Rivaling some BRIC countries, Middle East-North Africa region is a growing market

Print

14 September 2015

Mari Serebrov / BioWorld

MENA – the Middle East and North Africa. As a region, it's got everything a drugmaker could want. An expanding and aging population. Unmet medical need. A growing middle class. The desire and the ability to pay for branded and generic therapies.

Other factors spurring opportunity in the region include longer life expectancy, lower mortality rates, rising income levels and an increased prevalence of lifestyle-related diseases such as diabetes. It's also a doorway to the largely untapped African market.

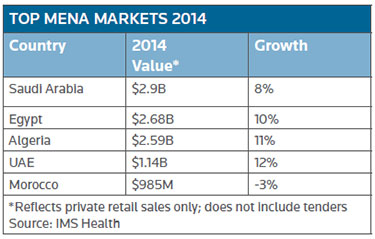

The biopharma market throughout the region exceeds $18 billion and is growing at about 8 percent a year. While MENA has more than 140 homegrown drugmakers, most of them produce generics. There is a need for newer diagnostics and therapies. Adding to the allure are the potential for relatively higher prices than in other emerging markets, increased insurance coverage, urbanization, a strong base of U.S.-educated and trained medical specialists, low-cost manufacturing and low corporate tax rates.

Then there's the growing harmonization among the members of the Gulf Cooperation Council – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE). But there are drawbacks.

While some MENA countries have great wealth, per capita incomes in the region remain low. With the government paying the health care bills in many countries, biosimilars and generics are likely to be the drugs of choice for much of the region and price controls may be a reality for both drug- and device-makers. Local restrictions on ownership of manufacturing facilities and frustrations around intellectual property (IP) also have to be weighed. Plus there's the geopolitical instability that can turn a promising market into a forbidden territory overnight.

Despite the downsides, several multinational drug- and device-makers, as well as smaller foreign companies, are targeting the region because of its growing market and the unmet need.

MENA's 'SWEET SPOT'

"Pharma-emerging markets are very attractive," especially those that find themselves in the sweet spot of having both purchasing power and growth, Abdullah Baaj, CEO and founder of Boston Oncology, toldBioWorld Today. Taken as a group, Algeria, Egypt and the GCC hit that sweet spot – along with markets like Brazil, Mexico, Russia, South Korea and Turkey.

Together, the three areas equal one emerging market of about 180 million people, comparable with Brazil, and boasting a compound annual growth rate (CAGR) of 12 percent to 15 percent, Baaj said. In comparison, developed markets like the U.S. are on track for a 1 percent to 4 percent CAGR from 2012-2016. In carving out a market focusing on Algeria, Egypt and the GCC, Boston Oncology is sidestepping the MENA hotspots.

The Gulf countries have a lot going for them as a biopharma/biotech market. Since 1961, the life expectancy in the Gulf has grown from 50 years to about 75. While two-thirds of the population is younger than 40, the majority will be older than 40 in the next 10-25 years, Baaj said. It's a baby boom in the making, but it won't be the bubble experienced in the U.S., because the reproduction rate is not declining.

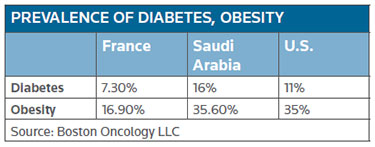

The result will be a growing market with an increase in age-related diseases, as well as conditions linked to the adoption of a Western lifestyle. For instance, Baaj noted that the incidence of diabetes and obesity is now greater in Saudi Arabia than it is in France and the U.S. Since both conditions have been linked to a higher risk for cancer, the need for oncology treatments is expanding throughout the region. (SeePrevalence of Diabetes, Obesity chart, below.)

One mistake drug- and device-makers need to avoid is looking at MENA as a unified market. IP issues – one of the biggest challenges, according to Baaj – vary throughout the region. And even though the GCC has a centralized registration process and increasing harmonization, countries outside the Gulf do not. Having to register a product in every country creates inefficiencies, Baaj said.

