Nanotechnology Markets in Healthcare & Medicine

Print

27 January 2015

Drug Development & Delivery

INTRODUCTION

In the field of nanomedicine research, the US accounts for one-third of all publications and half of patent filings. A comparison between Europe as a whole and the US shows that while Europe is at the forefront of research, the US leads in the number of patent filings. The strong patenting activity of US scientists and companies indicates a more advanced commercialization status.

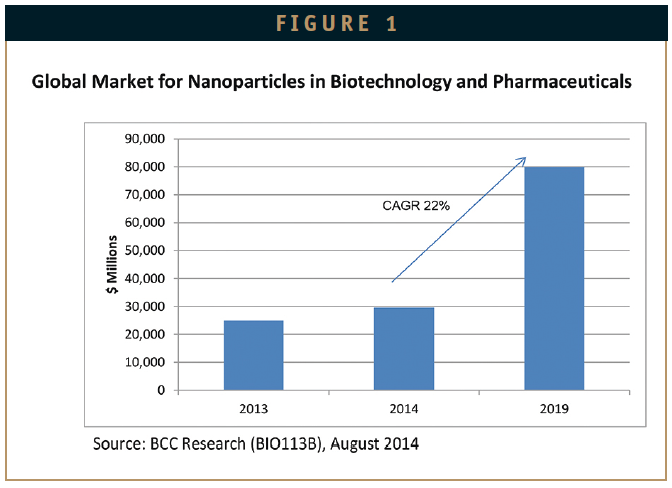

According to BCC Research (www.bccresearch.com), the global market for nanoparticles in the life sciences is estimated at over $29.6 billion for 2014. This market is forecast to grow to more than $79.8 billion by 2019, to register a healthy compound annual growth rate (CAGR) of 22%. The biggest increase will come in the area of drug delivery systems.

As products complete clinical trials and gain US FDA market approval, the revenues from these products will grow at 23%. Basic biotechnology research revenues will increase due to the quest to find more nanoparticle applications, as more drugs become successfully delivered by these carrier systems. Drug development and formulation will show steady sustained growth at 20.7%. Nanoparticles for use in diagnostic imaging will continue to show healthy growth at 20.1%. This will result from the need to develop more definitive nanoparticle markets for disease diagnosis.

APPLICATIONS IN MEDICINE

Nanomedicine includes several distinct application areas, including drug delivery, drugs and therapies, in vivo imaging, in vitro diagnostics, biomaterials, and active implants. In these fields, nanomedicine has seen increased research activity during the past decade. Currently, nanomedicine accounts for about 5% of nanotechnology research publications worldwide.

The dominant research field in nanomedicine is drug delivery, contributing 76% of the scientific publications, followed by in vitro diagnostics with a contribution of 11%. The countries of the European Union account for 36% of all nanomedicine publications worldwide, compared to the US with a contribution of 32% and Asia with 18%. Research efforts in nanomedicine are driven by significant governmental nanotechnology funding programs. Three countries - the US, Germany, and Japan - have given clear commitments to nanomedicine by establishing focused nanomedicine research programs.

However, when one looks at the commercialization of this field, the US emerges as having about half of the world market for nanomedicine products. US companies manufacture 45% to 50% of marketed nanomedicine products, while European companies have a 35% share. Product pipelines suggest that this gap will widen, reflecting mainly the weak position of European nanomedicine companies in the drug delivery sector, where they represent less than one quarter of all the companies in this field, compared to 60% for US companies.

Of the approximately 200 companies identified as active in nanomedicine worldwide, some three-quarters are startups and SMEs focusing on the development of nanotechnology-enhanced pharmaceuticals and medical devices. Another 40-plus major pharmaceutical and medical device corporations have nanomedicine products. Individual nanomedicine application areas are defined below.

Drug Delivery: Nanoscale particles/molecules are developed to improve the bioavailability and pharmacokinetics of therapeutics. Examples are liposomes (and virosomes), polymer nanoparticles, nanosuspensions, and polymer therapeutics. Drugs in which a protein is combined with a polymer nanoparticle or chemical nanostructure to improve its pharmacokinetic properties would qualify as nano-enhanced drug delivery.

Drugs and Therapy: Nanoscale particles/molecules used in the treatment of diseases that according to their structure have unique medical effects and as such differ from traditional small-molecule drugs; examples include drugs based on fullerenes or dendrimers.

In Vivo Imaging: Nanoparticle contrast agents, particularly for MRI and ultrasound, provide improved contrast and favorable biodistribution; for example,

superparamagnetic iron oxide nanoparticles for use as MRI contrast agents.

In Vitro Diagnostics: Novel sensor concepts are based on nanotubes, nanowires, cantilevers, or atomic force microscopy applied to diagnostic devices/sensors. The aim of these sensors is to improve sensitivity, reduce production costs, or measure novel analytes (eg, Alzheimer plaques) that could not otherwise be detected reliably.

