Russia has the right prescription for pharma companies

Print

27 November 2012

Ruud Dobber, Financial Times / Beyondbrics

The recent social unrest in Russia has been pervasive and well publicised, resurrecting the western typecast of Russia as a risky place to do business. Even veteran international investors, who should know better, have grown bearish about binding their profits to Russia. This would be a mistake.

The country still has enormous potential and is one of the few growing markets in what is a predominantly barren global economy. There is good cause for foreign businesses in Russia to be optimistic, not least in pharmaceuticals.

The country’s recent entry into the World Trade Organisation should prove a catalyst for Russia’s industrial modernisation. An extra $49bn of GDP a year, and more importantly an international stamp of approval, signal that Russia is not only open for business, but is on the fast track to global financial and economic integration.

The Russian government’s plan to double GDP within 10 years is not unrealistic. After a sharp downturn in 2009, the economy has rebounded, experiencing two years of 4 per cent growth. Russia’s economy is clearly back on track.

With its population of over 140m growing again after years of decline, Russia has an economy increasingly driven by consumer spending, thanks to a rising middle class, with an overwhelming appetite for quality goods and services. This works to the advantage of those companies with high-end brands that are willing and able to meet the shift in demand caused by this changing demographic.

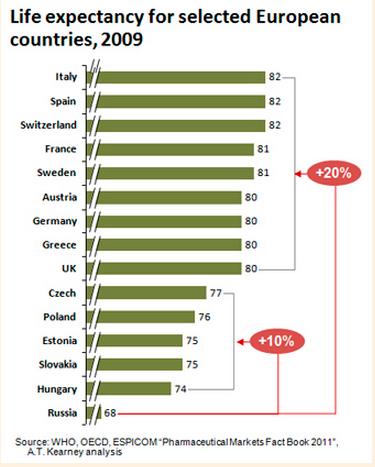

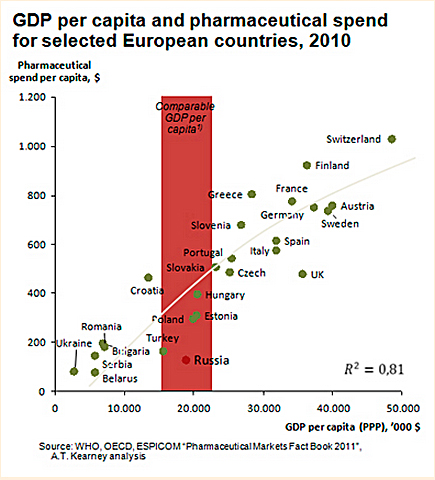

But what does this mean for medicines? Demand for healthcare is also rising. While the average life expectancy for men has increased 11 per cent in the last decade, it remains low: 63, compared to Russian women: 75, and both lag far behind their Western counterparts.

Despite an appetite for better healthcare, driven by a rapidly expanding wealthy middle-class, the country faces a looming health crisis with high levels of unmet need. For example, fewer than 6% of the estimated 70 million people with hypercholesterolemia (high cholesterol) in Russia are receiving treatment, whereas in the UK, 19% of the estimated 37 million with raised cholesterol receive treatment.

Despite an appetite for better healthcare, driven by a rapidly expanding wealthy middle-class, the country faces a looming health crisis with high levels of unmet need. For example, fewer than 6% of the estimated 70 million people with hypercholesterolemia (high cholesterol) in Russia are receiving treatment, whereas in the UK, 19% of the estimated 37 million with raised cholesterol receive treatment.

Drug reimbursement coverage will also be expanded, meaning that more patients will receive access to better treatments. The wider health and pharmaceutical sector is forecast to grow faster in Russia than anywhere else in Central and Eastern Europe in 2012.

Drug reimbursement coverage will also be expanded, meaning that more patients will receive access to better treatments. The wider health and pharmaceutical sector is forecast to grow faster in Russia than anywhere else in Central and Eastern Europe in 2012.All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.