Russia's Medtech Market

Print

02 July 2013

Joel Gorski, MD+DI

The country has a large market for imports, but corruption and new government initiatives could be a hinderance to foreign device makers.

In 2011, Russia had the world’s ninth largest GDP and the highest per capita spending on healthcare of all the BRIC countries.[1] In sheer size, it is the largest of the BRIC countries, covering nine time zones and 17 million square miles. Russia is an upper middle class country with a highly educated workforce and a population of roughly 143 million discerning consumers.[2]

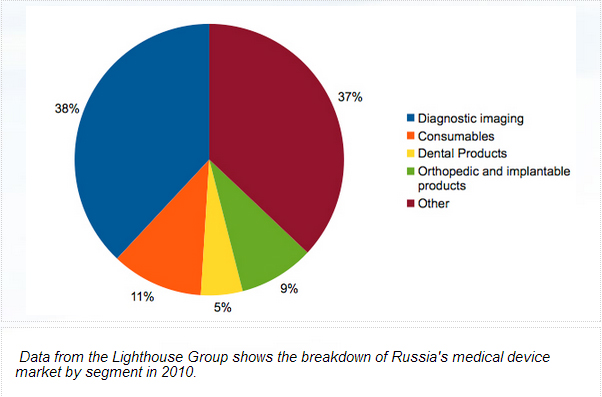

The Russian market for medical equipment and supplies is estimated at $6 billion. This puts the country's healthcare market among the top 20 in the world, although per capita spending remains low by European standards, at around $42.3 About 73% of the market is supplied by imports, with Germany, the United States, Japan, and China the leading suppliers. The value of imports greatly increased until 2008, when the country was hit hard by the global recession. The Russian market, however, remains strongly reliant on products from abroad, as domestic producers are small and undercapitalized.

The Russian market for medical equipment and supplies is estimated at $6 billion. This puts the country's healthcare market among the top 20 in the world, although per capita spending remains low by European standards, at around $42.3 About 73% of the market is supplied by imports, with Germany, the United States, Japan, and China the leading suppliers. The value of imports greatly increased until 2008, when the country was hit hard by the global recession. The Russian market, however, remains strongly reliant on products from abroad, as domestic producers are small and undercapitalized.Regulatory Climate

The Russian healthcare system is divided into national, regional, and municipal levels. The national government controls the budget, policy, and registration of technologies, while regional and municipal governments have control over their facilities and budgets.

Since 1996, the Russian government has provided free healthcare to all its citizens under the Mandatory Medical Insurance Initiative.[5] The national government collects taxes and distributes funds to the regional and municipal levels through Mandatory Health Insurance funds. This covers about two-thirds of the cost of procedures. To make up the difference, Russian citizens also have access to voluntary health insurance and private medical care. This system continues to evolve.

In 2010, the government implemented the Strategy 2020 initiative to attract investment, create jobs, produce safe and effective products, and reduce the country's dependence on foreign healthcare products to a maximum of 50% by 2020.[4]

The Russian health agency responsible for medical devices, Roszdravnadzor, recently published new regulations for medical devices.[6] The regulations took effect January 1, 2013, and have only been published in Russian, so the rest of the world is trying to figure out just what the changes consist of for the industry. However, allegations of bribery by senior officials and the resulting review of past medical device registrations has put new medical device registrations on hold at Roszdravnadzor, furthering the country's image as being opaque and corrupt when it comes to healthcare policies and practices.7

Challenges

The Russian market is full of potential for medical device manufacturers, but it also poses a number of challenges.

Size and Infrastructure. Russia is a large country, but it has a seriously underdeveloped infrastructure that poses significant challenges to market access, particularly outside major cities.

