QuintilesIMS analysts forecast a wave of new drug approvals by Т22, dominated by cancer and orphan therapies

Print

10 May 2017

John Carroll / Endpoints News

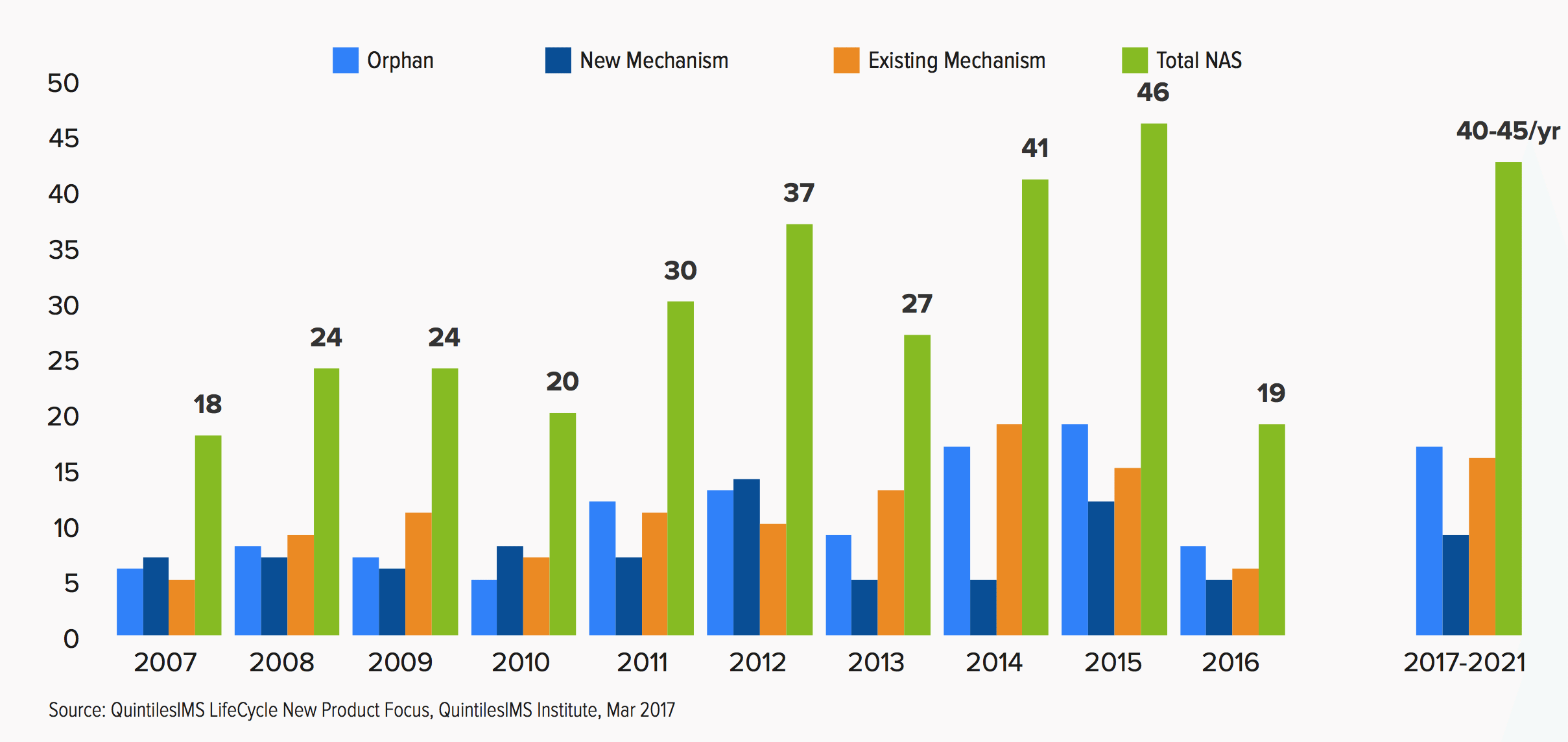

To hear analysts at the QuintilesIMS Institute tell it, 2016’s sudden plunge in new drug approvals was an aberration that won’t be repeated anytime over the next five years. In their new, annual drug spending report, the analysts at this group determined that the industry pipeline is brimming full and likely to spew out 40 to 45 new drug approvals every year from this year through 2022, returning to a level set in 2014 and 2015.

New Active Substances (NAS) Launched in the U.S. 2007-2021

And there are some other clear trend lines they would like to point out as well.

That same five years will see orphan drugs grow in importance even more than we’ve seen in recent years. A total of 66 orphan drugs were launched in the last five years — a number that will be overshadowed by the 80 to 90 new orphan drugs to come over the next five years.

