The state of U.S. venture valuations and other notable trends in 10 charts

Print

07 April 2016

PitchBook Blog

How have venture valuations shifted in response to the downturn in activity?

Our recently released VC Valuations & Trends Report examines multiple datasets of U.S. venture valuations in order to assess both the historic, recent ramp-up in the industry as well as the effects of the recent shift downward in activity.

Knowing not everyone has time to read through a packed 20-page report, we pulled 10 of the top charts featured in the report for a visual summary.

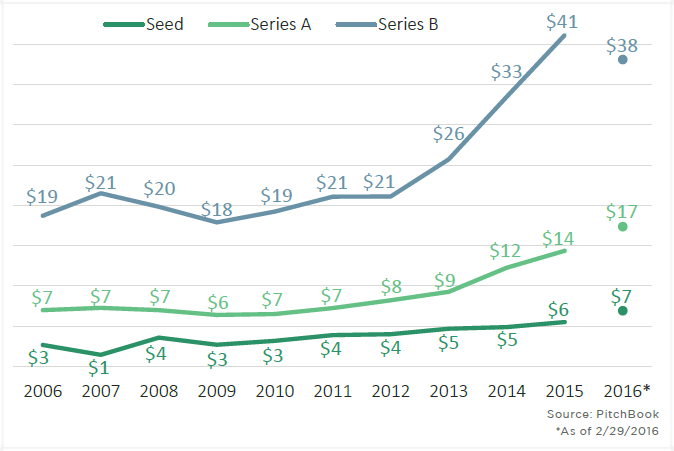

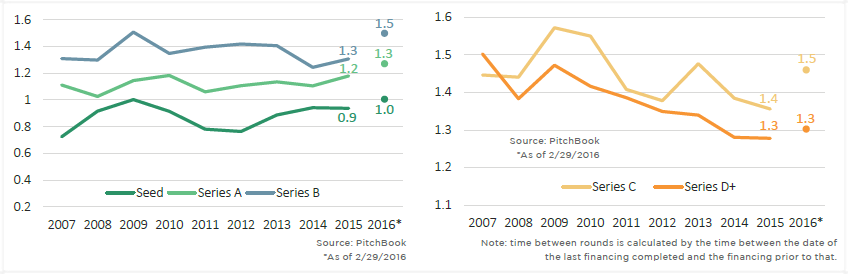

Median early-stage pre-money valuations ($M) by year in U.S.

Only Series B valuations have seen a slide, albeit modest.

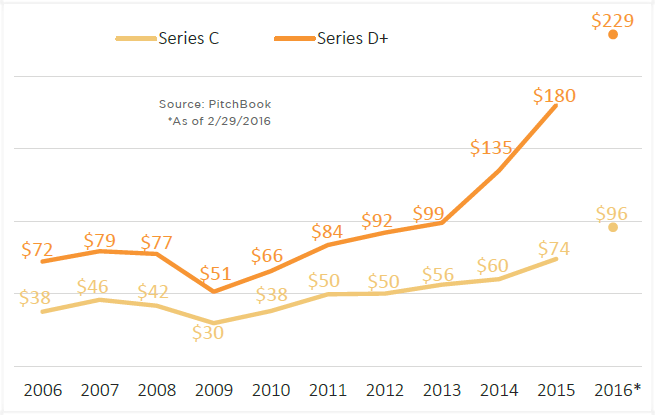

Median late-stage pre-money valuations ($M) by year in U.S.

A surge that apparently continues unabated into 2016.

