$58.8 Billion in Venture Capital Invested Across U.S. in 2015, According to the MoneyTree Report

Print

27 January 2016

PWC

Corporate Venture Groups Participated in One Fifth of All Deals and Provided 40 Percent of Investment in Industrial/Energy Companies

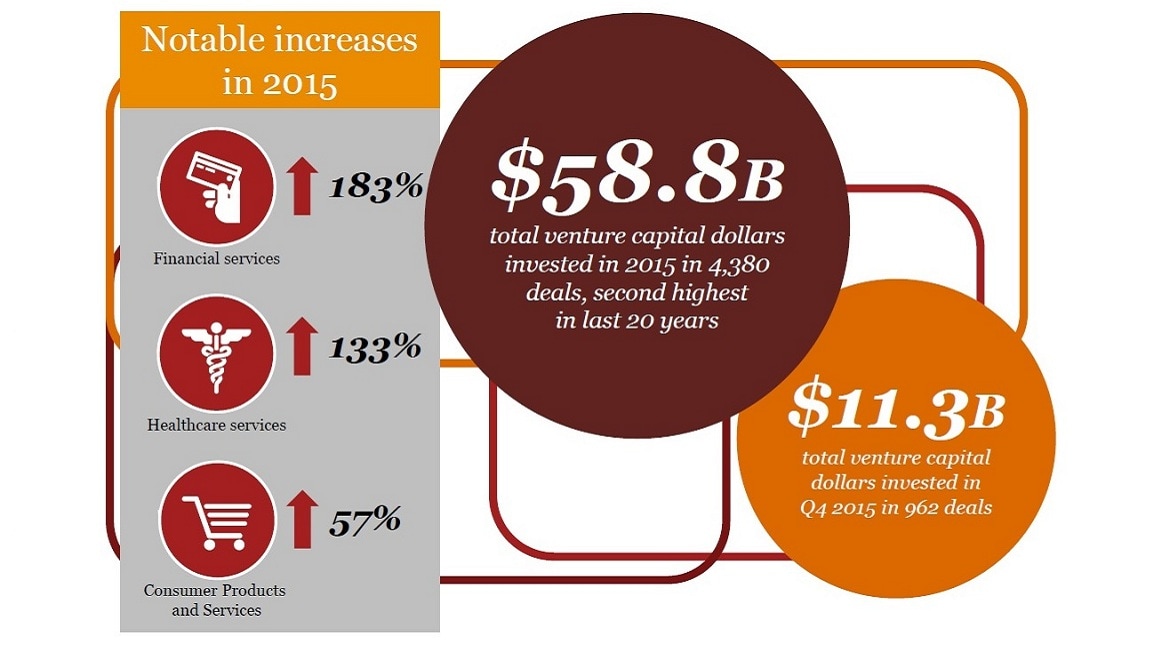

WASHINGTON, January 15, 2016 – The venture capital ecosystem deployed $58.8 billion across the United States in 2015, marking the second highest full year total in the last 20 years, according to the MoneyTree™ Report from PricewaterhouseCoopers LLP (PwC) and the National Venture Capital Association (NVCA), based on data provided by Thomson Reuters. For the fourth quarter of 2015, venture capitalists invested $11.3 billion into 962 deals, down 32 percent in dollars and 16 percent in deals compared with the third quarter when $16.6 billion was invested in 1,149 deals. The fourth quarter also marks the eighth consecutive quarter of more than $10 billion of venture capital invested in a single quarter, but also represents the smallest amount invested since the third quarter of 2014.

“The convergence of technology across sectors is becoming increasingly important and has emerged as a common thread as companies with innovative, disruptive technologies and business models continue to catch the eyes of investors,” said Tom Ciccolella, US Venture Capital Market Leader at PwC. “The fourth quarter's largest deals included startups that deploy technologies to challenge incumbents in the financial services, education, retail and consumer industries. These emerging tech-enabled segments have disrupted traditional industries and should continue to command a larger portion of venture capital dollars in 2016 and beyond.”

“With almost $60 billion deployed to startup companies in 2015, the venture capital ecosystem is strong and healthy, and committed to helping entrepreneurs get their breakthrough ideas off the ground and into the marketplace,” said Bobby Franklin, President and CEO of NVCA. "While a handful of unicorns and late-stage funding rounds by nontraditional investors continue to grab the headlines, more than half of all deals in 2015 went to seed and early stage companies, with more than 1,400 companies raising venture capital for the first time. Entrepreneurs in 46 states and the District of Columbia raised venture capital in 2015, a testament to the reach of the venture capital industry and the strength of startup ecosystems across America.”

Top Deals

In calendar year 2015, there were 74 megadeals (investments of $100 million or more), compared with 50 in 2014. Overall, Financial Services (up 183 percent), Consumer Products & Services (up 57 percent), and Healthcare Services (up 133 percent) saw stronger increases from 2014.

The top 10 deals accounted for 19 percent of dollars invested in the fourth quarter, which is the same as the percent of total venture capital deployed during the third quarter. Similar to the third quarter of 2015, deals spanned several diverse industries, including Software, Retailing/Distribution, Financial Services, IT Services, Consumer Products and Services, and Media & Entertainment.

