The Biotech IPO Floodgates Start to Open

Print

06 January 2016

Max Nisen / Bloomberg

A China-inspired global market selloff couldn't stop baby biotechs from heading off to the races on Monday -- suggesting the industry may have a better year ahead.

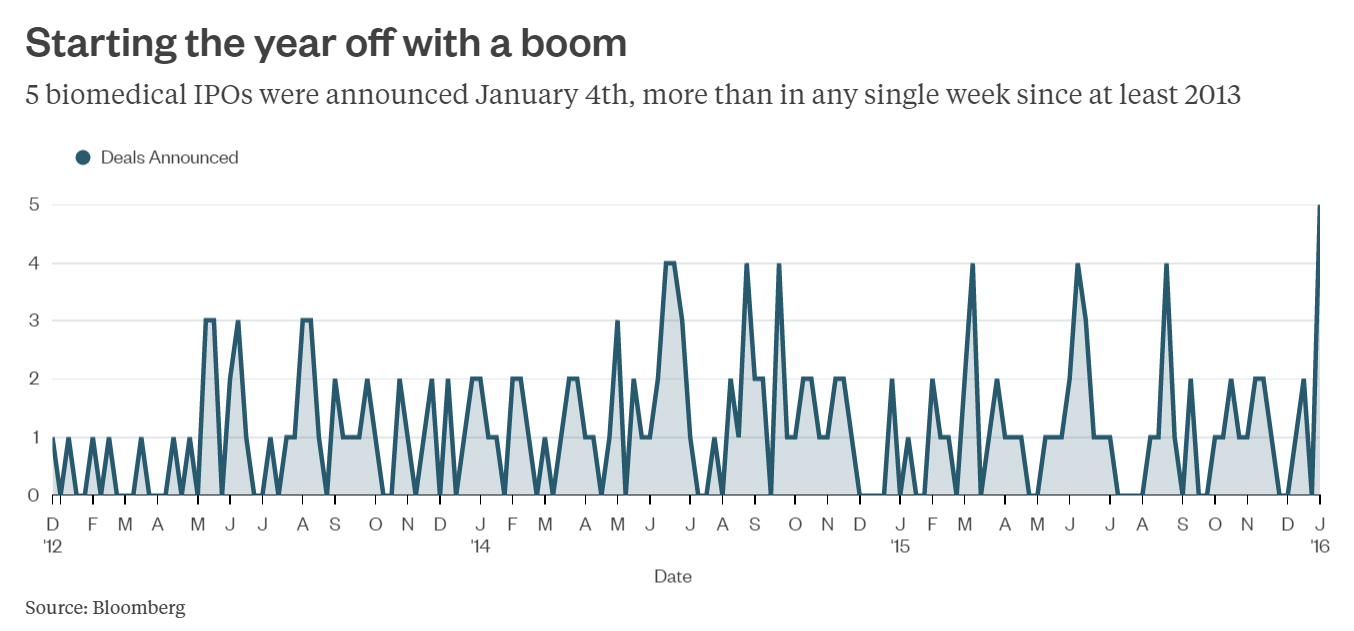

On the first trading day of 2016, even as the Nasdaq tumbled 2 percent, five biotechs filed S-1s in the U.S. That's more biotech IPO announcements in one day than in any week in the past couple of years, and more than in all but four months in 2015.

Filers included Google-and-Bill-Gates-backed Editas, which would be the first public company focused on Crispr gene editing, a controversial technique for editing DNA; Syndax, which has a cancer drug in advanced studies but pulled out of a planned IPO last year; and Corvus, a cancer drug company founded by a co-founder of Pharmacyclics, which sold to AbbVie for $21 billion last year. San Francisco-based Audentes Therapeutics and Texas-based Reata Therapeutics also filed. On top of that, Denmark's Bavarian Nordic filed an F-1 and intends to list on the Nasdaq.

These companies only have placeholder valuations so far, but the total value announced for the five U.S. companies was $467 million.

Not bad for a post-vacation Monday. Last year, 55 biotech IPOs were announced, worth $4.65 billion, but those were weighted toward the earlier part of the year as biotech's boom hit shaky ground in September. The total number of IPO filings last year was down from 2014's 70 (though the dollar amount was up from $3.96 billion).

The timing of the filings is no coincidence: Next week is JPMorgan's annual health care conference, which is biotech's Sun Valley and CES rolled into one. There's no better place to talk up a company.

But the variety, ambition, and sheer number of IPOs announced in a day suggest pent-up demand and a chance the IPO floodgates will open after biotech's autumn and winter of discontent. That dark period was provoked by the PR nightmare over the price-hiking practices of Valeant and Martin Shkreli's Turing Pharmaceuticals. Companies that hit the market in the fall had rough time of it and raised less than initially expected.

The environment has gotten a little better for IPOs: The Nasdaq Biotech Industry is up 14 percent from its low last year, and there's room to grow. The fall's huge price dive in biotech stocks drove out amateurs and non-specialists, according to some analysts, making prices more realistic -- an opportunity for investors who know what they're doing. And though Hillary Clinton's rhetoric on drug pricing has escalated, it could be tough for her to enact real price controls if she's elected.

There's also the fact that the FDA approved 45 novel new drugs last year, up from 41 in 2014, the most since 1996. This year might bring the first gene therapy approval in the U.S., along with a number of other promising new medicines. As bad as things looked at times in 2015, there's plenty of fascinating and important science going on in biotech, of which investors likely want a piece.

All of this adds up to at least some optimism for the sector. And there's nothing more optimistic than betting on a biotechnology IPO. A glance through the S-1s filed on Monday reveals that all of the U.S. companies expect to lose money for years to come. Still, several of these companies have drugs in fairly late-stage trials -- there's some meat on the bone here compared to some firms that went public last year, including one with a single Alzheimer's drug candidate discarded by another firm that managed to raise more than $300 million in a public offering.

Every private biotech and venture capitalist is going to watch the market's reaction to this first wave of IPOs like a hawk. If these five manage to go public in a way more reminiscent of early 2015 than of the Shkreli era, then there's likely to be a wave of followers.

Correction: An earlier version of this story incorrectly spelled the name of Corvus.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.