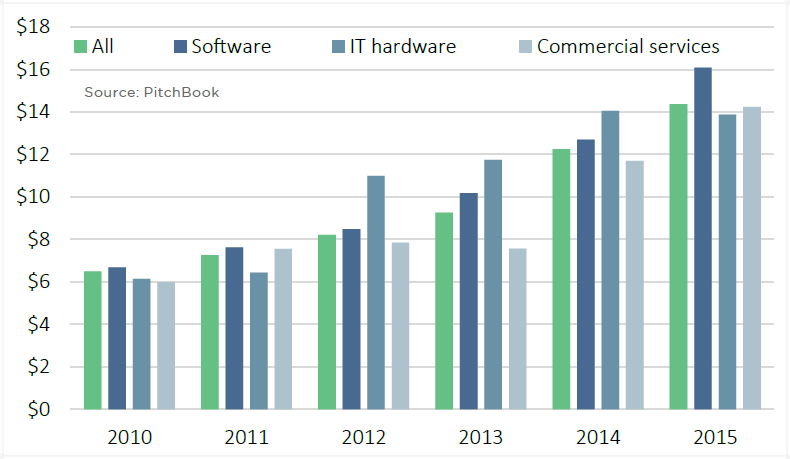

Median Series A pre-money valuations ($M) by sector

The crop of startups vying for Series A dollars has exploded, and valuations have remained more than healthy.

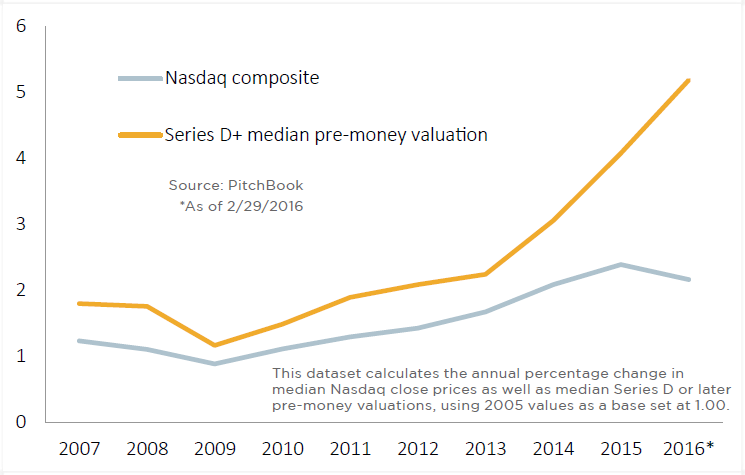

Median Nasdaq price vs. median U.S. Series D+ valuation by year

The only companies still even raising at Series D and later are the ones that enjoy the most investor confidence.

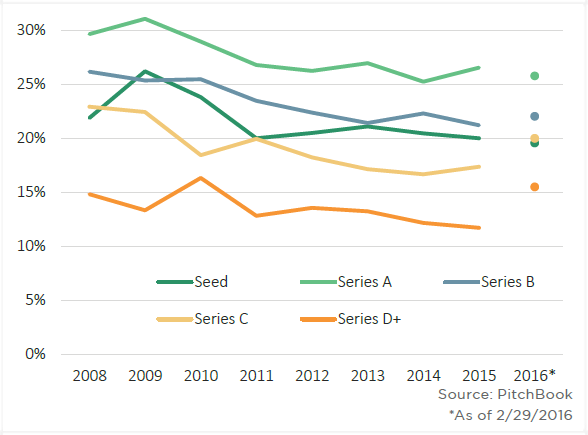

Median % acquired by series and year in U.S.

Investors have used the reset in order to shift terms already, particularly at the late stage.

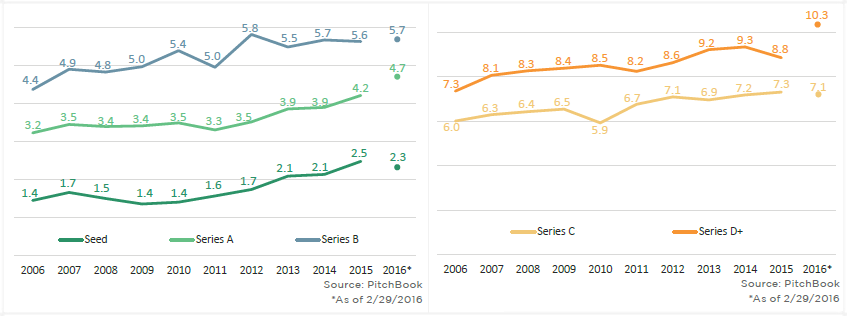

Average age of U.S. VC-backed startups

It’s no secret that companies have been staying private for longer and longer for a variety of reasons.

