled by investors. The year was a record-breaker from the start and by its close venture funding for digital health companies surpassed $4.1B, nearly the total of all three prior years combined. This represents a 125% YoY growth in funding compared to 2013.

It wasn’t just the total dollars raised that significantly increased in 2014. We saw 295 deals close and an average deal size of $14.1M, an increase of nearly 40% YoY. (Note: Our venture funding data only includes disclosed US deals above $2M).

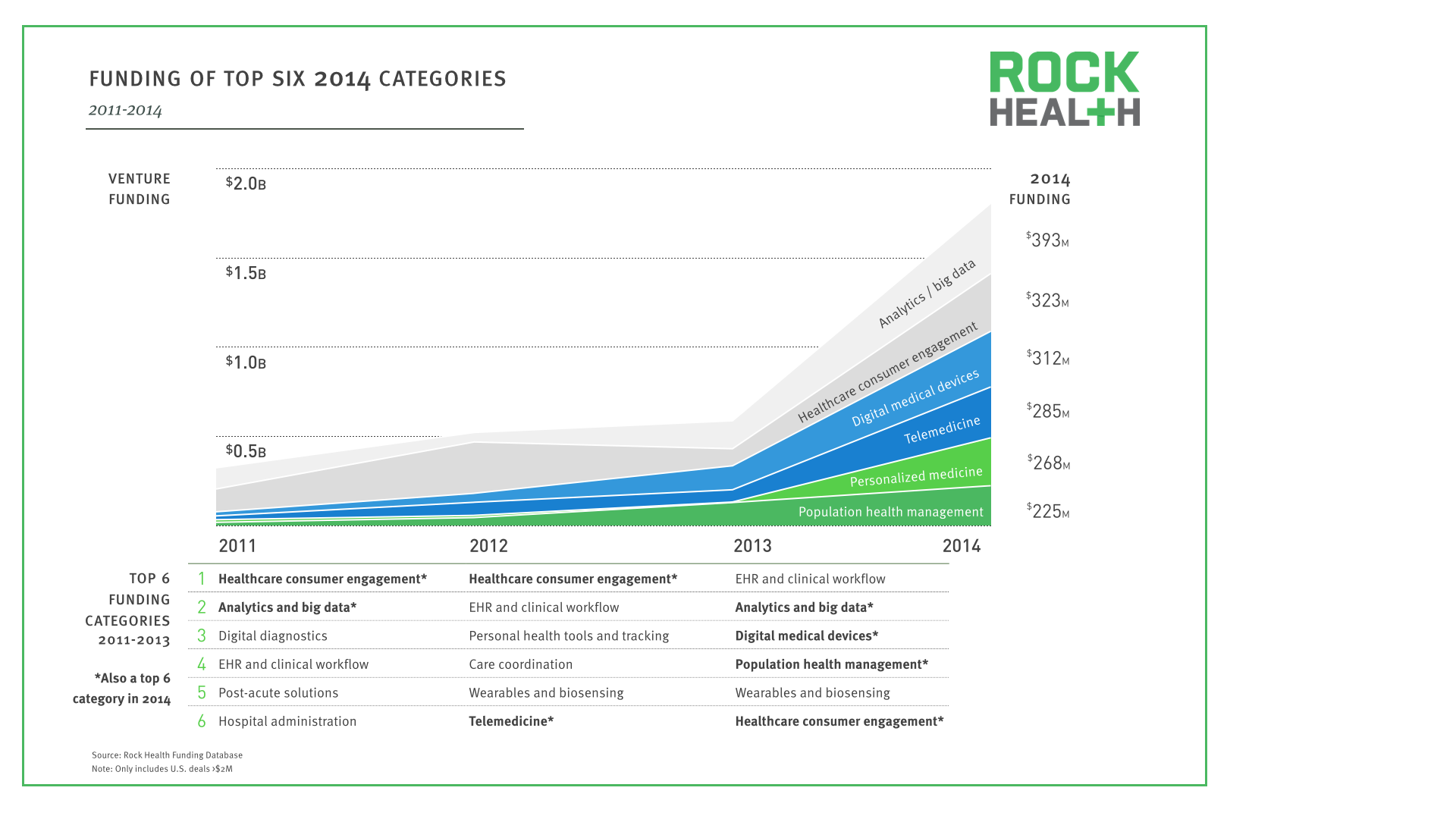

The top six categories that accounted for 44% of all digital health funding in 2014 were analytics and big data, healthcare consumer engagement, digital medical devices, telemedicine, personalized medicine, and population health management. Personalized medicine, defined as software used to support the practice of medicine customized to an individual’s genetics, slid into the top six for the very first time this year. This growth in funding could be attributable to the technological innovations in both genomics and data analysis in recent years. The other five categories continue to see strong funding as a result of the changing healthcare legislative and reimbursement environment.

