Big Pharma Stock Unappreciated by Analysts Is a Top Performer

Print

21 September 2015

Oliver Renick Melissa Mittelman Drew Armstrong / Bloomberg Business

-

Eli Lilly shares have gained 149 percent since September 2010

-

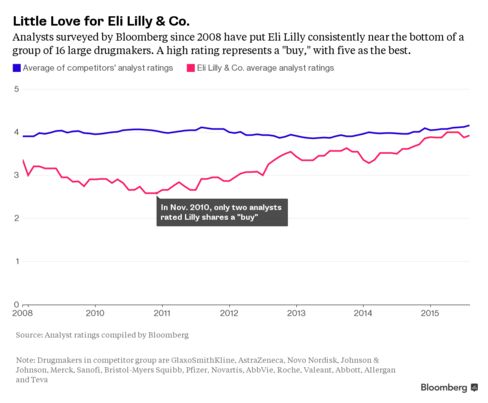

Less than half of analysts rated stock "buy" over last decade

Eli Lilly & Co. has been one of the drug industry’s least-loved stocks by industry analysts. That was the wrong call.

Lilly’s shares have been on a five-year rally, helped by the company’s growing portfolio of diabetes medications and bets on cancer and Alzheimer’s disease.

Yet analysts have consistently given the Indianapolis-based company among the lowest ratings among a group of 16 large drugmakers, according to data compiled by Bloomberg. Only AstraZeneca Plc got lower ratings since 2009, on average.

Over the last five years, Lilly has outperformed gains by Pfizer Inc., Merck & Co., Bristol-Myers Squibb Co., as well as a broader index of 12 drug companies, and the Standard & Poor’s 500 Index. The shares have gained 149 percent over that period and are trading at a 15-year high of almost $90.

"It’s an interesting story, Lilly, when you look at it on a 15-year view," said Richard Purkiss, an analyst with Piper Jaffray. "It’s gone through this aggressive downside with actually quite remarkable recovery."

"Now we’re looking at what looks like really material upside, which the market actually didn’t price in quickly enough," Purkiss said. His $120 price target is the highest among analysts surveyed by Bloomberg. He was previously at Atlantic Equities, where he changed from an "underweight" to an "overweight" rating in August 2012.

Most recently, Lilly reported data from a diabetes drug, Jardiance, that showed it helped reduce the rate of cardiac events -- sending the stock up almost 10 percent this week.

"If you’ve been underweight the stock into the diabetes data, you might have some considerable thinking to do as to whether you remain underweight through the balance of next year," Purkiss said.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.