Which European cities generate the biggest VC returns?

Print

05 September 2016

Pitch Book Blog

With cities like London, Paris, Stockholm, Dublin and Barcelona in the mix, the hubs of VC activity in Europe represent centuries of international trade. But make no mistake, each city also represents an ecosystem fostering startups at every stage of development, along with the VC firms backing them.

But how do these cities rank against each other?

We asked ourselves this question about American VC hubs recently and Chicago seemed pretty happy about the results. So, we thought why not give Europe a go? Although London undeniably holds the crown for the best numbers available on VC activity, and a few other key datapoints that put it to the top, there are many other vibrant communities throughout the continent to consider.

Notable companies thrown around in conversations about European VC activity in the last decade include Skype, Spotify and Supercell. And those are just the ones that start with the letter S.

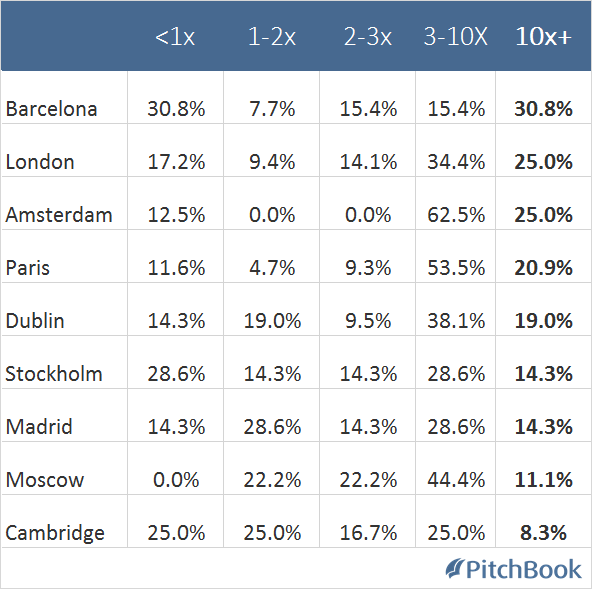

Using data from the PitchBook Platform, we calculated return multiples for some of the more prolific startup communities throughout Europe. Qualifiers for inclusion in this dataset:

- Full exit (acquisition or IPO) in last 10 years

- Companies must have raised at least $500,000 in VC funding before exiting

- We have a confirmed record of and amounts for all funding rounds to ensure accurate total invested capital

- We have a confirmed amount for the exit (IPO value is equal to market cap at IPO)

- Included cities must have at least 7 companies that meet all of the above criteria

MOIC - Multiple on Invested Capital = exit value/VC raised

Note: The chart below only includes companies with confirmed exit amounts, which will cause the data to be skewed positively as successful exits are more likely to be reported than smaller ones.

Percentage of exits separated by MOIC

The results are somewhat surprising, with lesser-known cities like Barcelona right up there with more established ones like London. And while our MOIC strategy is one way to slice the data, there are many other methods one could employ to get an idea of VC activity and success in various cities.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.