Only One Big Drugmaker Is Working on a Nanobot Cure

Print

03 August 2016

Matthew Campbell / Bloomberg

When Kris Famm was 15, he became obsessed with photosynthesis. He lived with his parents and older brother, Fredrik, on a farm not far from the Baltic coast in southeastern Sweden, in an expanse of gentle hills threaded with forests of birch and spruce. It was a paradise for two energetic boys, and they spent most of their free time outside, often with their grandfather. Leading Kris and Fredrik on long hikes through the woods, he taught them about trees and wildlife and the richness of the land, which he was the last in the family to till.

The late 1980s and early ’90s were a time of rising environmental concern in Sweden. Climate change was entering the public consciousness, and the first traces of abnormal radiation from Chernobyl had been detected at a Swedish nuclear plant. To the teenage Kris, it seemed like the world would destroy itself without finding a radical new source of clean power. Photosynthesis, he thought, must hold the key: If plants could produce infinite energy from nothing but air, water, and sunlight, why couldn’t humans?

“I remember thinking, ‘There is this secret all around us, and we should be able to put it to use,’ ” Famm says. “There is clearly, in nature, a scientifically anchored way of doing this.” He resolved to learn everything he could about biochemistry. For his high school thesis, Famm devised a series of experiments to measure the efficiency of photosynthesis when leaves were coated with different dyes and waxes.

Famm is now 38, with a floppy thatch of blond hair and a singsong accent that gives away his Scandinavian roots. He’s traded the bucolic pleasures of rural Sweden for a maze-like research center squeezed between a highway and a rail line in Stevenage, north of London. On a blustery Tuesday in March, Famm is cramped into a sort of modernist garden hut, about the size of a large cube van, set up in a courtyard.

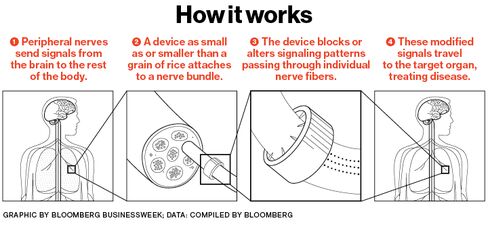

The complex belongs to GlaxoSmithKline, the $100 billion British pharmaceutical company, where Famm is in charge of developing a class of treatments called bioelectronics. The idea is to create implants the size of a grain of rice, or even smaller, that can be bolted directly onto nerves to treat diseases, augmenting or replacing drugs. With internal batteries to send tiny electric pulses, the implants could alter nerve signals to loosen up airways in asthma sufferers, for example, or reduce inflammation in the gut from Crohn’s disease. Even cancer is a long-term target. Side effects could be minimal, in theory, compared with those of drugs, which flood the body with foreign molecules. Doctors could stop worrying about patients forgetting to take pills.

Like photosynthetic energy, bioelectronics leverage something that already exists: the nervous-system connections linking every part of the body to the brain. “You piggyback on the circuits that are there,” Famm says. “These cables go to and from all our organs. They’re there to control our physiology.”

The underlying concepts are well-established, and early versions of what he’s describing are already on the market. Still, the project is a long-odds bet that Glaxo is virtually alone in making among its Big Pharma peers. It has started a $50 million venture fund for bioelectronics and funded about 100 outside scientists, along with an in-house research team of 30, because the microgadgets may offer a solution to the ruthless arithmetic of drug development. The past decade has seen huge advances in conventional molecular therapies for a wide range of diseases, but the treatments are coming at ever-higher prices. The average new drug takes 10 years and $2.6 billion to get from lab to pharmacy, according to industry group PhRMA. At the same time, hospitals and insurers in the U.S., the world’s most profitable market, are resisting high prices, squeezing returns. The implants, and the advances leading to them, would all be patentable, giving their inventors a lock on the proceeds.

Although Glaxo is nowhere near abandoning traditional drug development, the company needs a hit more than most. Core earnings per share, its preferred measure of profitability, have fallen in 8 of the last 10 quarters. Glaxo’s blockbuster asthma treatment, Advair, is about to face generic competition in the U.S., and major trials of a new heart drug and a cancer vaccine have failed in the final stages. The company’s shares have lagged those of its peers for the last several years.

