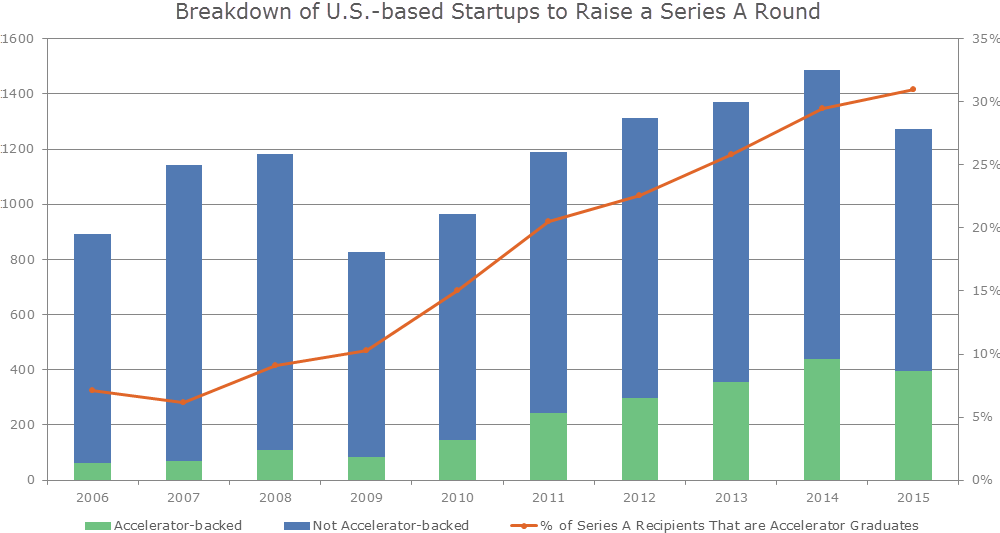

One-third of U.S. startups that raised a Series A in 2015 went through an accelerator

Print

03 February 2016

PitchBook Blog

The topic of accelerators is among the more contentious in today’s startup industry. More and more seem to be popping up every month with different vertical focuses and value propositions for early stage founders. Opinions on the matter range. Some doubt that the value accelerators provide is worth the equity they take, while others say they play a valuable role in the industry, vetting and training startup founders and in turn creating more quality companies. One thing is not arguable, accelerator programs are playing an increasing role in today’s venture capital ecosystem.

But just how big that role is can be difficult to quantify. It's tempting to look at how the total number of accelerator graduates has increased over the years, but that doesn't really show whether companies coming out of these programs are quality startups with potential to make an economic impact. A better metric to look at is the proportion of Series A rounds completed each year by companies that have graduated from an accelerator program. This data can filter for quality (raising a Series A round adds a layer of investor confidence) while also showing how much investment activity is driven toward graduates of accelerators.

Below, we’ve laid out the results of our analysis, and a couple things stand out. First, the proportion of Series A rounds completed each year by accelerator alums has increased YoY for the past eight years, showing the growing amount of influence these programs are having. That said, the percentage increase slowed a bit last year, and it will be interesting to see whether this trend continues throughout 2016. Will accelerator graduates see the YoY proportion of total Series A rounds drop for the first time in nine years?

If the current funding environment is any indicator, that may just be the case. Accelerators have thrived over the past few years in general as their successful business models have enabled crops of their graduates to garner institutional venture funding. But that stream of capital is beginning to sputter as macroeconomic trends spark concern among investors in terms of the viability of some of the most heavily funded startups. That concern has proliferated across the venture financing cycle, with early-stage investors scrutinizing their relatively riskier prospects more carefully, leading to a decline in early-stage numbers overall over the past few quarters.

In a time of caution, early-stage VCs may only look to top-tier accelerators known for producing quality graduates as a potential pipeline of worthy prospects. That could lead to the proportion of accelerators garnering Series A financing to fall relative to the whole.

Source: PitchBook

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.