Two-thirds of all orphan drugs were for oncology indications, while the remaining indications targeted rare diseases, such as hemophilia B and cystic fibrosis, reports the institute.

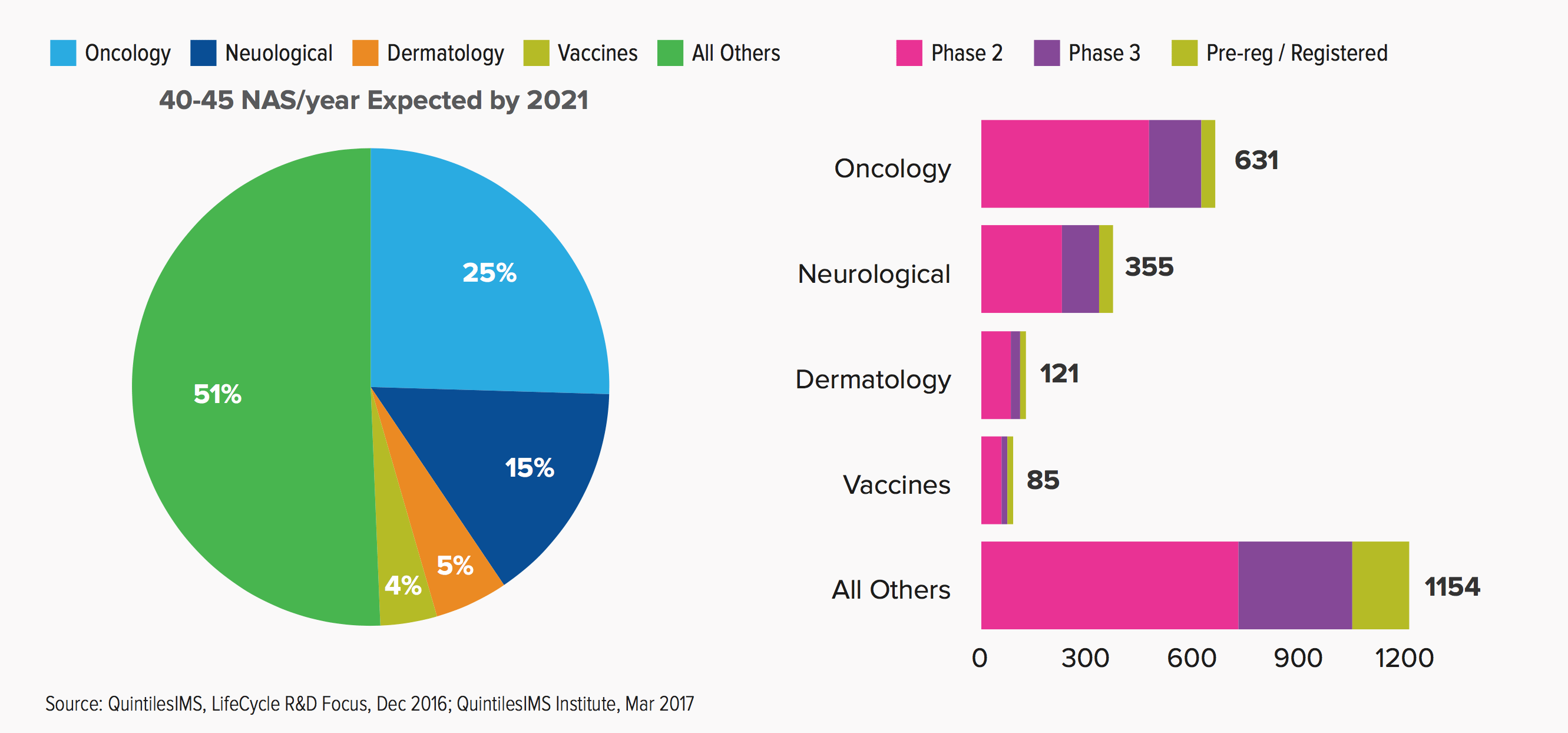

Late Phase R&D Pipeline by Top Therapy Areas

In addition, fully a quarter of all the drugs in the late-stage pipeline are now concentrated in oncology. What’s more:

The pace of development in cancer treatments is accelerating, not just because of the number of new medicines in research, but the combination regimens that may have greater effects than the individual drugs, and because of the continuous development of biomarkers and the potential to more appropriately target the right drug to the right patient with minimal waste and risk of non-response.

The rate of oncology drug development has now hit such a rapid pace that new drugs are superseding old ones in a matter of a few years — a trend likely to continue to accelerate.

Neurological drugs are now dominated by pain, Alzheimer’s and epilepsy, which may well raise significant pricing issues for society.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.