To make matters worse, Glaxo has largely missed out on the breakthroughs in immune therapy and hepatitis drugs that have supercharged rivals such as Merck and Bristol-Myers Squibb. Also, a bribery scandal in China led to a $489 million fine in 2014. In March, Glaxo’s chief executive, Andrew Witty, said he’d step down in 2017 amid investor criticism of a weak research and development pipeline.

The nervous system is a bit like a computer. Neurons are either on or off, one or zero, firing electric impulses called action potentials in patterns that carry instructions from the brain. Introducing new electrical pulses can tweak those patterns, blocking some commands and encouraging others. Scientists now believe the pulses’ precise wavelength and frequency matter immensely and may need to change moment by moment to have the desired effect.

Early prototypes of bioelectronics are being tested in rats. Those implants—about the size of a pill and packaged in resin, metal, or ceramic—are wirelessly powered. Glaxo is planning initial human trials for three major chronic diseases next year using third-party devices, with the first implant developed by the company itself to follow in 2019. It won’t specify the diseases it’s looking into, but arthritis and diabetes are where the big money is. Three of the world’s top five best-selling drugs are primarily used for arthritis, led by AbbVie’s Humira, which pulls in more than $14 billion a year.

Using electricity as medicine isn’t a stretch. Pacemakers have been around since the 1930s. The earliest models had to be hand-cranked to generate voltage. More recently, deep-brain stimulation has become a common treatment for Parkinson’s disease. Electrodes are threaded far into the brain from a battery typically implanted in the torso.

What Glaxo and a clutch of other companies and research organizations envision is far more ambitious: tiny devices that might surround a bundle of nerve fibers like a cuff, bristling with even smaller electrodes resembling spokes on a tiny wheel. They’d be capable of autonomously monitoring symptoms at the source and adjusting their electrical output accordingly, perhaps for a patient’s whole lifetime.

There’s a daunting list of challenges to overcome first, but one stands out: understanding the body’s supremely complex wiring. Scientists still don’t know which neurons control which organ functions, or how to finely adjust their behavior. As Edward Boyden, who leads a brain-mapping effort at MIT, says, “The hard part of neuroengineering is the ‘neuro’ part.”

Famm came to Britain in 2002 to work on a doctorate in molecular biology at Cambridge. He’d dreamed of following in the footsteps of James Watson and Francis Crick, the discoverers of the DNA molecule, and he started working in the same institute where the two made their breakthrough in 1953. Famm’s supervisor was Greg Winter, a scientist whose research on antibodies led to the development of Humira and the creation of a string of biotech companies. Winter was a demanding mentor, covering Famm’s thesis drafts in red-penned marginalia instructing him to junk whole sections of “waffle” and zero in on a few specific concepts. Famm was focused on antibody engineering, the design of finely targeted proteins to fight disease.

Even though Cambridge was responsible for “some of the best years in my life,” Famm says, he strained against the deliberate pace of academia and what seemed like a vast distance between foundational research and real-world products. He left the lab for a job at consulting firm McKinsey in 2006. Famm says his academic colleagues thought he was making a “pact with the devil”—except Winter, who told him it was the right move for making a big scientific impact later on. After three years as a consultant, Famm went to work as a strategist for Glaxo’s R&D department, a job that required him to scan the horizons of medical research for the most promising and profitable concepts.

Glaxo’s drugmaking roots date to the 1840s, when one of its predecessor companies had a hit with Beecham’s Pills, a Victorian laxative made of aloe and ginger that was also marketed for “female ailments.” The modern company is an assemblage of smaller ones cobbled together through decades of mergers and acquisitions. Some lab coats still bear the pale blue logo of Glaxo Wellcome, which ceased to exist in 2000 after it merged with SmithKlineBeecham.

