EvaluatePharma World Preview 2018, Outlook to 2024

Print

21 June 2018

EvaluatePharma® World Preview 2018, Outlook to 2024

Worldwide prescription drug sales accelerate to $1.2 trillion by 2024

|

|

|

Into the second half of 2018 the pharma sector seems a more stable place. The political uncertainty that characterised much of 2017 may not have settled down, but is causing pharma and other industries less anxiety. Gone are the days when a presidential aside on pricing could cause the shares of pharma groups to lose millions if not billions.

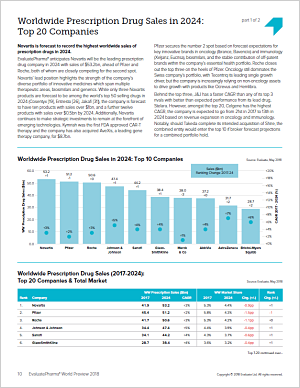

And according to EvaluatePharma’s World Preview 2018, we are looking at an industry set to experience sales accelerating from the sluggish levels following the financial crisis, to annual compound growth of over 6% between now and 2024.

Much of the expansion of the market will be driven by continuing unmet need in a number of disorders, as demonstrated by sales forecasts for the orphan drug market reaching $262bn in 2024, accounting for 20% of the total prescription drug market.

The launch of novel therapies, including gene and cell therapies, as well as increased access to medicines globally should also help fuel progress in the market. Total prescription sales are expected to be $1.2trn in 2024.

However, it might not be all plain sailing for the industry, there is the ever-present danger of product failure as seen by the demise of Incyte’s epacadosat, which has raised questions about the utility of combination immunotherapies.

And even if the threat of price control from politicians has evaporated it remains from payers. The demand for real world evidence before insurers and governments will consider reimbursing drugs will continue to intensify, no matter how innovative developers claim their products are, as Sanofi and Amgen have found with their cholesterol-lowering PCSK9 drugs.

As such, outcomes data is set to become an integral part of the industry.

What this will mean for the some of the most valuable R&D products in this year’s report is hard to gauge.

Those operating in niche or orphan areas like Vertex’s triplet cystic fibrosis drug might find it easier to justify their pricing structure. Abbvie’s new rheumatoid arthritis drug, upadacitinib, is however, more likely to face pushback on pricing given the increasing competition from biosimilar versions of Remicade.

The growing power of payers, combined with the arguably underestimated threat of biosimilars and the genericisation of some of the industry’s biggest products, including Humira are factors that could act as a brake on growth. The report shows that $251bn of sales are at risk between 2018 and 2024, teeing up a second patent cliff the industry will have to get over.

These potential disruptions to the market could test industry growth forecasts and Evaluate is following the sector closely in order to help navigate this fast-moving landscape.

Faced with these challenges of keeping up innovation – at a reasonable cost – not to mention demonstrating value to increasingly wider audiences, including patients, pharma companies will have to take a long hard look at their business models in the coming years.

Earlier discussions with payers, targeted therapies and harnessing the advantages of technology such as machine learning for target screening will all play their part in changing business models and ensuring pharma does keep growing to meet forecasts.

All Portfolio

MEDIA CENTER

-

The RMI group has completed sertain projects

The RMI Group has exited from the capital of portfolio companies:

Marinus Pharmaceuticals, Inc.,

Syndax Pharmaceuticals, Inc.,

Atea Pharmaceuticals, Inc.