BDO Special Report: PE Deal Activity in Healthcare

Print

07 December 2015

BDO USA

“Outpatient services will play an increasingly large role in healthcare delivery moving forward, as payers and providers aim to deliver quality care in the lowest-cost settings as site neutrality provisions begin to take hold. Reimbursements for healthcare providers are increasingly tied to patient outcomes, as well as treating patients in the right place at the right time, so collaboration among hospitals and niche providers is critical in this new environment. Partnerships, joint ventures, deployment of telemedicine where appropriate and other collaborative business models are essential to success.” - Patrick Pilch, managing director and Healthcare Advisory practice leader with The BDO Center for Healthcare Excellence & Innovation.

The BDO PE Deal Activity in Healthcare report, powered by PitchBook, compiles data from the PitchBook Private Equity Database and insights from The BDO Center for Healthcare Excellence & Innovation to evaluate the latest trends and opportunities for private equity investments in the healthcare industry.

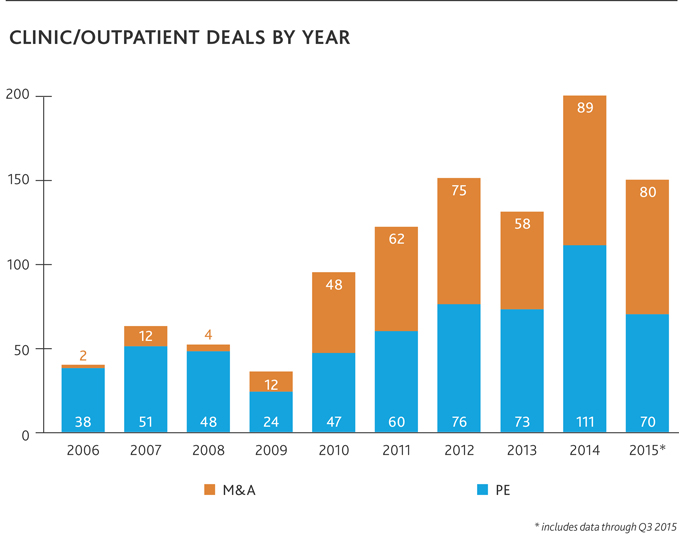

Healthcare is a magnet for deal activity and investment opportunities as providers rethink their approach to delivering care. One of the most active targets for deals has been clinics and other outpatient service providers.

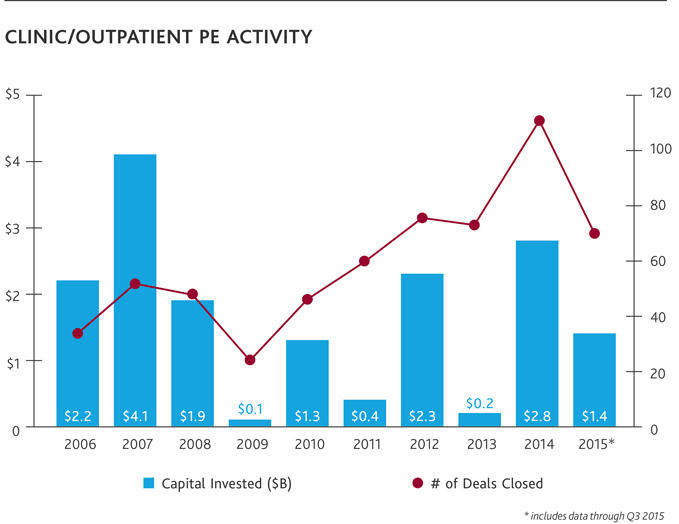

Private equity transactions in this space hit their highest level in a decade at $2.8 billion with 111 deals last year; the pace slowed only slightly this year with 70 deals valued at $1.4 billion hitting the books through the end of Q3. Non-private equity deals targeting clinics and outpatient services has maintained an aggressive pace as well, with 80 transactions recorded through the end of Q3, and compared with 89 deals for all of 2014.

Update: While PE transactions in the clinic/outpatient space are still lagging slightly behind 2014, there has been forward progress since the end of Q3, with an additional five deals valued at $78.4 million through the end of October. Other, non-M&A clinic/outpatient deal activity has also continued since Q3, with seven new deals valued at $63.3 million in capital invested through Oct. 31.

