Big Pharma's Foe Takes Victory Lap as Drug Price Increases Slow

Print

16 September 2015

Robert Langreth / Bloomberg Business

Just as he’s about to retire, George Paz’s strategy to rein in drug companies’ price increases is starting to show results.

A new analysis shows that attempts by drugmakers to raise prices on their prescription medications are being wiped out in negotiations with managers of drug insurance benefits, led by Paz’s company, Express Scripts Holding Co., and his biggest rival, CVS Health Corp. Express Scripts said Wednesday that Paz will retire in May, making way for the company’s president, Tim Wentworth, to take over.

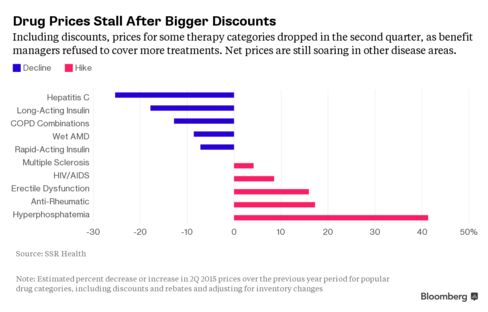

While list prices for drugs continue to rise rapidly, the analysis published this week by SSR Health found that after rebates and discounts, U.S. brand-name drug prices rose just 0.7 percent in the second quarter from the previous year. That compares with a 4.4 percent rise in the second quarter of 2014. That’s because companies like Express Scripts and CVS have embarked on strategies to exclude big-selling treatments from lists of covered drugs unless their makers offer better prices, according to the report from SSR, an investment research firm.

Express Scripts and CVS negotiate discounts with drug companies on behalf of insurers and employers. Increasingly in the last few years, they have inked deals to offer one drug company’s medicine exclusively in exchange for a lower price, shutting out competitors.

Brand-name drug price inflation “is about as low as it has been in a very long time,” said Richard Evans, an analyst at SSR Health in Montclair, New Jersey. His analysis found that most of the change was driven by price declines in a handful of disease categories including hepatitis C and diabetes.

Price War

In December, Express Scripts said it would exclude Gilead Sciences Inc.’s hepatitis C treatment Harvoni from its main list of covered drugs this year, in favor of a competing treatment fromAbbVie Inc. That move set off a price war over hepatitis C drugs, with several other insurers and payers covering only the Gilead medicine.

With the discounts that followed, hepatitis C therapy prices declined 25 percent in the second quarter, SSR estimated. Meanwhile, prices for long-acting insulin drugs declined 18 percent. Lantus from Sanofi and Levemir from Novo Nordisk A/S are the main medications in that category.

Paz helped gain negotiating leverage for Express Scripts by bulking up, acquiring rival Medco Health Solutions Inc. in 2012. Wentworth joined the company through that acquisition.

In negotiating prices with drug companies, “size does matter,” Wentworth said Wednesday in an interview. More deals could be on the way, he said.

Approved Lists

Benefit managers will continue to use covered-drug lists as a way to keep drug price increases down, Wentworth said. “It enabled us to break into sensible places for pricing discussions,” he said.

CVS didn’t respond to requests for comment.

For drugmakers, Express Scripts and CVS have been tough negotiating foes, pushing back against their arguments that higher prices are needed to support research and development for medical advances. At the same time, pharmaceutical companies have credited benefit managers with pushing them to be competitive on price.

Private Talks

The SSR data suggest that the U.S. system of behind-the-scenes negotiations between drugmakers and payers is working to control health-care costs, said Robert Zirkelbach, spokesman for the drug-industry group Pharmaceutical Research and Manufacturers of America.

“Too often the public policy debate focuses exclusively on the list price of medicines,” while ignoring discounts that big drug benefit managers get, he said.

While drugmakers don’t disclose the discounts they give to gain favorable insurance coverage, SSR Health estimated the final prices after rebates by comparing company-reported net sales to the number of units sold of each drug in each quarter and adjusting for changes in inventory, Evans said.

Drugs for erectile dysfunction, such as Pfizer Inc.’s Viagra and Cialis from Eli Lilly & Co., could be next to feel increasing pricing pressure, SSR Health predicted. Even after discounts, prices for this category jumped 16 percent in the second quarter from a year earlier.

Last month, CVS said it would drop Viagra from its list of coverage for drug insurance benefits starting Jan. 1. The company still covers Cialis.

CVS still sells Viagra in its drugstores to customers whose insurance covers the medication or who pay in full for it. Employers and insurers who use CVS to manage their drug benefits can also choose to make exceptions to the formulary.

Express Scripts is increasing its focus on high-priced cancer drugs, Wentworth said, because “the cost of oncology continues to concern our clients greatly.” It’s also looking for ways to drive down prices for hepatitis C drugs further, he said.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.