- Strategy 2020. The high level of imports has fueled the government’s plan to attract healthcare investment, including jobs and manufacturing, via the Strategy 2020 initiative. It is intended to boost innovation, accelerate start-ups, sustain R&D into the future, and open Russia and other international markets to newly developed healthcare products.[4]

- Healthcare Reform. An incomplete transition from national to regional and municipal oversight of healthcare delivery has also led to poorly implemented delivery across the nation. The old communist ideal of healthcare equality for all is a good theory. However, inefficiencies and corruption abound, and life expectancy is decreasing, so further reform must occur.[8, 9] Unfortunately, it looks like the Russian government is going to cut its healthcare budget and require citizens to pick up the tab on services not covered by the compulsory health insurance standard package.[10]

- Corruption. Recent issues associated with senior-level bribery have led to significant turnover at Roszdravnadzor, the Russian health agency. At the moment, Roszdravnadzor remains closed while staff is replaced and all past medical device registrations are reviewed.

Opportunities

- An Underserved Market. Russia has 143 million people and a wealth of natural resources. The population is driving the demand for affordable and sophisticated healthcare technologies. As mentioned previously, the Russian market is supplied primarily by imports, and the Strategy 2020 initiative will stimulate R&D and the addition of manufacturing operations within Russia to supply the country’s needs. But even if Strategy 2020 is successful, demand will continue for leading-edge healthcare technologies that Russia will likely not be able to supply itself.

- Expanding Infrastructure. As rural cities become better connected through improvements in infrastructure, access to rural healthcare markets will increase. In addition, overall healthcare spending, as well as per capita spending, will increase in Russia.

- Challenges Become Opportunities. The current shake-up in Roszdravnadzor could ultimately lead to less corruption, more transparency and even application of law, and an overall improvement in the healthcare sector of the Russian market.

Conclusion

That Russia has the highest per capita healthcare spending of all the BRIC countries indicates that there is money available for healthcare opportunities in the country. While the majority of Russia's healthcare needs are supplied by imports, the country is enacting initiatives to stimulate internal R&D and manufacturing inside its borders. Outsiders looking to invest in the Russian market may find growth opportunities in the country's large, underserved population and expanding infrastructure. However, corruption and lack of transparency at the regulatory level could hinder innovation.

References

1. World’s Largest Economies, [online] (Atlanta, GA: CNN Money, 2013); available from Internet: http://money.cnn.com/news/economy/world_economies_gdp/.

2. Doing Business in Russia: 2013 Commercial Guide for U.S. Companies, [online] (Baltimore, MD: Export.gov, 2003]; available from Internet: http://export.gov/russia/doingbusinessinrussia/index.asp.

3. The Medical Device Market: Russia, [online] (New York, NY: Reportlinker.com, 2013) available from Internet: www.reportlinker.com/p0203014/The-Medical-Device-Market-Russia.html.

4. Norbert Sparrow, “Russia Seeks Parity with Medtech Economies by 2020” in medtechinsider [online] (November 2011); available from Internet:http://medtechinsider.com/archives/25933.

5. Russian Healthcare System Overview, [online] (Community of Practice); available from Internet: http://cop.health-rights.org/files/f/6/f68e677a2e9b501660f093c5c11b62a3.pdf.

6. “Russia Introduces New Medical Device Regulations” in QMed [online]; available from Internet: www.qmed.com/news/russia-introduces-new-medtech-regulations.

7. Stewart Eisenhart, “Staff Shakeup Underway at Russian Medical Device Regulator”[online] (Austin, TX: Emergo Group, May 2013); available from Internet: www.emergogroup.com/blog/2013/05/staff-shakeup-underway-russian-medical-....

8. Maria Danilova (Moscow Times), “Despite Oil Wealth, Russia Faces Huge Health Care Problems” in New York Times [online]; available from Internet: www.nytimes.com/2007/06/28/business/worldbusiness/28iht-russhealth.4.639....

9. Boris A. Rozenfeld, “The Crisis of Russian Healthcare and Attempts at Reform” [online] (Santa Monica, CA: Rand Corporation) available from Internet: www.rand.org/pubs/conf_proceedings/CF124/CF124.chap5.html.

10. Varvara Petrenko, “Russian Authorities Plan to Cut Health Spending in 2013” in Russia & India Report [online] January 2013; available from Internet: http://indrus.in/articles/2013/01/15/russian_authorities_plan_to_cut_hea....

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.