THRIVING DOMESTIC INDUSTRY

Companies wanting to market in the MENA region could learn from thriving homegrown drugmakers like Jordan's Hikma Pharmaceuticals plc and the UAE's Julphar, both of which are becoming multinational players in their own right.

Having expanded from its Middle East base, Hikma has a presence in 21 countries with manufacturing facilities in Europe and the U.S., as well as in several MENA countries. Its goal is to offer the first or second generic on the market to ensure the best price for its products. It relies on launches of new products to counter the impact of price erosion in certain markets.

Hikma undertook significant restructuring of its operations in Algeria last year and saw its business in Iraq and Libya impacted by "political disruptions," according to the company's 2014 annual report. However, those downturns were offset by strong growth in Egypt, the GCC and some of its foreign markets. The key to its success is diversifying its markets and improving the mix of its sales toward higher value products in the fastest growing therapeutic categories – cardiovascular, diabetes, central nervous system and oncology.

Julphar also felt the "effects of uncertain and devastating geopolitics in major markets such as Iraq, Syria and Libya," it said in its 2014 annual report. As a result, it is looking to diversify its markets and expand its manufacturing capabilities globally. The GCC remains a cornerstone of Julphar's growth strategy due to increased health care spending by local Gulf governments and the maturity of the health insurance industry there.

However, emerging markets continue to be a key priority for the company's sustainable growth, with Julphar noting that its "Middle Eastern roots allow it to reach difficult markets in a timely manner."

Both companies have prospered from partnerships with foreign companies and sales of biosimilars and generic drugs. "The pharmaceutical markets in MENA tend to be branded markets in which products, both generic and patented, are marketed under specific brand names through large sales and marketing teams," Hikma said in its annual report.

MARKET HIGHLIGHTS

The following insights into individual MENA markets have been gleaned from Hikma, Julphar, Baaj, Cortellis and BioWorld's report Biosimilars: A Global Perspective of a New Market – Opportunities, Threats and Critical Strategies 2014:

Algeria: Given Algeria's aspirations to join the World Trade Organization, the country's national legislation is expected to increasingly align with international norms. This shift should benefit Algeria's well-developed domestic life sciences industry. The government requires that 45 percent of drug imports be generics. Algeria has strong local R&D centers, which can help accelerate product launches and address specific market opportunities. Health care is provided free to all citizens at public hospitals, but the number of public hospitals is limited. Algeria remained on the U.S. Priority Watch List in 2015 because of its ban on a number of imported drugs and medical devices in favor of local products.

Bahrain: To meet the growing need, the Ministry of Health plans to expand health care access. Those plans include the development of three health centers between 2015 and 2016.

Egypt: While there is some unrest in Egypt, the country is an attractive market with a growing middle class and a well-developed domestic life sciences industry. The government continues to increase the number of products that qualify as essential medicines. Like Algeria, Egypt has strong local R&D centers that can help with product launches and respond to specific market needs. In 2013, Egypt released draft guidelines to recognize biosimilars approved elsewhere and create a path for biosimilars being developed specifically for the Egyptian market. Egypt remains on the U.S. Watch List mainly because of weak IP protection, especially in preventing counterfeits from entering the country. In this year's Special 301 Report, the U.S. urged Egypt to clarify its protection against the unfair commercial use and unauthorized disclosure of test or other data used to obtain marketing approval of pharmaceutical products.

Iran: Drug- and device-makers wanting to provide therapies to the Iranian market have had to navigate sanctions against the country. New international treaties could make it easier to do business there in the future.

Iraq: Despite the political unrest, the market is expected to grow due to increased health care spending, a growing aging population and a government pledge to invest $276 million into health care infrastructure.

