New medicines targeting age-related macular degeneration

Print

01 June 2016

Peter Winter / BioWorld

Significant progress has been made in ophthalmology, with biopharma companies working on innovative treatments for sight-threatening diseases. As the research accelerates, promising gene therapy, stem cell-based and biopharmaceutical product candidates have progressed into clinical trials. Those innovative next-generation therapies will be welcomed as millions of people around the world suffer from blinding retinal degenerative diseases.

As the population ages, that number is only expected to get worse. For example, a recent analysis paints a scary picture. Based on the latest census data and from studies funded by the National Eye Institute (NEI), part of the NIH, the number of people with visual impairment or blindness in the U.S. is expected to double to more than 8 million by 2050. Another 16.4 million Americans are expected to have difficulty seeing due to correctable refractive errors such as myopia (nearsightedness) or hyperopia (farsightedness) that can be fixed with glasses, contacts or surgery.

Led by Rohit Varma, director of the University of Southern California's Roski Eye Institute, Los Angeles, researchers published their analysis in JAMA Ophthalmology. They estimate that 1 million Americans were legally blind (20/200 vision or worse) in 2015.

"These findings are an important forewarning of the magnitude of vision loss to come," notes NEI Director Paul Sieving.

Over the next 35 years, Varma and his colleagues project that the number of people with legal blindness will increase by 21 percent each decade to 2 million by 2050.

ON THE INCREASE

As we age one of the most prevalent diseases of the eye is age-related macular degeneration (AMD). As the name suggests, the macula, the part of the eye that provides sharp, central vision needed for seeing objects clearly, degenerates. According to the NEI, by 2050, the estimated number of people with AMD is expected to more than double from over 2 million to 5.4 million. Dry AMD is the most common type and accounts for about 90 percent of all cases, with wet AMD, the more severe form, representing about 10 percent of disease incidence. Wet AMD occurs when abnormal blood vessels grow underneath the retina, a process known as choroidal neovascularization (CNV). While the condition is treatable, approximately 15 percent of patients do not respond well to the standard treatment with anti-VEGF and continue to lose vision.

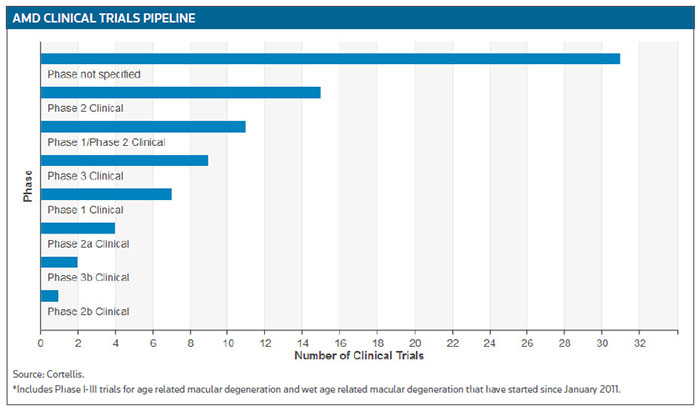

According to Cortellis Clinical Trials Intelligence, there are about 80 ongoing trials testing the potential of therapeutics targeting all forms of AMD. (See AMD Clinical Trials Pipeline, below.)

Not surprisingly, the market for AMD therapeutics is growing. Regeneron Pharmaceuticals Inc., for example, generated $1.2 billion, a 44 percent increase over the previous comparable period, in U.S. and global net sales of VEGF trap Eylea (aflibercept) in the first quarter of 2016. (See BioWorld Today, May 6, 2016.)

Roche AG reported sales of $358 million the first quarter of 2016 for its wet AMD treatment, Lucentis (ranibizumab).

Regeneron has also broadened its ongoing research in that field with partner Bayer AG through a new $130 million agreement to test Eylea in combination with the angiopoietin2 (Ang2) antibody nesvacumab, and two phase II trials are enrolling patients with wet AMD or diabetic macular edema. Angiopoietins in tandem with VEGF promote blood and lymphatic vessels in the eye.

Ophthotech Corp., of New York, is working on a combination therapeutic strategy to treat the disease. It has completed patient recruitment for its second phase III trial of Fovista (pegpleranib) in combination with Lucentis for the treatment of wet AMD. The company said it expects to announce initial, top-line data from both phase III trials of Fovista in combination with Lucentis in the fourth quarter of this year.