Investment activity has centered heavily on rolling up smaller providers in specialty areas, such as behavioral healthcare and pain management, into scalable platforms. This type of model intrigues PE investors who can leverage their operational expertise through a buy-and-build strategy at lower overall purchase multiples. With the market skewing more heavily in favor of sellers in recent years, PE firms have found success in selling off those platforms or expanding further as larger groups look for acquisitive growth.

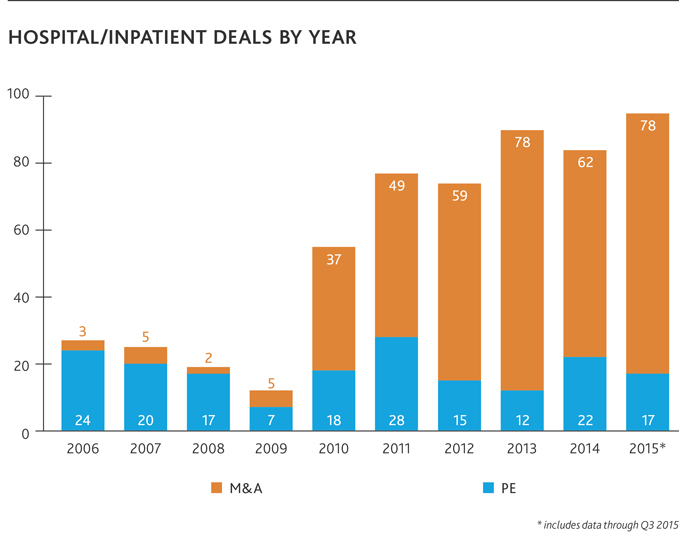

Meanwhile, deal activity in the hospital and inpatient services space has been trending upward, but excitement is much more subdued than on the outpatient side. Non-PE deals have skyrocketed since 2010: Only 37 deals (valued at $290 million) were recorded five years ago, compared with 78 deals through Q3 2015 valued at $4.5 billion—meaning on average, deal values increased more than seven times over. However, PE interest has remained relatively low. PE-related transactions hit a high of 28 in 2011, but have diminished since then, with 22 last year and 17 through Q3 this year.

Similarly, PE investments have taken a backseat to other M&A in the hospital space, in part because there are few healthcare-dedicated PE firms that can regularly pull off mega-mergers between hospital chains. Consolidation will be a major trend in the hospital/inpatient space for the coming years as hospital chains look to achieve efficiencies of scale and maximize their existing infrastructure.

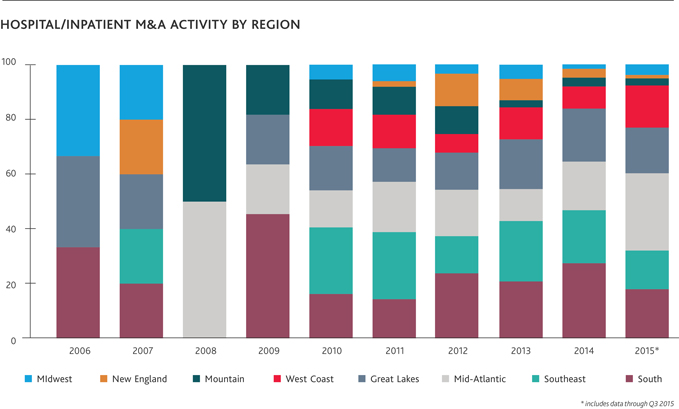

Healthcare spending continues to grow. The Centers for Medicare & Medicaid Services (CMS), for example, project an average growth rate of 5.8 percent in health spending from 2012 to 2022, peaking at 19.9 percent of U.S. GDP in 2022. The market is opportune for investment and acquisition; however the supply of quality targets for PE buyers and strategic acquirers isn’t limitless. Moreover, significant interest in investment has lifted comparable values for targets likely not deserving of such benefit. For example, hospitals/inpatient services in the southern United States have been a hot target for investors looking to gain efficiencies of scale, but investors may find the greatest follow-on value investment opportunities in the post-acute space, as providers and investors develop integrated care models to enhance value under the new bundled payment reimbursement models being introduced by CMS.

Deal multiples are trending quite high with healthy competition occurring across both the inpatient and outpatient service areas. (For general healthcare services in the U.S. across PE transactions and general M&A activity, the median valuation multiple in 2015 was 8.2 times EBITDA.) The pace of activity will likely start to slow soon, given that deal flow has been so heavy in recent years. But with strong growth prospects overall in healthcare, this natural slowdown is more likely to be a dip than a slump.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.