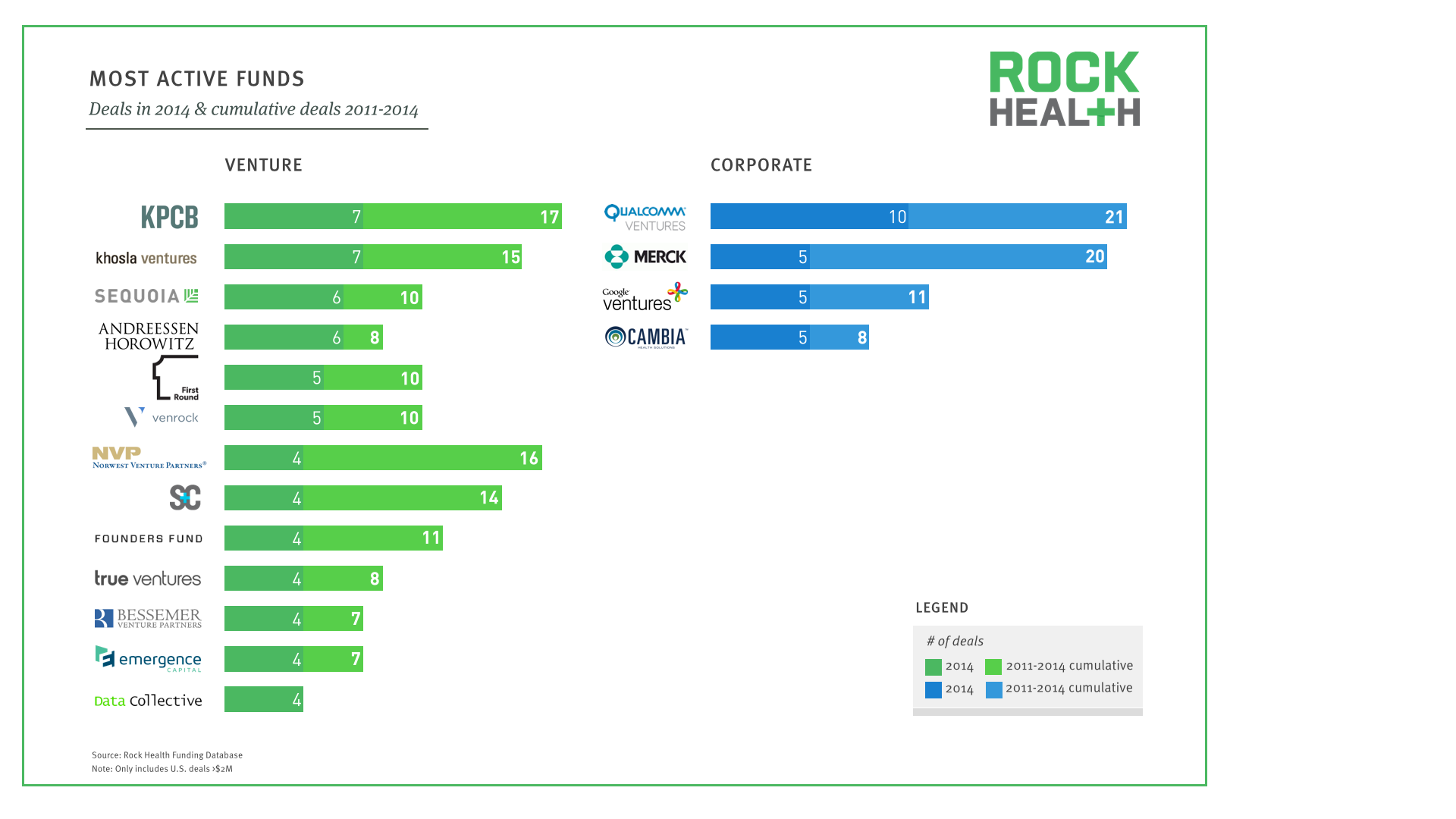

Investors are getting (really) active. In 2014, there were 344 dabbling investors (one or two deals per year) compared to only 121 back in 2011—a nearly 3X increase. And there’s a growing group of serial investors (three or more deals per year) establishing themselves in the space, with 55% of the serial investors of 2013 continuing to do 3+ deals in 2014. The most active investors in digital health represent a diverse mix of corporate, healthcare, technology, and agnostic venture funds.

Throughout 2014, 95 M&A deals were tracked, with disclosed transactions valuing over $20B. Large health tech companies continued to be the most active acquirers—but medical device, payers, and tech companies are making moves too. These industry players understand that the convergence of healthcare and technology will shape their business models and competitive landscape.

M&A isn’t the only exit option for digital health companies. Five digital health companies went public during the first half of 2014, raising a cumulative $1.7B. The public markets may have cooled off a bit in the second half of 2014, but this doesn’t mean our readers aren’t looking forward to IPOs in 2015!

As we look forward to 2015 and beyond, three categories experienced significant growth–and we’re optimistic about how these digital health companies can help improve care while reducing costs. Telemedicine and digital therapies are redefining what is considered care and how it gets delivered. By leveraging technologies, both healthcare professionals and care treatments can be more widely distributed and accessible to those in need. Moreover, as healthcare reform continues to change the reimbursement environment, payer administration tools will become key to helping stakeholders navigate the healthcare system (and get paid).

Thanks 2014 for an incredible year!

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.