The Biotech sector still remains solid after meltdown of general markets

Print

08 September 2015

Peter Winter / BioWorld

The fears that the downward spiral of the capital markets during the financial crisis that occurred in 2008 would be repeated in the wake of last week's "Black Monday" are, for the time being, in the rearview mirror. In fact, the markets have rebounded strongly and now seem poised to remain positive for the final months of the year, although it is predicted there will be some turbulence along the way.

It was certainly scary for a couple of days at the start of last week as investors headed for the hills on news that China's economy appeared to be in rougher shape than originally forecast. As a result, there was a sharp selloff of shares that saw the Dow drop 3.6 percent last Monday, with all sectors feeling the brunt of the downdraft including biotech. However, by the close of the markets on Thursday investors had returned just as fast as they had left, no doubt encouraged by a surge in the Chinese stock market and welcome news from a report showing that the U.S. economy in the second quarter had expanded at a much faster pace than previously estimated.

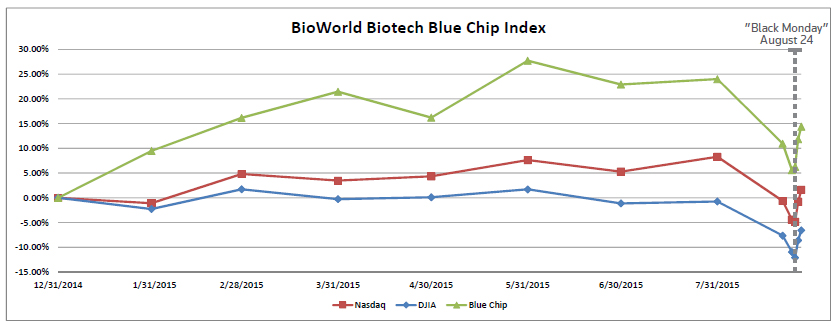

The temporary dip in biotech valuations didn't seem to shake investors' confidence in the industry too much. Although Black Monday shaved almost 5 percent off the BioWorld Blue Chip Index, which comprises 20 of the leading companies ranked by market cap, by market close Thursday it had recovered that value and then some, finishing up 3 percent for the week.

The improvement in biotech's elite companies did not mask what, for them, has been a very lackluster and uncharacteristic month for the sector as a whole. With two trading left, in what has seemed a rather prolonged August, the index has tumbled almost 8 percent. (See BioWorld Blue Chip Index, below.)

Almost all of the blue chip group's companies were caught in a general selloff resulting in a significant erosion of their share values.

The reset in biotech has long been predicted and, according to RBC Capital Markets analyst Michael Yee, "the pullback is probably relatively healthy to shake out weaker hands that have driven up some names too fast."

It was a sentiment reflected by Joe Rosenberg, senior biotech analyst at Nasdaq Advisory Services. There have been a few pullbacks during the year as part of normal market trading, he told BioWorld Insight. This time around, it is a healthy one for the sector given the high valuations that a number of companies had achieved.

Certainly, the current correction has a different feel to it than the biotech bubble that we saw in 2000. The main reason is that the more mature companies in the sector have valuations that are driven by solid fundamentals such as earnings as opposed to expectations based on promising pipelines alone, Rosenberg noted.

BIG BIOTECHS CAUGHT UP, TOO

Biotech's two top companies by market cap were caught up in the pullback, with Amgen Inc. (NASDAQ:AMGN) and Gilead Sciences Inc. (NASDAQ:GILD) seeing their share values drop approximately 12 percent and 8 percent, respectively, in August.

Amgen, however, was poised to recover some of its share value last Friday on its announcement, after the markets had closed Thursday, that it received an expected FDA approval for Repatha (evolocumab), its PCSK9 inhibitor, with a label that includes the homozygous familial hypercholesterolemia. (See BioWorld Today, Aug. 28, 2015.)

The biotech correction wave even washed over companies developing cancer drugs in the white hot immune-oncology space. Juno Therapeutics Inc., for example, saw its share value drop almost 24 percent.

ARRESTING GROWTH

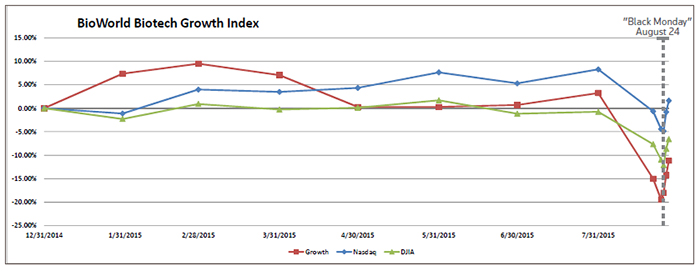

Companies comprising the BioWorld Biotech Growth Index also took it on the chin in August, with the index tumbling by almost 14 percent. (See BioWorld Biotech Growth Index, below.)

One of the largest decliners in the group was Alnylam Pharmaceuticals Inc. (NASDAQ:ALNY), whose share value dropped almost 18 percent partly precipitated by the company reporting second quarter financials. A much wider net loss for the second quarter of $71.8 million, compared to $44.1 million for the same period in 2014, disappointed investors.

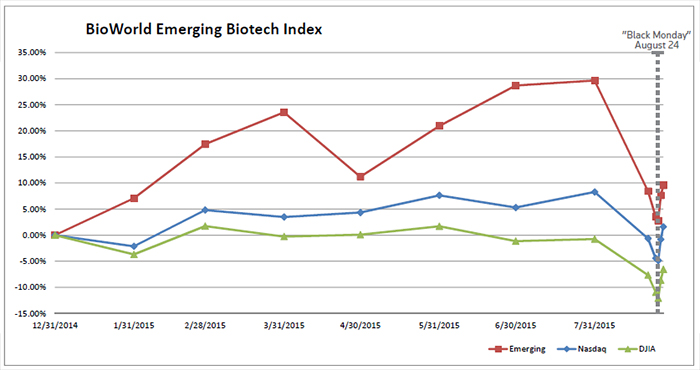

The BioWorld Biotech Emerging Growth Index also mirrored the performance of the BioWorld Biotech Growth Index, with its value dropping 15 percent during the month. (See BioWorld Biotech Emerging Growth Index, below.)

ONWARD AND UPWARD

Despite the correction, biotech still remains well placed to conclude the rest of the year on a positive note. Its strong first half has provided a solid foundation to weather current and potential future macroeconomic events. Post Labor Day, analysts expect the large-cap biotechs to do most of the heavy lifting while the smaller-cap companies may face headwinds with investors being more cautious as they evaluate opportunities much more closely and selectively in emerging biotech opportunities.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.