A third phase III trial is investigating Fovista in combination with either Eylea or Avastin (bevacizumab, Roche AG) and the study remains on track to complete enrollment in 2016.

Ohr Pharmaceutical Inc. has an ongoing phase III trial of its lead drug candidate squalamine lactate ophthalmic solution, 0.2 percent (OHR-102) for the treatment of wet AMD. Target enrollment is 650 treatment-naïve subjects. OHR-102 will be administered twice a day in combination with Lucentis injections. The primary endpoint will be a measurement of visual acuity gains at nine months, with subjects followed to two years for safety.

PROMISING PIPELINE

Seattle-based Acucela Inc. has finished the treatment period in an ongoing phase IIb/III trial of investigational visual cycle modulator emixustat hydrochloride. The study enrolled 508 patients with geographic atrophy (GA) secondary to dry AMD. The primary objective of the study is to detect differences in lesion growth rate between treatment groups. Acucela expects to analyze and report top-line data next month.

Emixustat is a once-daily, orally administered small molecule that inhibits RPE65, an enzyme crucial to the visual cycle, the chemical pathway in the retina central to the initiation of visual perception. Emixustat has been shown to play a critical role in slowing the progression of multiple retinal degenerative diseases in animal models.

Opthea Ltd., of Melbourne, Australia, reported this month that it has randomized and dosed the first patient in a phase IIa dose expansion trial of OPT-302, a VEGF-C/D trap therapy for wet AMD. The study will enroll 30 subjects with wet AMD, randomized in a 1-to-1 ratio to two treatment groups of OPT-302 given as monotherapy or in combination with Lucentis administered by intravitreal injection on a monthly basis for three months. Primary analysis data are anticipated by the end of 2016.

Heidelberg, Germany-based Novaliq GmbH, a company focusing on a drug delivery platform that transforms poorly soluble drugs into effective therapeutics for ophthalmology, has completed enrollment in its phase II trial that is evaluating the safety, efficacy and tolerability of Cyclasol for the treatment of moderate to severe dry eye disease. The compound is an ophthalmic solution of cyclosporine A formulated using the company's Eyesol technology. The 207 patients were randomized to one of four treatment groups that included two Cyclasol groups, a placebo (vehicle control) group and an open-label cyclosporine A 0.05 percent ophthalmic emulsion group. Study subjects are self-administering one drop twice daily, and returning for examination periodically and at the end of the trial at four months.

Roche's RG7716, which is designed to bind both VEGF and Ang2, is in phase II studies. The product is a bispecific antibody developed with Crossmab technology to tightly bind VEGF-A on one arm and Ang2 on the other arm. A randomized, active comparator-controlled phase II study is investigating the safety and efficacy of RG7716 in patients with choroidal neovascularization secondary to age-related macular degeneration.

Investor interest in that space was evidenced by the successful $44.5 million series B financing completed by Redwood City, Calif.-based Graybug Vision Inc. this month. The proceeds will be used to develop GB-102 the company's lead drug for wet AMD, through phase II trials. The compound is a dual-acting inhibitor of VEGF and PDGF receptors, administered twice per year in wet AMD patients.

The company reported it recently completed a six-month study on GB-102 to address the current challenges in therapies for neovascular AMD (nAMD).

The company's goal "is to provide a more effective and less burdensome treatment for the large number of patients suffering from nAMD," said Jeffrey Cleland, president and CEO.

The company believes current treatments are suboptimal due to the need for intravitreal (IVT) dosing every four to eight weeks as well as the inability to target more than one disease pathway.

Reducing the treatment period to twice a year is achieved by using engineered biodegradable microparticles (GB-102) containing Sutent (sunitinib malate, Pfizer Inc.). Graybug's study concluded that a single intravitreal dose of GB-102 containing 0.2 or 1 mg sunitinib malate was able to deliver pharmacologically active levels of sunitinib to retina and RPE/choroid for up to six months.

The FDA has agreed with the company's plans for GB-102 investigational new drug application-enabling studies and for a phase I/II study in wet AMD patients to be initiated next year to confirm the animal data.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.