3Q venture capital decreases, but there's a silver lining

Print

14 October 2015

Brian Orelli / BioWorld

When you compare third quarter investments in private U.S companies to the rest of 2015, it doesn't look pretty. Just 39 companies tracked by BioWorld Snapshots garnered the attention of venture capitalists in the third quarter compared to 53 in the first quarter and 50 in the second quarter.

The total amount of investments doesn't look any better. The $1.4 billion invested in private companies in the third quarter was substantially lower than the nearly $1.8 billion in the second quarter and the $1.94 billion that we started the year off with.

It's tempting to say the weak public markets in the third quarter had something to do with the decrease, but venture capitalists I've talked to insist that they're investing for the long term. They claim that the public capital markets and even the current state of the IPO window have little effect on their investment decisions.

"VCs have to be long-term investors, especially those of us starting new companies. Periods of great returns – like now – help to provide capital flows into the space, but the companies we are starting now have five- to seven-year paths ahead of them before they achieve significant clinical outcomes," Atlas Venture partner Bruce Booth told BioWorld Today last December.

So what's keeping venture capitalists from making investments? My guess is the beach. July and August both fall in the third quarter. After doing more than 100 deals in the first half of the year, they certainly deserve a little vacation.

For reference, last year, the 35 deals we saw in the third quarter was substantially lower than the 50 deals registered in the second quarter, so this may be a new trend that we didn't see in the leaner years of 2012 and 2013 where then number of deals were flat quarter over quarter (35 vs. 35) and up slightly (11 vs. seven), respectively.

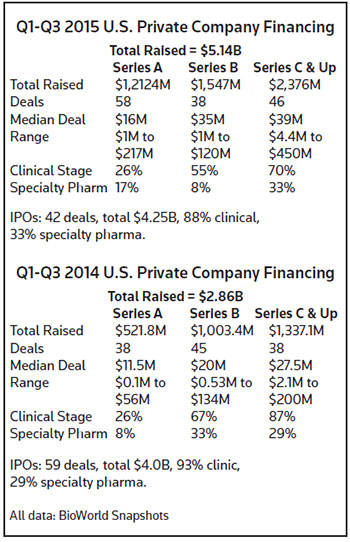

Despite the quarter-over-quarter decrease this year, there's a silver lining: We're still well ahead of where we were this time last year with more than $5.1 billion in investments vs. less than $2.9 billion in the first three quarters of last year. The total number of deals is also up year over year (142 vs. 121).

Taking a look at the breakdown of deals, new company starts are up substantially year over year (58 vs. 38) and investments in later-stage companies also rose (46 vs. 38). The number of series B investments has declined year over year (38 vs. 45), but that might not be anything to worry about; the most recent quarter had the largest number of series B investments of the year (17 vs. 13 and eight in the two prior quarters), so perhaps the trend has already reversed.

The $720 million invested in series B rounds in the third quarter was substantially more than the $471 million and $356 million invested in series B rounds in the first and second quarters, respectively.

The increase can be traced to a large number of big deals. Six of the seven largest 2015 series B rounds happened in the third quarter, including Cambridge, Mass.-based Editas Medicine Inc.'s oversubscribed $120 million round. (See BioWorld Today, Aug. 11, 2015.)

While investment in private companies is up year over year, the number of companies moving to the public markets is down. The 12 IPOs on U.S.-based exchanges in the third quarter brings the total for the year to 42. This time last year, we already had 58 IPOs under our belt.

Despite the smaller number of companies going public, the deal sizes have been larger, on average, allowing the companies to raise more capital from the public markets – $4.25 billion this year vs. $4 billion in the first three quarters of last year.

And, of course, like everything, the number of IPOs is relative. There were only 30 IPOs in the first three quarters of 2013 and a paltry eight in the same time period of 2012. In that perspective, 42 IPOs doesn't look too bad.

Let's see if all these newcos formed over the last few years can keep the window propped open while we wait for the VCs to come back from vacation.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.