By the time Famm arrived, the company’s need for new revenue was getting acute. Patent protection had expired on four of Glaxo’s 15 best-sellers in 2008, and in 2010 a major drug for diabetes, Avandia, had to be largely pulled from the market after studies suggested it might contribute to heart attacks. The same year, Moncef Slaoui, a Moroccan-born molecular biologist who headed R&D, convened a small group to explore breakthroughs in areas beyond traditional drugmaking. Famm was on the team. The instructions were “to look at the convergence between technology, IT, and biology to see if there was something there,” he says. “A somewhat vague brief.”

In the spring of 2011, Famm and other executives gathered at Glaxo’s townhouse office in Mayfair, London’s Bentleys-and-bling district, and watched a presentation on vestibular implants. The devices can help patients whose sense of balance has been damaged by disease. Placed in the inner ear, they measure the movement of the head and convert that information into precise electrical pulses they feed by electrodes into nerve branches and the brain, delivering information directly into the nervous system. They’re analogous to a cochlear implant for hearing, which is to a traditional sound-amplifying hearing aid as an F-22 is to a hot-air balloon. “It sounds obvious in retrospect,” Famm says. “Couldn’t you do it elsewhere in the body? And why isn’t it done elsewhere in the body?” He and Slaoui had found their big idea.

The two spent much of the next 18 months visiting scientists around the world, even if their research seemed only loosely relevant. One trip was to the Georgia Institute of Technology in Atlanta to meet with materials scientist Zhong Lin Wang. His work has demonstrated the feasibility of “self-powered nanodevices,” which can generate their own electricity from tiny vibrations in their environment. Zhenan Bao, a professor of chemical engineering at Stanford, was consulted for her take on interactions between nerves and electrical fields.

As they learned more, Famm and Slaoui needed to answer a big question: Would Glaxo try to design implants to insert directly into the brain to treat disease elsewhere in the body? Or would it target the peripheral nervous system, the network that connects to tissues, muscles, and organs? Trying to do both, they worried, might be too sprawling and costly. Yet another trip, to Switzerland, helped settle the issue. The pair had gone to a campus of boxy labs in Lausanne to visit Henry Markram, an Israeli neuroscientist who leads part of the European Union’s flagship brain-science project. His research focuses on mapping and imaging the billions of connections in neural tissue.

Markram gave his visitors 3D glasses to view a model of a mouse’s cortical column, a relatively straightforward piece of peripheral neural anatomy that nonetheless consists of millions of cells. The complexity was mind-boggling—exactly Markram’s point. As Famm and Slaoui drove back to the airport, they agreed that to deliver moneymaking medicines in the next decade, they’d have to focus on the peripheral nervous system.

Famm set out to build a small team and recruit partners at university labs. MIT’s Boyden was an early supporter, as was Brian Litt, the namesake of the University of Pennsylvania’s Litt Lab, which develops brain implants using exotic materials such as graphene. In 2013, Glaxo made its bioelectronics efforts public. In a commentary that year in Nature, Famm and academic collaborators invited readers to “imagine a day when electrical impulses are a mainstay of medical treatment” and announced an initial program to fund as many as 40 external researchers. That number has since more than doubled, and the company has collected some powerful allies. Darpa, the Pentagon’s skunk works, is funding experiments at MIT, Johns Hopkins, and elsewhere, while the National Institutes of Health has introduced a $230 million program to encourage research.

Glaxo has also started an XPrize-style challenge for external researchers, with $6 million available for teams trying to create a working implant. Famm, who leaves most of the lab work to others while he oversees strategy, won’t disclose the company’s total outlay. He says only that the ultimate startup costs will be “very much on par with those you often see quoted for molecular medicines”—or potentially in the billions. He thinks the economics after that could be much more attractive than those of traditional drugs, because devices could, in theory, be repurposed for many different diseases with only slight tweaks to their firing patterns.

Glaxo’s ambition is to deliver a marketable product in the next decade. But to target specific bundles of nerve fibers, doctors will need to figure out which neural “circuits” control a given organ function, and such a “functional map” of the nervous system doesn’t yet exist. “The technology we have today is really quite limited in terms of targeting,” says Doug Weber, the manager of ElectRx, Darpa’s bioelectronics program. To be useful, those maps will also need to show how patterns and frequencies of stimuli affect an organ. Or, as Slaoui says, “What does it mean to accelerate your heartbeat in terms of electrical signals? Is it beep-beep-beep? Or beeeeeeeep, beep, beeeeeeeep?”

