Bannockburn, Ill.-based Baxalta Inc. is helping set the pace toward another active year for partnership and licensing transactions. Late last month the company completed its second deal, reporting it was hooking up with Precision Bioscience Inc. in a potential $1.7 billion, six-target cancer deal centered on its gene editing technology. Baxalta paid $105 million up front with the rest earmarked for milestone payments. Research up to phase II trials will be handled by Precision, after which Baxalta bears the exclusive rights to opt in for later-stage development and commercialization. The first program is expected to enter the clinic late next year. (See BioWorld Today, Feb. 26, 2016.)

Baxalta also paid $175 million in a major immuno-oncology deal with Ballerup, Denmark-based Symphogen A/S focused on up to six immune checkpoint targets. A further $1.6 billion more has been allocated to option fees and milestone payments to help fund Symphogen's preclinical research and clinical development through phase I, at which point Baxalta will be entitled to in-license each program, on a product-by-product basis. The two companies have not disclosed the targets involved, but they expect the first program to enter the clinic in 2017. (See BioWorld Today, Jan. 5, 2016.)

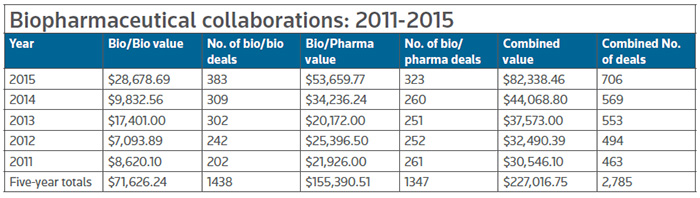

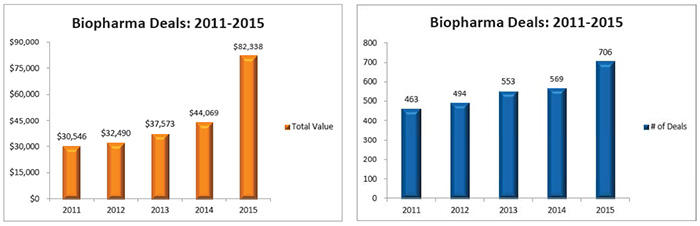

Those two deals alone contribute about 20 percent of the almost $16.7 billion in total biodollars associated with the deals that revealed financial terms in the first two months of this year – well ahead of the totals raised in the same periods of 2015 (+15 percent) and 2014 (+146 percent). The number of deals tracked by BioWorld, however, remained about the about the same, with 143 so far this year, an increase of about 6 percent over the same period last year. (See Biopharma Deals: January-February, below.)

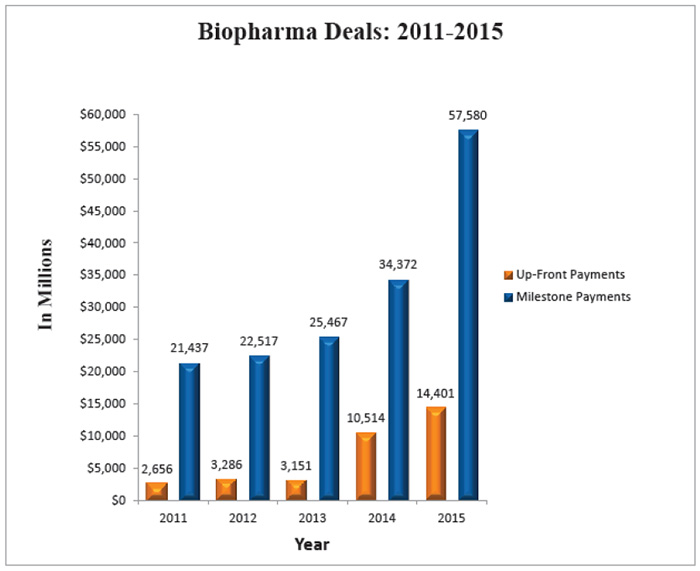

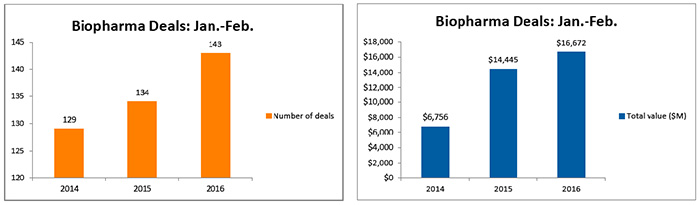

If that momentum continues for the rest of the year, the industry will be on pace to beat the record $83 billion in total deal values from 706 deals completed last year. (See Biopharma Deals: 2011-2015, below.)

MARQUEE

One of the marquee transactions included in the period involved Astrazeneca plc, which completed a transaction in which it paid $2.5 billion up front to obtain 55 percent of privately held Acerta Pharma LLC, the developer of acalabrutinib, a phase III oral small-molecule Bruton's tyrosine kinase (BTK) inhibitor that it expects to transform the treatment of B-cell malignancies. The first regulatory submission from the hematology program is anticipated in the second half of the year, which will also see the read out of phase I/II trials in solid tumors. (See BioWorld Today, Dec. 18, 2015, and Feb. 26, 2016.)