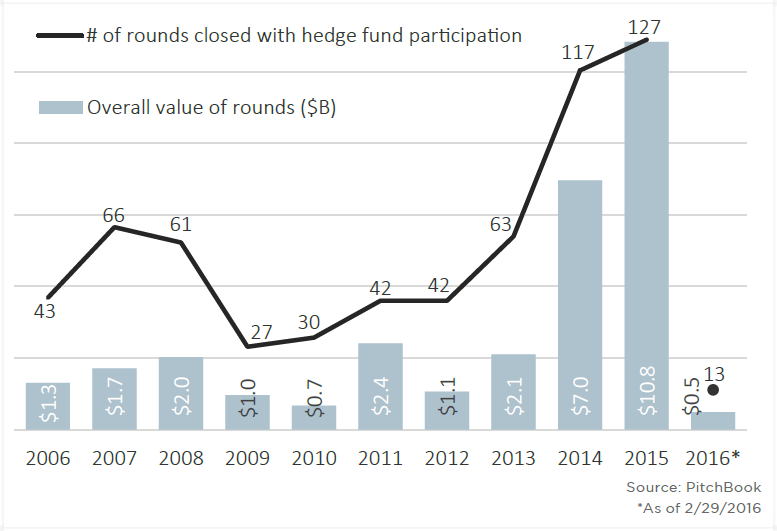

U.S. VC rounds with hedge fund participation

Hedge funds’ participation is considerably off in 2016 so far (for more on this subject, click here).

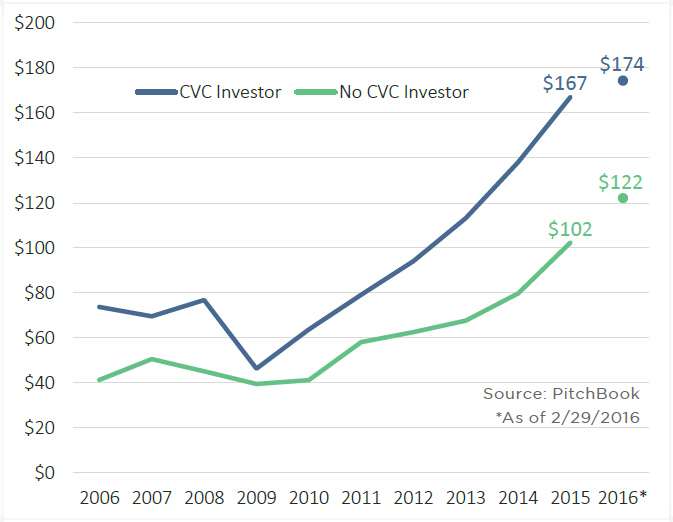

Median pre-money valuation ($M) of U.S. late-stage VC rounds with corporate VC participation

Corporate venture arms will continue investing in robust startups whose focuses align best with their parents.

Median time (years) between rounds in U.S. by series

Series B and C financings have seen the starkest increases in time between rounds.

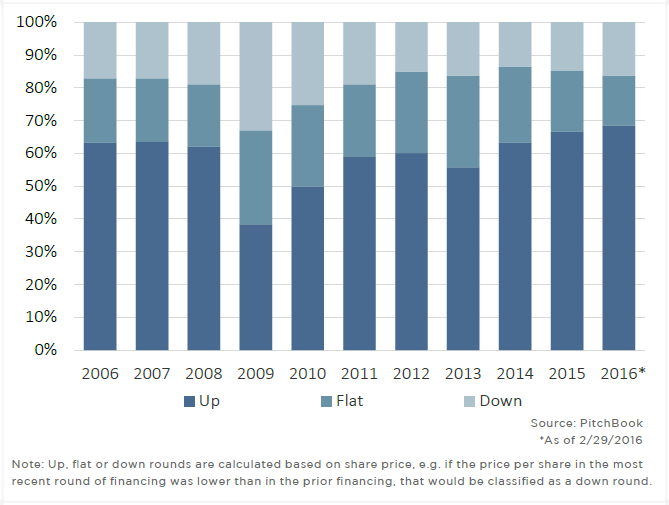

U.S. venture up, flat or down rounds by year

VC investors are either willing to be persuaded to re-up even in a down round—in order to recoup later—or don’t need to be. 2016, though, has seen a record pace of down rounds.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.