MIT’s Boyden is attempting to map nerves through “expansion microscopy”: He surrounds a sample with polymers similar to those found in diapers, then adds water, enlarging them to a scale at which their intricate connections can be studied more easily. Another avenue of study involves an exotic-sounding discipline called optogenetics. First, an artificial virus changes neurons’ genetic makeup to make them sensitive to light. Researchers then use light to switch them on and off and measure the responses further downstream. That makes it possible to understand which neurons control a particular organ function and ultimately target them with implants.

Glaxo will also need to develop the following: small power sources that can last decades; computers within the implants capable of reading and analyzing biological signals and adjusting output; and materials that won’t degrade over time or harm fragile nerves. At tiny scales, Slaoui says, metal and plastic don’t always play well with human tissue. “Most of the materials are edgy, and biology is smooth,” he says.

One substance for which Glaxo and Darpa are funding research is shape-memory polymer, which is stiff at room temperature but flexible when heated. Electronics can be layered onto the stiff surface; then the polymer is heated into a form that hugs tightly around a nerve, almost like shrink-wrap. Prototype devices are three times thinner than a human hair, placed by surgeons “with steady hands and microscopes,” researcher Walter Voit says. Other approaches could involve adhesives or magnets.

At the Mayo Clinic in Rochester, Minn., scientists are working with electrically conductive synthetic diamonds, manufactured at 3,500F, to make brain implants more effective. Diamonds are a good material for measuring the concentration of neurotransmitters, such as dopamine, in real time. Perfecting that process would help “close the loop” for some devices, allowing them to monitor the impact they have on the brain and adjust their settings autonomously. Because of the boron used in the fabrication process, the stones glow blue, like the Hope Diamond.

The scale of the unknowns and the weird-science vibe of some proposals give plenty of ammunition to skeptics. “I want well-proven products and pathways and business models. This sounds very high-risk,” says Claudio Nessi, the Geneva-based managing partner at NeoMed Management, a medical investment firm. “When certain government agencies or charities get involved in something, I don’t get involved. Their mandate is to look at very futuristic technologies, and losing money isn’t a problem.”

But companies much smaller than Glaxo are trying to make money with the technology. Last year the U.S. Food and Drug Administration approved a device from EnteroMedics, in St. Paul, Minn., designed to reduce appetite in the very obese. Pitched as an alternative to bariatric surgery, the implant consists of a pair of quarter-inch-wide electrodes sutured around the vagus nerve, a highway that runs from the brain to the abdomen. Silicone leads are connected to a power and control unit, the size of a deck of cards, inserted just beneath the skin. The apparatus took more than a decade to develop, during which EnteroMedics lost $285 million. Another company, NeuroPace, recently began marketing an epilepsy device called the RNS System, which monitors and stops seizures with a rapid electric impulse. It includes a curved power unit an eighth of an inch thick that’s placed inside the skull. A surgeon then threads leads through brain tissue to where the patient’s seizures are focused. It’s been in development since the late 1990s.

Drugs remain the moneymaker at Glaxo. The vast majority of its 13,000 R&D employees are devoted to developing conventional medicines, and investors are looking to those for signs of a recovery in the company’s fortunes.

A few hundred feet from Famm’s desk in Stevenage are row upon row of lab stations devoted to the grunt work of drug discovery: screening thousands of molecular compounds for their effect on a given disease. Robotic arms whir as they select tiny vials for testing; automatic dispensers measure out liquids a couple of nanoliters at a time. About 250 experiments occur every month, drawing on a library of more than 2 million compounds and generating terabytes of data.

Molecular work is what Famm, while at Cambridge, was originally trained to do. But even before that, he was primed to break away. As kids, Famm and his brother, now an executive at H&M, “had a million different clubs, just him and I,” he says, devoted to tracking animals or waging mock wars with neighbors. As the eldest, Fredrik was always the leader, with just one exception. He put Kris in charge of the invention club. “There is a bit of a frontier in this space,” Famm says about bioelectronics. “But that’s perfect.”

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.