Industry Analysis

As has been the recent trend, the Software industry continued to receive the highest level of funding of all industries in the fourth quarter, receiving $4.5 billion going into 369 deals for the quarter, despite being down 24 percent in dollars and 17 percent in deals compared to the third quarter. For the full year of 2015, Software was up 8 percent in dollars, but down 5 percent in deals, compared with 2014. Four of the top 10 megadeals in the fourth quarter went to Software companies.

The Biotechnology industry received the second largest amount of venture capital for the quarter, with $1.5 billion going into 95 deals. While dollars invested declined 32 percent and the number of deals declined 25 percent compared with the third quarter, Biotech ended the year up 17 percent in dollars and relatively flat in deals for the full year 2015, compared with the previous year. Despite ranking second in terms of dollars invested, Biotech did not secure any of the Top 10 deals.

Investments in the Life Sciences sector (Biotechnology and Medical Devices combined) during the fourth quarter accounted for $2 billion going into 172 deals, declining 31 percent in dollars and 16 percent in deals, compared with the third quarter. Like in the previous quarter, Life Sciences investments accounted for 18 percent of all venture capital deployed to the startup ecosystem in the fourth quarter. In 2015, Life Sciences dollars were up 12 percent and deals were down 3 percent, compared with 2014.

Media & Entertainment companies received the third largest amount of venture capital for the quarter with $881 million deployed across 114 deals, which is a 40 percent decrease in dollars compared to the third quarter, despite a 14 percent increase in number of deals. Additionally, only one of the top 10 megadeals was within the Media & Entertainment space in the fourth quarter. For calendar year 2015, Media & Entertainment dollars remained flat, and deals were down 13 percent versus 2014.

Thirteen of the 17 MoneyTree™ industries experienced decreases in dollars invested in the fourth quarter, most notably Business Products & Services (77 percent decrease), Semiconductors (58 percent decrease) and Computers and Peripherals (57 percent decrease). However, overall in 2015, 12 of the MoneyTree™ industries increased in dollars invested, compared with 2014, with Financial Services receiving the greatest increase in dollars invested (183 percent increase).

Venture capitalists invested $2.9 billion into 229 Internet-specific deals during the fourth quarter of 2015, a 42 percent decline in dollars and 12 percent decline in deal count, compared to the third quarter of 2015 when $5 billion went into 261 deals. Internet-specific increased 35 percent in dollars and remained flat in deals in 2015, compared with the previous year. “Internet-Specific” is a discrete classification assigned to a company with a business model that is fundamentally dependent on the Internet, regardless of the company’s primary industry category.

Stage of Development

Dollars invested in Seed stage companies rose by 55 percent during the fourth quarter, totaling $375 million in 52 deals, representing 3 percent of all venture investment dollars and 5 percent of all deals for the quarter. Early stage investment declined 9 percent in dollars and 18 percent in deals with $4.9 billion going into 494 deals. Seed/Early stage deals accounted for 57 percent of total deal volume in the fourth quarter, which is the same as the prior quarter. The average Seed stage deal in the fourth quarter was $7.2 million, up from $4.1 million in the third quarter. The average Early stage deal in the fourth quarter was $10 million, up from $9 million in the prior quarter. For calendar year 2015, the average amount invested for both seed and early stage deals were up 23 percent each versus 2014.

Expansion stage investment was down 53 percent in dollars and down 10 percent in deals from the previous quarter with $3 billion going into 247 deals. Expansion stage deals accounted for 27 percent of all venture deals in the fourth quarter. The average Expansion stage deal amount was $12.2 million, down 15 percent from $23.4 million in the third quarter.

Investments in Later stage companies decreased 33 percent to $3 billion going into 169 deals in the fourth quarter. Later stage deals accounted for 27 percent of total deal volume for the quarter, which is flat, compared with the previous quarter. The average Later stage deal in the fourth quarter was $17.8 million, down from $20.9 million in the prior quarter.

First-Time Financings

First-time financing (companies receiving venture capital for the first time) dollars decreased 12 percent to $2.2 billion in the fourth quarter, as the number of deals declined by 20 percent to 322 compared to the previous quarter. First-time financings accounted for 19 percent of all dollars and 33 percent of all deals in the fourth quarter.

Of the companies receiving venture capital funding for the first time in the fourth quarter, Software companies captured the largest share, accounting for 37 percent of the dollars and 39 percent of the deals with $811 million going into 125 deals. First-time funding in the Life Sciences sector during the fourth quarter was up 17 percent in dollars and up 2 percent in deals, rising to $485 million going into 47 deals. In 2015, Life Sciences investments are up 67 percent in dollars and 15 percent in deals versus 2014.

The average first-time deal in the fourth quarter was $6.8 million, up from $6.2 million in the prior quarter. Seed/Early stage companies received the bulk of first-time investments, capturing 72 percent of the dollars and 82 percent of the deals in the fourth quarter.

MoneyTree™ Report results are available online at www.pwcmoneytree.com and www.nvca.org.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.