The forecast for biotech IPOs in 2017? Not nearly as hot as the industry would like

Print

11 January 2017

John Carroll / Endpoints News

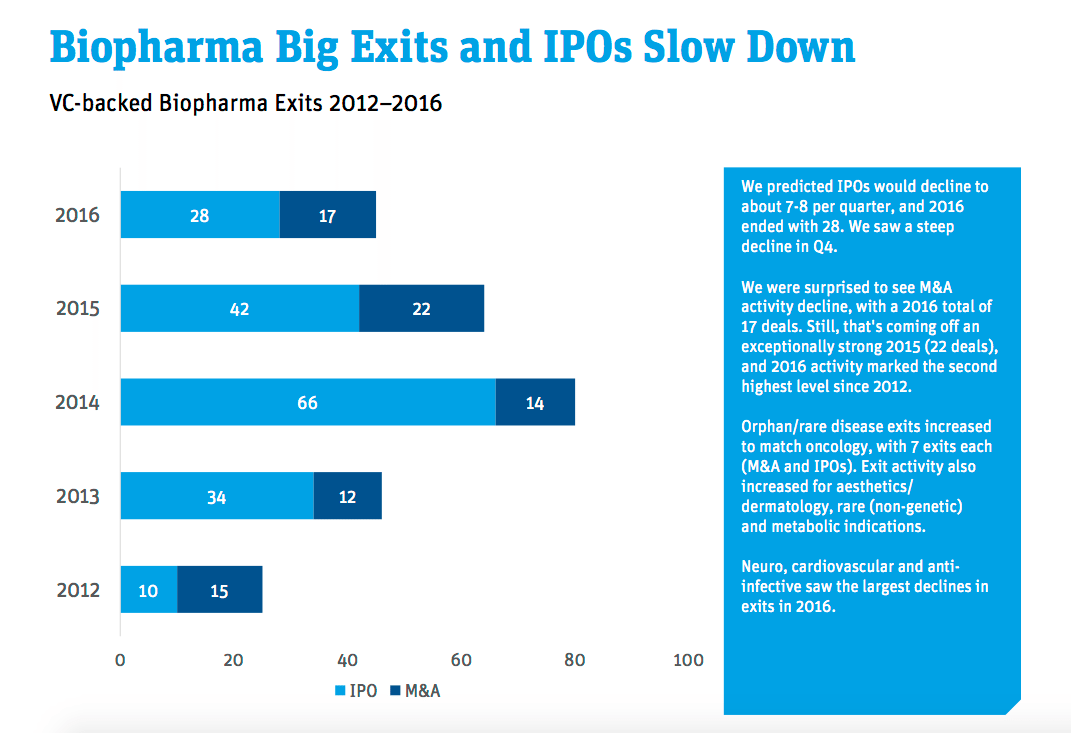

Last year only 28 biopharma companies managed to complete an IPO in the US, the worst record since the bad old days of 2012. And the smart money at Silicon Valley Bank says you can expect a repeat, or maybe something just slightly better, in the year ahead.

In other words, if you had to summarize SVB’s IPO projection for 2017, a shaky thumbs-up is about the best you’re going to get. The conga line of 2014 and 2015 has dissolved and shows no signs of reforming anytime soon.

SVB called last year’s IPO number in advance, and with public biotechs still floundering in an unforgiving environment for risk, you’re not going to get much of an argument from any other analysts that they’re being overly cautious.

For those of you making the trek to San Francisco this week for JP Morgan, you can expect to hear plenty more about this topic. But even as the mood tends to run on the optimistic side in San Francisco, reality is not being ignored.

SVB’s team, led by Jon Norris, did get one thing wrong in its 2016 forecast. The number of M&A deals in the sector shrunk to 17 in 2016 — missing a forecast for a surge that was also widely shared among analysts. This year, says SVB, look for 18 to 22 M&A exits, with half reserved for early-stage companies, where most of the investment action is these days.

Last year we saw a big run of Series A investments, where you’ll continue to see plenty of emphasis this year. One caveat, though: Crossovers, which have been backing off as the IPO wave dwindled to kiddie pool size, may start shifting their cash to back up their companies as they get into B rounds.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.