2016 finally sees first U.S. IPO

Print

08 February 2016

Kyle Stanford / PitchBook Blog

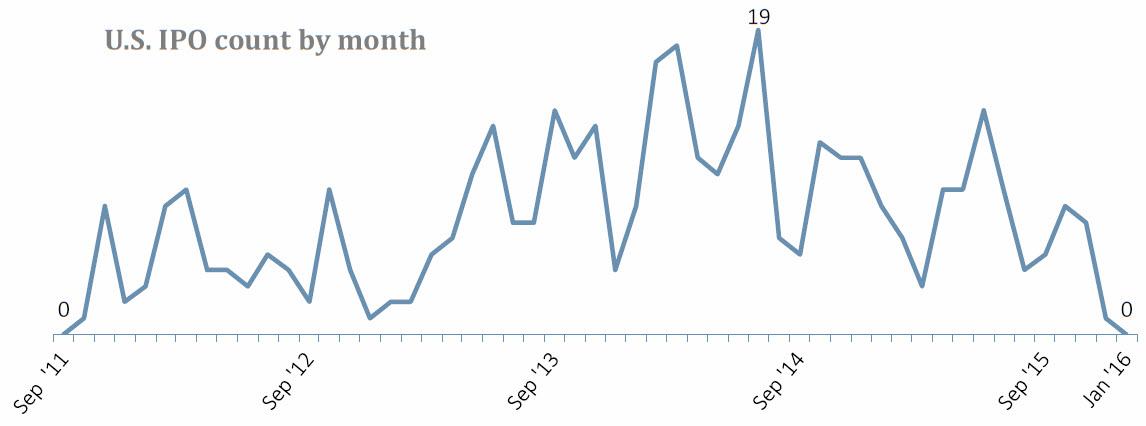

VC-backed IPO activity in the U.S. is expected to stay low in 2016. The markets are volatile, oil prices are dragging down stocks and fears of overly frothy private valuations pervade. Many recent IPOs have underperformed, even after their terms were revised in many cases, adding to the wariness of investors looking to cash in on their investment and take a company public. When the dust settled on 2015, the markets were down almost across the board, with the NASDAQ eeking up just 5.7%, after double-digit increases in each of the past three years. It comes as a surprise, however, that not a single VC-backed company completed an IPO on the NASDAQ or NYSE during the month of January—the longest period without an IPO since September 2011.

Editas Medicine ended the one-month+ IPO drought yesterday, marking the first VC-backed entrant into the U.S. public markets since December 18. The stock, listed on the NASDAQ under the symbol EDIT, closed its debut up 13.8% at $18.20 to claim at least a small victory for the moment.

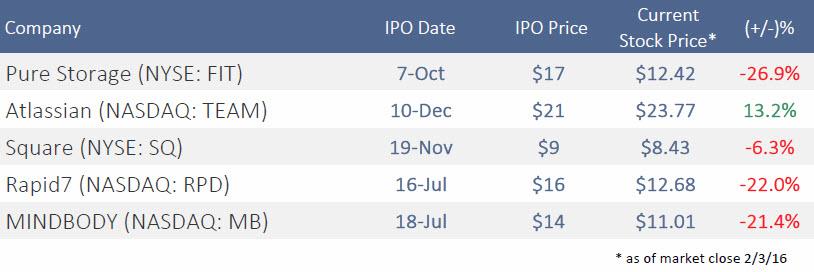

It’s not overly surprising that a healthcare company was the first to IPO in 2016. 58% of VC-backed IPOs last year came from the healthcare sector, and the slide in tech stock valuations has made the prospect of exiting through the public markets much less appetizing for any software provider. Over the last half of 2015, IT accounted for just 28% of completed VC-backed IPOs. Only one of the five largest U.S. tech IPOs during that time is currently trading above its IPO price—Atlassian—and calling that a VC-backed IPO is shaky, given the company was self-funded and institutional investors only grabbed pre-IPO stakes through secondary transactions.

The uninviting IPO exit environment immediately puts a focus on the unicorns that have spread across the VC industry over the past few years. Bleak exit prospects may hurt no one more than these companies—or at least their investors—since the possibility of down rounds increases and that ROI that looked to be 100x is quickly shrinking. Gilt Groupe, a one-time unicorn was recently acquired for roughly 25% of its highest valuation, and Square, once valued at over $6 billion, is trading with a market cap less than half that.

Early in 2015, it was expected that many of the unicorns would be making public exits in the near future, or at least beginning to explore the option. The further the year moved along, however, the more we began to discuss the rise of "private IPOs"—late-stage rounds above $40 million that are raised at a time when a company would normally explore turning to the public markets. The number of private IPOs rose to a high of 135 in 3Q 2015 (the highest ever), before a pullback during the last quarter; and the first month of 2016 has already seen 44 VC deals of $40 million or more completed.

In the two months before Editas ended 2016's IPO drought, more VC-backed companies had completely withdrawn their IPOs (three) than had completed the exit (one), including Gelesis, which quickly raised a new round of equity financing to support its operations. The IPO slump in 2016 isn't likely to hit 2008 levels (when just six companies completed IPOs) but the lack of VC-backed public offerings does signal a "wait-and-see" approach by investors and companies alike.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.