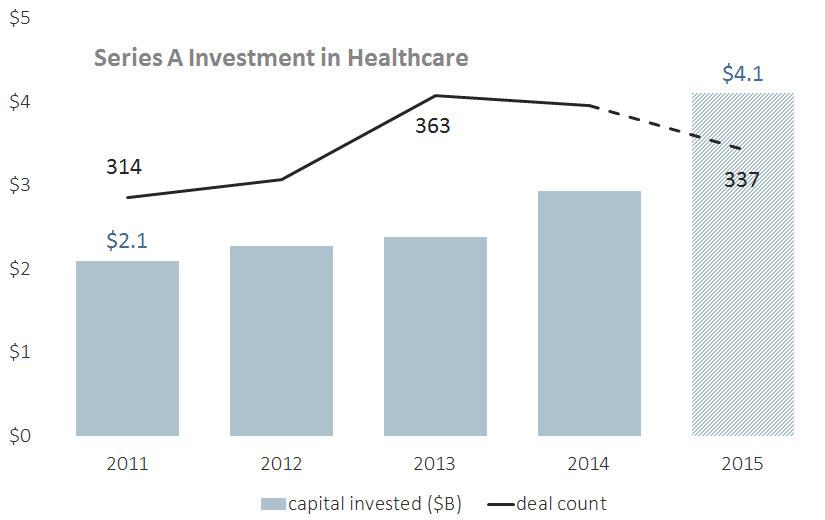

Record $4.1B of Series A capital invested in healthcare in 2015

Print

10 December 2015

Kyle Stanford / PitchBook Blog

Healthcare has become a more and more enticing target for venture capital over the past few years, even attracting VC heavyweights that hadn't been active within the space in the past. For example, Andreessen Horowitz recently launched a $200 million fund focusing on the intersection of biotechnology and computer science. Healthcare exit data may provide a window into why investment has been so strong. Since 2012, the total exit value of VC-backed healthcare companies has reached $142.4 billion, according to PitchBook data, and for the first time in over a decade, healthcare accounted for a larger percentage of total VC capital exited (47%) than IT (24%).

This year has seen nearly $21 billion of VC invested in healthcare to date, $2 billion more than all of 2014. Much of the increase has come at the early stage, where the median deal size has jumped to $6.3 million, double what it was last year. Series A rounds in particular seem to be generating the most investor interest, with $4.1 billion invested at the stage YTD, including 25 rounds valued at $50 million or more.

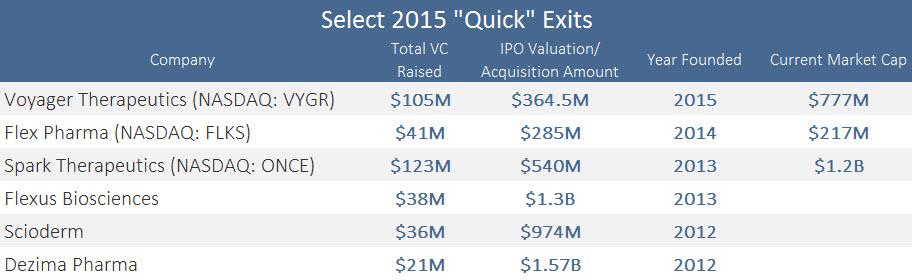

The large increase in early stage funding can be attributed to the relatively quick investment-to-exit cycle that healthcare, especially biotech, has seen over the past couple years. Juno Therapeutics, for example, went public last December less than a year after raising its first round of VC funding, and early investors received quite a healthy exit multiple. The company raised over $316 million in the year before its IPO and debuted with a $1.9 billion valuation (its current market cap is $5.4 billion).

Not only has the quick turnover given investors great returns, but it's freeing up capital to be used on new investments, rather than being tabbed for portfolio follow-on rounds. The fast exit by Juno has allowed its backers to invest in new companies, and they have since participated in nearly double the number of early stage healthcare deals this year than they did in 2014; 57% of their 2015 investments have been made in the healthcare sector.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.