BDO Special Report: PE Deal Activity in Healthcare

Print

30 July 2015

BDO

With the U.S. Supreme Court’s recent decision upholding healthcare coverage of millions of Americans, private equity investment in the industry may regain some of the steam it lost in the first half of 2015.

After a banner year in 2014, with at least 120 healthcare deals closed each quarter – and Q2, in particular, seeing a massive $12.4 billion in capital invested – the first half of 2015 experienced a slowdown in the number of completed deals, with Q2 just falling short of 100 transactions, the lowest healthcare deal count seen since Q3 2011. Deal value, however, began to resurge slightly in Q2, with total capital invested reaching $5.64 billion, compared to $3.03 billion and $3.7 billion, respectively, in the trailing two quarters.

.jpg)

While the frequency of transactions has tailed off in recent months, the size of deals has started to increase as large industry players come together to share risk and realize operational efficiencies,” said Patrick Pilch, managing director and Healthcare Advisory practice leader with The BDO Center for Healthcare Excellence & Innovation. “Of private equity fund managers already invested in healthcare, we’re seeing many focus on a ‘buy and build’ strategy, turning to joint ventures and organic growth opportunities that may not be reflected in deal count figures to increase the value of their investments.”

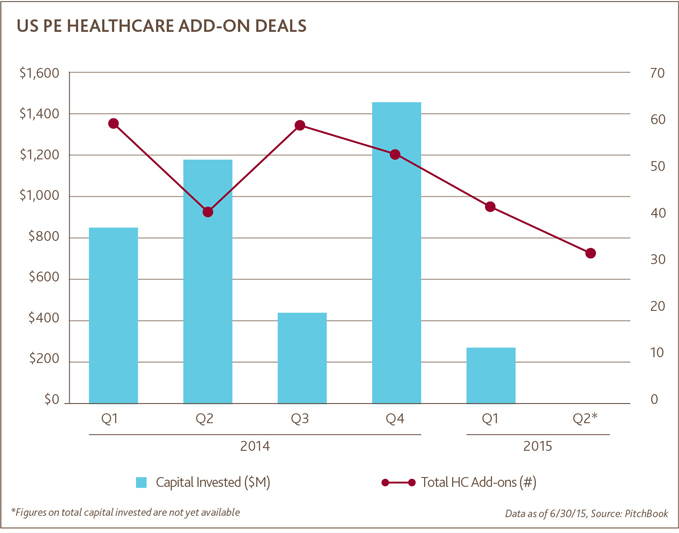

As private equity sponsors evaluate opportunities to grow their portfolios, many have also turned to add-ons during the past year, though they, too, experienced a small blip in the first two quarters of 2015. Q4 2014 saw 53 total add-on acquisitions in the healthcare industry, worth $1.45 billion in aggregate, and Q3 saw 59 total healthcare add-on deals close. That’s compared to 44 and 32 add-ons completed in Q1 and Q2 2015, respectively.

“Private equity fund managers are in the business of making their investments more stable and stronger. With healthcare provider organizations, that means reevaluating financial, clinical and operational models to better manage risk and align with value-based reimbursements,” added Pilch. “Many private equity sponsors are realizing returns in healthcare by investing in fragmented market players, rolling them up nationally to realize economies of scale and ensure the right care is being delivered at the right place and time.

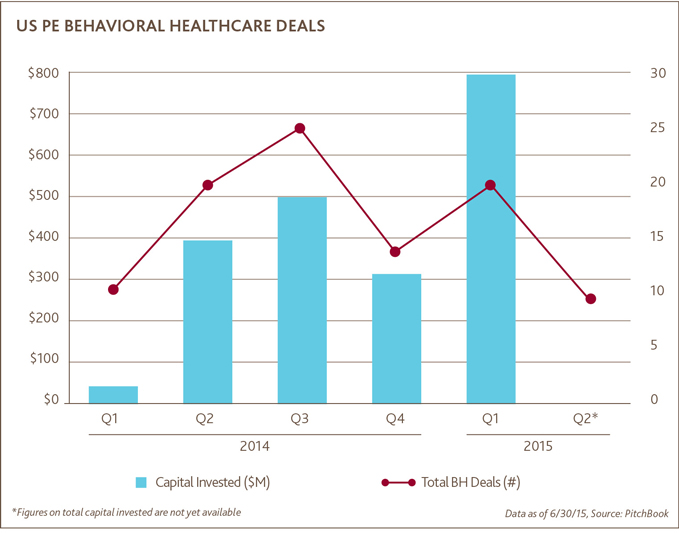

One area that is particularly attractive for private equity sponsors in today’s investment environment is behavioral healthcare. In the past decade, several important pieces of legislation have passed, increasing the number of covered lives faster than the availability of services to treat them. Demand initially began to increase in 2008 with the passing of the Mental Health Parity and Addiction Equity Act (MHPAEA) that ensured equal coverage for behavioral and medical health benefits. That same year, Congress also passed the Medicare Improvements for Patients and Providers Act (MIPPA), which increased access to mental health in Federal programs. Then, in 2010, the Affordable Care Act expanded coverage even further, building on the MHPAEA by requiring that most insurance plans cover mental health and substance abuse services.

Behavioral healthcare programs can also have attractive margins on secure revenue streams. That, coupled with the heavily fragmented nature of the industry – the behavioral healthcare sector is currently dominated by small providers with no national footprint – has led to increased private equity interest. Last year, for example, the sector registered close to 20 deals worth nearly $800 million, a third of which were add-ons. Given the fragmentation of the market for behavioral healthcare services, it’s reasonable to expect an increase in private equity-backed rollups that are able to capitalize on economies of scale, and both clinical and administrative standardization.

A challenge in behavioral healthcare investing, however, is the efficacy of the target provider. According to a Professional Psychology: Research and Practice article, of 59 alcohol and other substance abuse treatments rated by experts in 2006, only five were deemed credible (rated either “not at all” or “unlikely” discredited). Behavioral healthcare may have improved since then, but efficacy is still a concern, particularly as insurers move to reimburse only for outcomes and evidence-based treatments.

Overall, there is plenty of opportunity in behavioral healthcare for the careful private equity investor. “Behavioral healthcare is a large and growing market,” added Dr. Bithoney. “During the next five years, we expect to see more and more consolidation as investors capitalize on the opportunities evident in a highly fragmented market, creating efficiencies that improve the quality of care and return on investment for private equity sponsors.”

“With the Mental Health Parity Act and other recent legislation increasing coverage for mental health and substance abuse treatments, demand is significantly outpacing the supply of behavioral health services,” said Dr. William Bithoney, Chief Physician Executive with The BDO Center for Healthcare Excellence & Innovation. “For investors who are able to sort out the quality investments from the bad, this imbalance is generating compelling investment opportunities in a market that is poised for significant growth.” “While there’s significant value to be generated in behavioral healthcare, it’s critical that investors undertake a holistic financial, clinical and operational review of their targets to fully understand the long-term viability of their potential investments,” said Pilch. “We envision more compelling rollup strategies that will integrate clinical and behavioral health.” –

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.