Which big biopharma companies put R&D as their top priority?

Print

19 July 2016

John Carroll / ENDPOINTS

We love charts at Endpoints. They’re a great way to offer a snapshot of the data that highlight a dramatic comparison for readers. So we were delighted when one of our readers came up with two new charts from last week’s special report on the top 15 R&D budgets in biopharma.

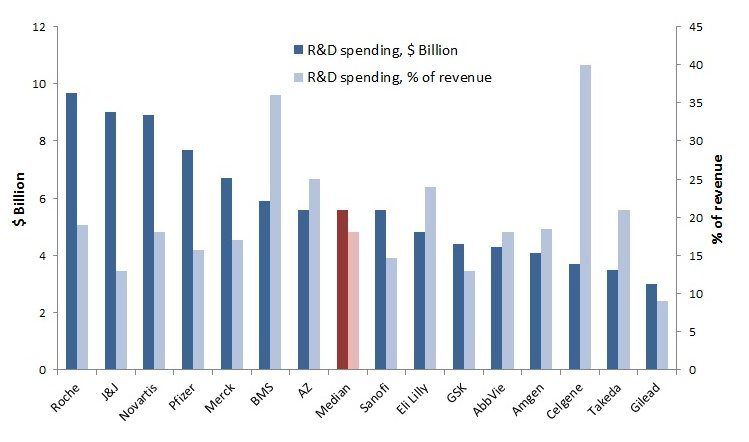

Aris Angelis, research officer and PhD candidate at the London School of Economics, first went to work comparing how the companies did at research spending as a comparison to the percentage of revenue spent on research.

As you can see at a glance, most of the pharma giants like to contain this number at a steady, predictable pace that wins the approval of Wall Street analysts. AstraZeneca and Eli Lilly, though, don’t have that luxury. Both have lots to prove yet in developing important new drugs, and that is pushing up research spending relative to income. By a lot. (Nothing new there for Eli Lilly, which has been consistently spending heavily on R&D for years in the face of a brutal onslaught of generics and the loss of key drug franchises.) Celgene’s been doing a series of big deals, like its $1 billion pact with Juno and its $7.2 billion buyout of Receptos. So its percentage is a chart buster.

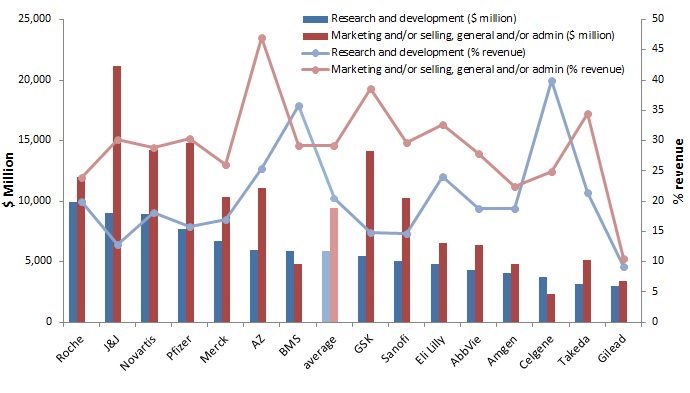

Twitter loved it. And Angelis followed up with another crowd pleaser comparing spending on marketing to research spending. Not surprising to anyone who follows this topic, marketing expenses tend to run well ahead of R&D budgets in the business. The exceptions: Research focused outfits at Bristol-Myers and Celgene.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.