Biomaterials: These include self-assembling particles or other types of nanomaterial that improve the mechanical properties and biocompatibility of biomaterials for medical implants; examples include nanocomposite materials used as dental fillers and nanohydroxyapatite used for implant coatings and bone substitutes.

Active Implants: Particles/materials improve electrode surfaces and biocompatibility of device housings. Examples include magnetic nanoparticle-based coatings that make medical implants safe for use with MRI imaging.

NANOMEDICINE MARKET

Nano-enabled medical products began appearing on the market over a decade ago and some have become best-sellers in their therapeutic categories. The main areas in which nanomedical products have made an impact are cancer, CNS diseases, cardiovascular disease, and infection control.

At present, cancer is one of the largest therapeutic areas in which nano-enabled products have made major contributions; these include Abraxane, Depocyt, Oncospar, Doxil, and Neulasta. Cancer is a prime focus for nanopharmaceutical R&D, and companies with clinical-stage developments in this field include Celgene, Access, Camurus, and Cytimmune.

Treatments for CNS disorders including Alzheimer’s disease and stroke also feature prominently in nanotherapeutic research, seeking to build on achievements already posted by products such as Tysabri, Copazone, and Diprivan. According to BCC Research, this is a field hungry for successful therapeutic advances and annual growth from existing and advanced pipeline products is expected to reach 16% over the next 5 years.

Autoimmune-related inflammatory disease has an increasingly high profile, and nanotechnology has contributed to the success of products such as Remicade and Humira. Enzon is among companies vigorously pursuing new product development in this field, and new products are expected to add to the continuing market penetration of existing therapies, contributing to annual growth rates around 15%.

In addition, nanotechnology has contributed to a wide variety of anti-infective products, from PEGylated interferons used in viral disease to nanocrystalline silver used topically in wound infections. Biosanté and NanoBio are among companies actively involved in this field.

The US market is by far the largest in the global nanomedicine market, and is set to continue to dominate the world marketplace, but other national markets are expected to increase their shares over the next 5 years.

COMMERCIALIZED & FUTURE MARKETS

Apart from targeted cancer chemotherapy, nanotechnology is being used more widely in creating a new generation of drug delivery systems. A key factor in its

adoption is that nanoscale particles have a greater surface-to-volume ratio than macroparticles. Thus, a drug-bearing nanoparticle can release a drug more quickly and more abundantly than larger particles. This is helpful when the drug poses problems with solubility and absorption, as is the case with a considerable proportion of new drugs.

Already on the market in the US and elsewhere are wound dressings that exploit the antimicrobial properties of nanocrystalline silver. Ionic silver is a powerful antibacterial, effective even against problem organisms like MRSA, and nanotechnology offers a way to optimize its effect when incorporated in a wound dressing.

While current medical nanotech applications focus on single nanoparticles and simple structures, future possibilities will involve combing such single elements into structures that can carry out more complex tasks than, for example, releasing drug payloads. Thus, nanostructures may be developed that can insert probes into elected cells and inject DNA or protein to correct genetic abnormalities.

Another possibility is to design nanostructures that can foster and direct the regeneration of nerve cells; these would be used in the treatment of stroke and trauma victims, and possibly for the restoration of lost function in Alzheimer’s disease. However, a sober estimate of timing would warn us not to expect these developments to become reality until 10 to 20 years from now.

The nanomedicine market is in early growth. While nano-enhanced drug delivery products are already a commercial reality, more advanced nanotech-based medical devices are still in development, although some are at the clinical testing stage.

Most of the money being spent on the wider field of nanotechnology R&D comes from government and established corporations. In the nanomedicine field, pharmaceutical and specialist companies are at the forefront of research into the medical applications of nanotechnology.

To date, drug delivery has been the main near-term opportunity for medical nanotechnology. This market has an estimated value of $15.8 billion for 2014 and is forecast to grow to $44.5 billion by 2019, to register a significant CAGR of 23%. The drug development category, the second fastest-growing opportunity, was projected at nearly $12.6 billion for 2014 and is expected to increase to $32.2 billion by 2019 at a 20.7% CAGR.

This article is based on the following market analysis reports published by BCC Research: Nanoparticles in Biotechnology, Drug Development & Drug Delivery (BIO113B) by Jackson Highsmith, and Nanotechnology in Medical Applications: The Global Market (HLC069B) by Paul Evers. For more information, visit www.bccresearch.com.

Kevin James is a New York City-based healthcare and medical communications professional with more than 15 years of experience in the private and public health sectors.

Jackson Highsmith is a life sciences research consultant with more than 16 years of research experience. Mr. Highsmith has been consulting with specialty pharmaceuticals and large pharmaceutical industry players since 2007. Prior to that, he worked at a large research consultancy, where he focused on in-depth

research; he has also worked at a large pharmaceutical company dealing with a wide range of medical therapeutics in early- and mid-stage drug development.

Paul Evers has been involved in analyzing pharmaceutical and medical markets for 20 years. His expertise includes nanotechnology in medical applications, generic drugs, pharmaceutical regulatory issues, and trends in major therapeutic categories.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.