Israel: With a thriving domestic life sciences industry, Israel is home to the likes of pharma giant Teva Pharmaceutical Industries Ltd. Although the country plans to boost public spending on health care by more than $254 million in the next year, it has one of the lowest levels of public expenditures of countries in the Organisation for Economic Co-operation and Development, according to the Ministry of Health.

Jordan: Last year, the Jordan Food and Drug Administration reduced prices of 199 domestic and imported drugs, with the discounts ranging from 1 percent to 90 percent of the original price. Some drugmakers have cited preferential treatment for domestic companies. Economic weakness and political unrest among Jordan's neighbors are factors to consider. In 2013, Jordan began shaping a biosimilar regulatory path that follows EMA and the International Conference on Harmonisation (ICH) guidelines. The path allows biosimilars to reference biologics approved in the EU or Jordan. Jordan doesn't publish patent applications, which can lead to submarine patents and abuse of IP rights.

Kuwait: The country's health care needs are increasing with its growing population. Subsequently, it's facing pressure to contain costs and keep the use of fake generics in check. Kuwait was placed on the U.S. Priority Watch List in 2014 and repeated that listing in this year's report. According to the U.S. Trade Representative, the country's appearance on the list was due primarily to copyright issues.

Lebanon: The Health Ministry last year reduced the price of costly drugs by 10 percent to 17 percent. The country is in the process of reforming its IP laws, but enforcement remains weak, according to the U.S. 2015 Special 301 Report. Lebanon is on the U.S. Watch List.

Libya: One of the smaller markets in the region, Libya offers the potential for growth, but it is plagued by political disruptions.

Morocco: The country has implemented the final phase of its universal health insurance program. It boasts a growing middle class, along with an increasing reliance on drug imports. However, the government has mandated drug price cuts.

Oman: As part of the government's strategy to tackle lifestyle-related diseases, the country more than doubled its planned health care budget from $1.3 billion in 2013 to $3.38 billion in 2014. With more Omanis moving toward private medical providers, the government plans to expand the range of available medical facilities.

Qatar: The Supreme Council of Health is completing its master plan that will drive the development of health care facilities through 2033. The plan is intended to identify key trends and enable better access to the health system, spurring further growth in the demand for medicines.

Saudi Arabia: Saudis tend to prefer patented drugs, but the government is trying to contain increasing health care costs through strict price controls and mandatory price reductions. In recent years, the government has required mandatory health insurance coverage. Having finalized a biosimilar path in 2010 that follows EMA and ICH models, Saudi was the first MENA country to implement a distinct regulatory route for the follow-ons. Under the general guidance, a biosimilar may reference a biologic approved by either the Saudi Food and Drug Authority or the EMA.

Syria: For years, Syria was an attractive market as it had one of the fastest growing economies in the region. But because of the current unrest, it is difficult to do business there.

UAE: In general, the UAE is business friendly and welcomes investment. Generic drug spending in the UAE is expected to grow from $300 million in 2013 to $470 million in 2018 – a CAGR of about 9 percent, compared with an expected 5.9 percent growth for patented drugs. The government made health insurance coverage mandatory in 2014. Responding to a high burden of disease, significant investment and increased government spending are being planned in the coming years to help further develop the health care infrastructure, especially in the four northern emirates.

Editor's note: Aside from the ongoing geopolitical storms in MENA, this region is shaping up as an attractive emerging market for drugmakers. The confluence of events and conditions include an expanding and aging population, low-cost manufacturing, increasing insurance coverage and growing regulatory harmonization, to name a few. This week BioWorld begins a series examining the status of drug development in the region. Today's article by Regulatory Editor Mari Serebrov sets the stage, provides market highlights and reveals MENA's sweet spot for drugmakers. Tomorrow, BioWorld Insight Editor Peter Winter will explore the dealmaking landscape. Articles to follow will dig into the financial markets, Halal regulations in the Islamic markets and a surprising Latin America connection. Also see Top MENA markets and MENA by the numbers, below.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.