Included in the terms of the deal is a deferred $1.5 billion more to be paid by the end of 2018 or upon approval of the drug, whichever comes first. The agreement also includes an option for shareholders of the Redwood City, Calif.-based company to sell their remaining 45 percent stake to Astrazeneca for about $3 billion upon acalabrutinib's approval in the U.S. and Europe.

In a Leerink research note at the time the deal was announced, analyst Seamus Fernandez said Astrazeneca's investment in Acerta should be viewed as a calculated risk that could pay long-term dividends, with acalabrutinib a potentially best-in-class BTK inhibitor. However, the drug is up against Abbvie Inc.'s Imbruvica, whose current leadership position, particularly in chronic lymphocytic leukemia (CLL), will be tough to overcome without striking results.

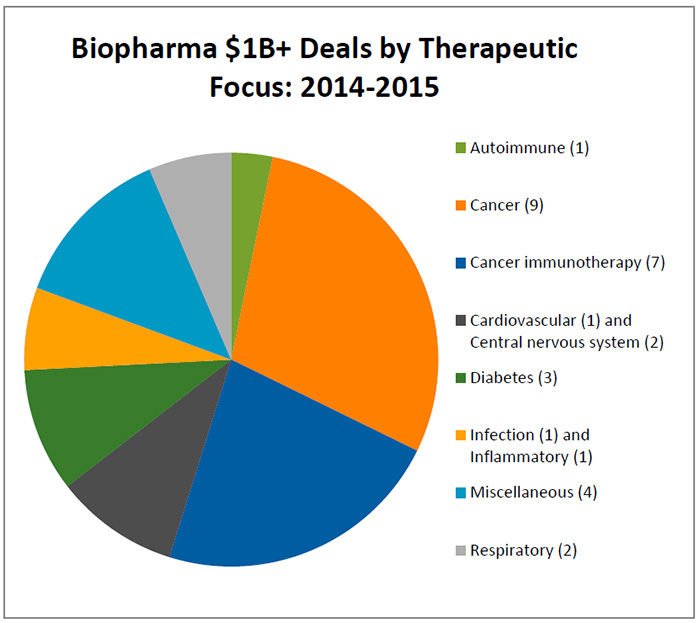

Not surprisingly, the land grab for assets relating to cancer, particularly immune-oncology, continues and the partnerships being signed this year are closely tracking the deals by therapeutic class completed last year. (See Biopharma $1B+ Deals by Therapeutic Focus: 2014-2015, below.)

Of the 31 biopharma deals that topped $1 billion in value for the two-year span of 2014-2015, those focused on cancer represent about half, and nearly a quarter of all deals are focused on, more specifically, cancer immunotherapy. (See Immuno-oncology boosting R&D, spurring collaborations in this issue.)

The total value of biopharmaceutical deals in 2015 grew by 87 percent from the prior year to $82.3 billion, from $44.1 billion in 2014.

The total number of deals showed a 24 percent increase, from 569 deals in 2014 to 706 in 2015. And it appears that upward trend is continuing into 2016 with the number of deals and value slightly higher than last year's first two months.

While the number of deals and their value have increased dramatically, it is notable to point out the consistent rise of up-front and milestone payments. Of those payments disclosed, $14.4 billion were up front in 2015 – a 37 percent increase over 2014 – and $57.6 billion were milestones – a 68 percent uptick.

BIG BIOPHARMAS ON A SPREE

Big biopharma companies continue to be very active dealmakers. In addition to closing its deal with Acerta, Astrazeneca reported two additional transactions. Its R&D arm, Medimmune will collaborate with Moderna Therapeutics Inc. to discover, co-develop and co-commercialize messenger RNA (mRNA) therapeutic candidates for the treatment of a range of cancers. Although no financial terms were revealed under the terms of the new agreement, they will focus on two specific immuno-oncology programs.

Astrazeneca also said it will collaborate with Incyte Corp., of Wilmington, Del., to evaluate the efficacy and safety of Incyte's Janus-associated kinase (JAK) 1 inhibitor, INCB39110, in combination with Astrazeneca's epidermal growth factor receptor (EGFR) inhibitor, Tagrisso (osimertinib). The combination will be assessed as a second-line treatment for patients with EGFR mutation-positive non-small-cell lung cancer who have been treated with a first-generation EGFR tyrosine kinase inhibitor and subsequently developed the T790M resistance mutation. Under terms of the agreement, a phase I/II study will be conducted by Incyte. That deal builds on an existing collaboration between the two companies, announced in May 2014, to explore Astrazeneca's anti-PD-L1 immune checkpoint inhibitor, durvalumab, in combination with Incyte's oral indoleamine dioxygenase-1 (IDO1) inhibitor, epacadostat (INCB24360).

