Partnership and licensing deal flows on pace for record year

Print

15 July 2016

Peter Winter / BioWorld

The insatiable appetite of companies for immuno-oncology assets is one of the main reasons that partnership and licensing deal flows remain on their torrid pace to eclipse the number and volume totals racked up last year.

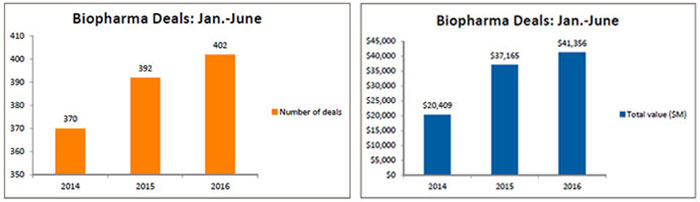

The number of deals tracked by BioWorld climbed above 400 in the first half of 2016, just above the 392 that were inked in the same period last year and 9 percent greater than the deals recorded in 2014. However, in terms of the total biodollars associated with the deals that revealed financial terms, current transactions are generating more dollars – 11.3 percent over the 2015 total and 102 percent over the 2014 total – reflecting the price for assets is increasing. (See Biopharma Deals: January-June, below.)

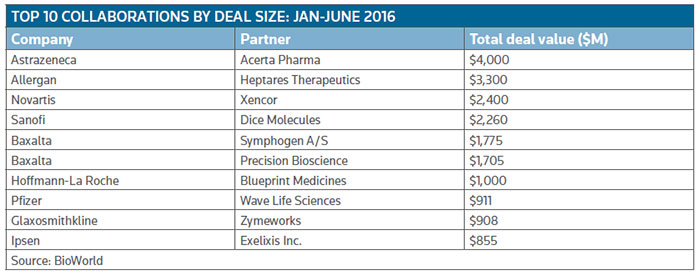

To emphasize the point, at the end of the second quarter Novartis AG inked a potential $2.4 billion-plus deal to gain global access, excluding U.S. rights, to Xencor Inc.'s bispecific technology. It ranks as the third largest deal, in terms of potential dollars it could generate, so far this year. (See Top 10 Collaborations by deal size: Jan.-June 2016, below.)

Monrovia, Calif.-based Xencor will develop and commercialize therapeutics, including XmAb 14045, expected to begin clinical development for acute myeloid leukemia this year, and XmAb13676, also expected to begin clinical development for B-cell malignancies in 2016.

The companies will collaborate and share development costs for their worldwide development. (See BioWorld Today, June 28, 2016.)

BARGAINING TABLE

Although the massive $160 billion M&A deal between Dublin-based Allergan plc and Pfizer Inc., of New York, didn't pan out, it didn't take long for the companies to get back to the bargaining table and ink deals with biotech companies during the second quarter.

Allergan, for example, entered a $3.3 billion collaboration in Alzheimer's disease and other neurological disorders, with G protein-coupled receptor (GPCR) specialist Heptares Therapeutics Ltd., a wholly owned subsidiary of Sosei Group Corp. Heptares will receive $125 million up front, with development milestones of up to $665 million payable up to the launch of the first of three products, followed by $2.5 billion in sales milestones. The Welwyn Garden City, U.K.-based firm also will be in line for double-digit royalties on sales. (See BioWorld Today, April 8, 2016.)

The agreement gives Allergan exclusive rights to a number of selective muscarinic receptor agonists discovered by Heptares, which has taken its lead products, HTL9936 and HTL18318, both M1 agonists, into phase I testing.

Preclinical genetic medicine company Wave Life Sciences Ltd., of Cambridge, Mass., is working with Pfizer to develop genetically targeted therapies for metabolic diseases. The value of their deal is $911 million, including a $40 million up-front payment with the remainder earmarked for milestone payments plus tiered royalties.

Wave Life's chemistry platform will be deployed to advance up to five nucleic acid programs from discovery through clinical candidate selection, and Pfizer has an option to exclusively license each program for further development and commercialization. (See BioWorld Today, May 6, 2016.)

