Biopharmas still seeing values slide despite market recovery

Print

28 March 2016

Peter Winter / BioWorld

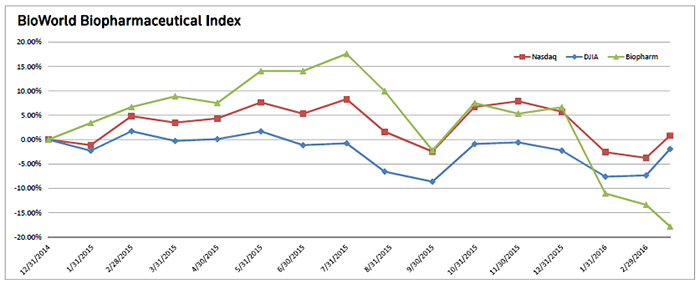

We are only a few days away from the end of the first quarter and it will certainly be a period that the biopharmaceutical sector will want to quickly forget. Year to date, the new BioWorld Biopharmaceutical Index, which combines group members from the BioWorld Blue Chip Biotech Index and BioWorld Pharma Index, has tumbled 23 percent – probably the sector's worst start to a year for almost 20 years. The volatile nature of the capital markets hasn't helped, but it hasn't benefited from a market recovery where most of the other sectors have bounced back from their lows. The Nasdaq Composite index is now only down 5 percent so far this year and the Dow Jones Industrial average has got back to even. (See BioWorld Biopharmaceutical Index, below.)

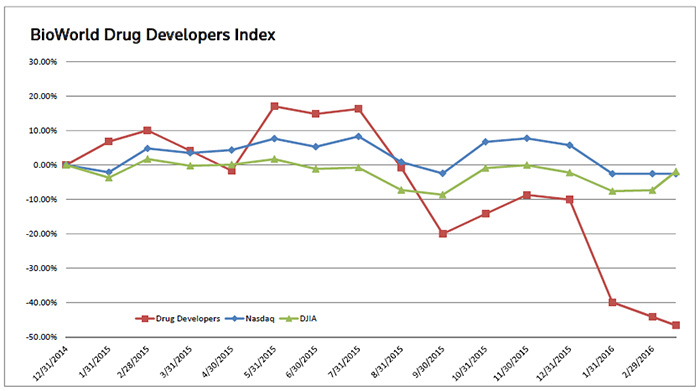

It is not a good time to be a drug developer these days with the BioWorld Drug Developers Index down a whopping 41 percent year-to-date (YTD). (See BioWorld Drug Developers Index, below.)

Can biopharmas right the ship? According to the results of a recent survey of investors conducted by Evercore ISI, uncertainty still prevails. Investors were asked to indicate how the sector would perform for the rest of the year: 36 percent indicated that it would perform in line with expectations, with 32 percent choosing "outperform" and 32 percent opting for "underperform."

The current uncertain investor climate suggests that this sentiment will prevail for several more months. The drug pricing issue that tanked the sector last September continues to keep investors on the sidelines in addition to the uncertain markets. As the presidential race heats up, the issue is not going away anytime soon.

While it is clear that although analysts are saying that the fundamentals for the sector's blue chip companies are strong and that their share prices are close to "oversold," it hasn't been enough to reverse the tide of negativity. It will need a series of positive catalysts going forward to bring investors back into the fold.

For now, companies will have to ride out the current financial climate and investor angst. The performance of all biopharma companies has been ugly. The top two biotech companies by market cap – Gilead Sciences Inc. and Amgen Inc. - have taken it on the chin seeing their shares swoon by almost 12 percent so far this year.

Also, Regeneron Pharmaceuticals Inc.'s shares have tumbled 32 percent YTD. This is despite the fact that it reported good news recently. Along with partner Sanofi SA, it reported that sarilumab, an interleukin-6 receptor antibody moving toward a potential FDA approval this fall or earlier, beat Humira (adalimumab, Abbvie Inc.) monotherapy on the primary endpoint, improving signs and symptoms in patients with active rheumatoid arthritis (RA), in a 24-week trial. (See BioWorld Today, March 14, 2016.)

The biggest decliner of the group so far this quarter has been Wilmington, Del.-based Incyte Corp., whose share value has cratered 42 percent. In addition to the overall market sentiment, the company's share slide was accelerated on news announced in February that it will back away from experiments in solid tumors with Janus kinase 1 (JAK1)/JAK2 inhibitor Jakafi. (See BioWorld Today, Feb 12. 2016.)

Despite the fact that Vertex Pharmaceuticals Inc. has a solid presence in the cystic fibrosis (CF) therapeutic arena, it has been a tough quarter so far for the company, which has seen its shares drop 37 percent. Investors reacted negatively to the fact that its competitors are trying to muscle into this domain. For example, Galapagos NV announced it had started a phase IIa trial with its CF therapy, Top-line results are expected in the fourth quarter of this year. (See BioWorld Today, March 7. 2016.)

While most of the steep declines in value of the companies in the group came in the first two months, there is little evidence that the slide is slowing, with the BioWorld Biopharmaceutical Index and the BioWorld Drug Developers Index both down 5 percent so far this month.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.