MULTI-DEALS

Other companies involved in multi-deals so far this year include Pfizer Inc., Sanofi SA and Merck & Co. Inc.

As well as gaining access to therapeutic assets, the deals completed by those companies reflect the importance that big biopharmas are attaching to the precision medicine space, especially involving big data and next generation sequencing.

Pfizer, of New York, for example, is tapping into Seattle-based Adaptive Biotechnologies Corp.'s next-generation sequencing (NGS) expertise via a translational research collaboration to leverage NGS of the adaptive immune system to advance its growing immuno-oncology franchise. Adaptive uses its technology to profile T-cell and B-cell receptors. Under the terms of the agreement, Pfizer and Adaptive will seek to combine drug development and platform technology biomarker expertise to identify patients who may preferentially benefit from immunotherapy.

Pfizer also renewed a nonexclusive research collaboration with Kinemed Inc. for the advancement of approaches toward metabolic disease, in particular type II diabetes. Kinemed's proteomics technology platform will map the impact of potential drug candidates on specific metabolic pathways.

Among its four announced deals so far this year, Paris-based Sanofi amended a collaboration with existing partner Warp Drive Bio LLC that could exceed $750 million. Warp Drive uses genomic mining and small-molecule assisted receptor targeting (SMART), platforms to discover new medicines using molecules and mechanisms discovered in nature. (See BioWorld Today, April 9, 2012.)

The basic concept is to take existing technologies and combine them in a different way to identify molecules in nature that could create successful modalities for previously undruggable targets and produce durable treatment responses. Its SMART drugs are able to penetrate cells, where they bind to an intracellular receptor. The resulting complex then inhibits a specific intracellular target. The company's genomic search engine queries DNA sequences within bacterial genomes and identifies natural product drugs that were historically "hidden" within microbes. (See BioWorld Today, Jan. 12, 2016.)

Warp Drive will lead the collaboration for five years, with Sanofi set to receive global licenses to develop and commercialize candidates. In oncology, Warp Drive has the option to lead development from post-investigational new drug filing to phase II studies, with Sanofi assuming development through filing of new drug applications. The pharma will lead all development activities in the antibiotic collaboration.

Sanofi also entered into a research collaboration with Global Genomics Group (G3) to identify new signaling pathways and targets involved in the etiology of coronary artery disease.

The two will utilize G3's platform with data from its G3lobal Database to further unravel the molecular underpinnings of LDL-cholesterol regulation and to better understand which patients may benefit from interference with such novel signaling pathways. G3 will receive undisclosed payments from Sanofi for the collaboration.

The database is derived from the GLOBAL clinical study, an international prospective, multicenter study recruiting up to 10,000 patients to characterize novel disease networks and biomarkers. The pan-omic study combines whole genome sequencing, whole transcriptome sequencing, unbiased proteomics, metabolomics, lipidomics and lipoprotein proteomics with coronary computed tomographic (CT) angiography, an advanced imaging technology for phenotyping, which allows the precise classification of disease in patients.

IMMUNO-ONCOLOGY

The immuno-oncology field continues to be hot and several deals in the field have already been signed so far this year. In addition to the Baxalta immuno-oncology deal with Symphogen A/S, Astrazeneca, its R&D arm, Medimmune, and Moderna Therapeutics Inc. said they are collaborating to discover, co-develop and co-commercialize messenger RNA (mRNA) therapeutic candidates for the treatment of a range of cancers. The collaboration is in addition to the agreement announced by the companies in 2013 to develop mRNA therapeutics for the treatment of cardiovascular, metabolic and renal diseases as well as selected targets in oncology. Under the terms of the new agreement, they will collaborate on two specific immuno-oncology programs, based on promising preclinical data, including pharmacology in tumor models. Moderna will fund and be responsible for discovery and preclinical development of product candidates, with the aim of delivering one investigational new drug application-ready molecule for each of the two programs. Moderna's efforts will be led by its oncology-focused venture, Onkaido. Astrazeneca will be responsible for early clinical development, led by Medimmune, and Moderna and Astrazeneca will share the costs of late-stage clinical development. The two companies will co-commercialize resulting products in the U.S. under a 50-50 profit-sharing arrangement.

F-star Biotechnology Inc., of Cambridge, U.K., entered a collaboration and license agreement with Abbvie Inc., of North Chicago, to research and develop bispecific antibodies in immuno-oncology. Financial terms were not disclosed. F-star's Modular Antibody Technology platform introduces an antigen binding site into the constant region of an antibody to create a so-called Fcab (an Fc-domain with antigen binding activity). In a combinatorial plug and play process, an Fcab can then be used to make many different bispecific antibodies using variable regions binding to second targets. F-star and Abbvie will create Fcabs against two immuno-oncology targets and generate several MAb2 drug development candidates from those Fcabs.