2017 NVCA Yearbook Highlights Busy Year for Venture Industry and NVCA

Print

20 March 2017

National Venture Capital Association

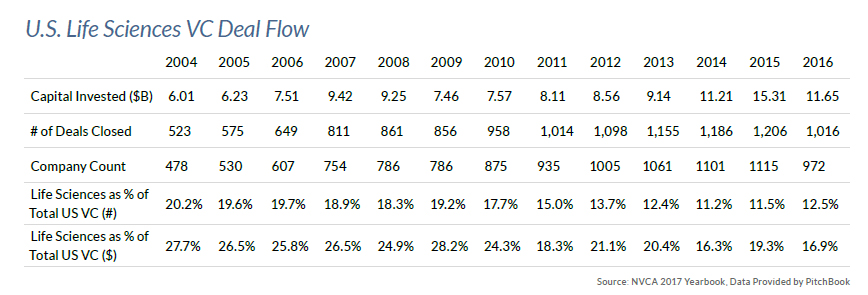

The National Venture Capital Association (NVCA) today released the 20th edition of the annual NVCA Yearbook, documenting trends and analysis of venture capital activity in the United States from the past year and capturing historical data and information about venture’s role in fueling entrepreneurship in America. The report shows that the number of life science deals as a share of overall venture deal count increased to 12.5% in 2016.

"While the overall number of investments (1,016) and venture dollars invested ($11.7 billion) into life science companies (defined as pharmaceuticals, biotechnology, and healthcare devices and supplies) declined year-over-year, the number of life science deals as a share of overall venture deal count increased to 12.5% in 2016. Notable investments into venture-backed life science companies included: Moderna, a drug developer for genetic disorders, hemophilic and blood factors, and oncology; Human Longevity, a developer of genomics and cell therapy-based diagnostic and therapeutic technology; and CVRx, a developer of implantable technology for the treatment of high blood pressure and heart failure."

General Industry Statistics

- At the end of 2016, 334 venture firms managed $50 million or less. By comparison, only 68 firms managed $1 billion of U.S. venture capital assets under management.

- In 2016, 2,105 venture firms participated in at least one investment in a U.S.-based startup. Of those, 738 firms participated in startups’ first round of institutional funding.

- The U.S. continues to attract a majority of global venture fundraising, investment, and exit dollars; however, its share has dropped compared to levels a decade ago. The U.S.’s share of global VC investment dropped from 81% in 2006 to 54% in 2016.

Commitments to Venture Funds

- In 2016, 253 venture capital funds raised $41.6 billion, a ten-year high, to deploy into promising startups.

- The concentration of capital managed by fewer funds increased in 2016 as seven funds closed with more than $1 billion in commitments, driving the annual median VC fund size to $75 million (the highest median since 2008).

- Outside of California, Massachusetts and New York, VC fund sizes remained relatively small, with a median 2016 fund size of $23.5 million.

- Many states outside of California, Massachusetts and New York posted year-over-year VC fundraising increases, including Ohio, New Jersey, Tennessee, Missouri, North Carolina and Arkansas.

- Twenty-two first-time funds raised $2.2 billion in commitments last year, the largest amount by first-time managers since 2008.

Capital Deployed to Startups

- More than 7,750 venture-backed companies received $69.1 billion in funding in 2016, representing the second highest annual total—after 2015—in the past 11 years.

- Startups receiving venture funding in 2016 represented approximately 370,000 employees.

- Angel/seed and early stage VC investments accounted for more than 6,600 (81%) of 2016 deal count and $30.7 billion (44%) of venture dollars.

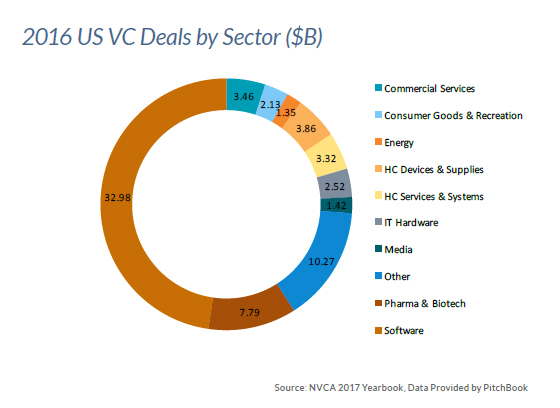

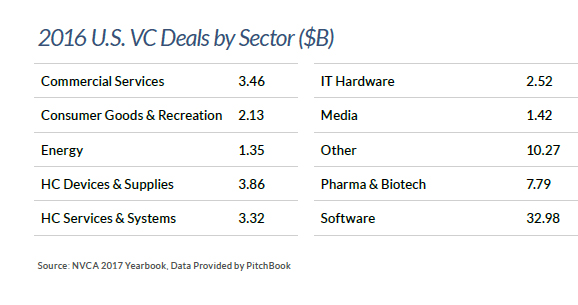

- Software companies attracted the lion’s share of venture investment ($33 billion or 48% of total venture dollars invested) in 2016. Within the software sector, social/platform software companies led the way.

- First-time financings (i.e., first round of equity funding in a startup by an institutional venture investor) dipped in 2016 to 2,340 companies receiving an aggregate of $6.6 billion.

- Venture funding was deployed to startups in all 50 states and the District of Columbia—reaching 226 Metropolitan Statistical Areas and 386 Congressional Districts.

Exit Landscape

- The exit environment for venture-backed companies remained challenging in 2016, with only 39 IPOs completed.

- At the end of 2016, 20 venture-backed companies were in IPO registration, suggesting optimism for a more active IPO window in 2017.

- Disclosed M&As accounted for 82% of the 726 VC-backed exits in 2016, which yielded a total of $46.8 billion in disclosed exit value.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.