As cardio R&D shrinks in size, a new study highlights some serious pitfalls Ц and a positive shift

Print

31 August 2016

John Carroll / ENDPOINTS

In biotech circles, it’s become an article of faith that cancer offers some of the best prospects in new drug development. Cardiology, meanwhile, looks like a long, expensive and risky prospect. And a new study now underscores the impact that shift in attitude has had, while spotlighting a solidly upbeat migration to a new generation of therapies looking to carve out some novel results as me-too drugs are relegated to the sidelines. The authors, including Aaron Kesselheim at Brigham and Women’s, also call out developers for failing to publish the results of failed studies.

The researchers looked at 347 cardio drugs that entered the clinic between 1990 and 2012. From 1990 to 1995, cardio drugs accounted for 108 of 679 Phase I studies – a total of 16%. But between 2005 and 2012, the percentage figure shrank to only 5%, accounting for 125 of 2,366 early stage projects going into the clinic. In 1990, 21% of all Phase III studies were in cardio, compared to only 7% in 2012.

Among other things, this study also indicates just how much bigger the overall industry pipeline is these days. The study was published in the Aug. 29 issue of the journal JACC: Basic to Translational Science.

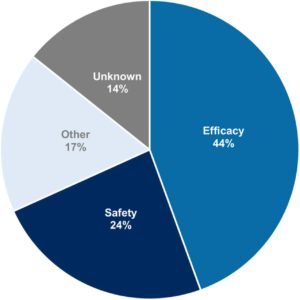

Causes for Cardio Drugs Being Discontinued in Phase 3

Not surprisingly, cardio is dominated by Big Pharma, which has the deep pockets to see a new drug in this field through late-stage studies that can offer require thousands of patients. Here’s the bottom line:

“Overall, small and medium-sized companies accounted for 43% of new Phase 1 trials for cardiovascular drugs, 38% of new Phase 2 trials, and 31% of new Phase 3 trials. In all three phases, the proportion of cardiovascular trials started by small and medium-sized companies was significantly smaller than that for noncardiovascular trials.”

And for both large and small companies, the focus has shifted from me-too drugs to novel therapeutics. Back in 1990, 27% of the cardio drugs in Phase III were categorized as novel entities, compared to 57% in 2012.

Tracking 54 late-stage cardio drugs that were discontinued, 44% were scuttled due to a lack of efficacy, with 24% torpedoed by safety issues. And some of those safety issues were linked to a higher death rate in the drug arm. But cardio, they add, is not particularly more risky than any other field in R&D. One big problem about the pivotal failures, the researchers add, is that data are frequently never published, leaving investigators in the field in the fog about what went wrong and how to avoid earlier mistakes.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.