Specifically, the collaboration is focused on the development of nucleic acid therapies aimed at silencing the underlying causes of debilitating metabolic diseases. Wave Life's synthetic chemistry drug development platform enables the design and development of stereopure nucleic acid. In the area of Duchenne muscular dystrophy, the company's program is based on preclinical data demonstrating an approximate 25-fold improvement in exon-skipping efficiency compared to drisapersen and eteplirsen, suggesting the potential for improved potency and an enhanced ability to restore the production of functional dystrophin. In addition, it reported that its muscle-targeting technology has demonstrated substantial improvement in distribution to critical tissues in animal models, including skeletal muscle, diaphragm and heart.

ONCOLOGY ASSETS

Not surprisingly, the land grab for assets relating to cancer, particularly immuno-oncology, continues. In the first half of the year, 35 percent of the collaborations were focused on the development of oncology-based therapeutics.

Big biopharma companies are anxious not to miss out on that hot area of technology and continue to be very active dealmakers. In addition to the significant Novartis deal, also in the second quarter, Glaxosmithkline plc signed a licensing agreement with Zymeworks Inc. for the research, development and commercialization of bispecific antibodies. GSK receives the option to develop and commercialize multiple bispecific drugs across different disease areas and in return will make up-front and preclinical payments of up to $36 million. A further $152 million will be available for development and clinical milestone payments, and further along commercial sales milestone payments of up to $720 million.

Abbvie Inc. tied up with Argenx NV in an immuno-oncology pact, based around the latter's preclinical antibody, ARGX-115, which inhibits Garp (glycoprotein A repetitions predominant), a target involved in maintaining the immunosuppressive activity of regulatory T cells (Treg cells).

Abbvie paid $40 million up front and will contribute up to $645 million in milestones. Argenx will conduct research and development through IND-enabling studies. If successful, Abbvie has an exclusive option to license the ARGX-115 program and then assume responsibility for further clinical development and commercialization.

Anil Singhal, vice president of early oncology development at Abbvie, commenting on the deal said that one of the most promising scientific advancements over the past decade is "the ability to modulate the body's own immune system to fight cancer." The ARGX-115 program provides "an opportunity to explore the potential to block certain immune-suppressive pathways that allow cancers to grow."

DEALMAKERS

While Pfizer (seven collaborations), Novartis (six collaborations) and Abbvie (five collaborations) were busy dealmakers in the first half of the year, they weren't the most active. Other companies such as Takeda Pharmaceutical Co. Ltd., Roche Holdings AG and Sanofi SA were involved in signing 12 deals or more during the period.

Takeda, in fact, continued its strong appetite for deals; at the beginning of the third quarter the company completed a sizeable $432 million ex-U.S. deal with Tigenix NV for its allogeneic cell therapy for Crohn's disease, Cx601, which is currently undergoing regulatory review in Europe.

Several of the collaborations signed by the Tokyo-based company were also focused on GI diseases, however Takeda did complete an oncology-related deal with Mersana Therapeutics Inc., in which it paid $40 million up front, with up to $750 million earmarked for milestone payments plus royalties, to gain ex-U.S. and Canada rights to the company's lead candidate, a preclinical antibody-drug conjugate (ADC) targeting HER2-expressing tumors, and to advance a potential new slate of ADCs, one of which Mersana can opt to co-develop following phase I studies. (See BioWorld Today, Feb. 4, 2016.)

RECORD YEAR

There is no doubt that large biopharmaceutical companies have the financial resources to maintain their business development programs designed to strengthen their product pipelines. In 2015, BioWorld recorded a total of 706 collaborative deals. (See BioWorld Insight, March 14, 2016.)

The sector is certainly on pace to exceed that number and, given the competition for prized biotech assets, the total dollar amounts will continue to soar. There have already been seven deals that have $1 billion or more price tags. Expect to see several more signed before the end of the year.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.